Discover the ins and outs of investing in the S&P 500, a major US stock market benchmark index.

Welcome to our monthly-ish market update, where we cover everything you need to know as an investor and discuss practical actions you can take to improve your finances.

In this episode, we break down the iShares S&P 500 ETF (ASX: IVV), a popular choice for Australian investors seeking low-cost, diversified exposure to top US companies.

Tune in to learn more about the benefits, risks, and why it’s a core holding in Rask Invest portfolios. Plus, Owen updates you on what’s been happening in global investment markets over the past month.

Major asset classes update (last 30 days)

- NDQ: -0.4%

- IVV: +0.65%

- VAS: +2%

- Hang Heng (index): +4.7%

- IAF: +0.05%

- VBND: +0.66%

- CASH (ING TD): 4.95%

- NUGG: +4%

- BTC USD: -1.7%

- AUD: 0.6850 (64.88 in early August | falt ytd | +7% YoY)

iShares S&P 500 ETF (ASX: IVV) Summary

- IVV Overview: The IVV ETF, managed by iShares (a subsidiary of Blackrock), is a popular Australian ETF that tracks the S&P 500 Index and provides exposure to the US stock market.

- Key Features: It offers low fees (0.04% per year) and quarterly dividends (with a 1.1% average annual yield). It is domiciled in Australia for tax simplicity.

- Benefits: IVV is a core holding in Rask Invest portfolios for international diversification and growth, offering exposure to top US companies and sectors.

- Considerations: It carries risks associated with sector concentration (30% in tech) and currency fluctuations (AUD-USD).

- Why IVV: Chosen for its low fees, pure S&P 500 exposure, and Australian domicile for tax benefits.

Who are iShares?

iShares is the ETF-managing arm of Blackrock, one of the largest fund managers in the world. In 2024 Blackrock held over AUD$14 trillion in funds under management globally.

In other words, if you want an experienced fund manager, you can’t go past Blackrock and their iShares subsidiary.

iShares has been managing some of the world’s largest ETFs for more than 20 years and currently has over 50 ETFs listed on the Australian Securities Exchange (ASX).

Their largest ETF in Australia (by a long way) is the iShares S&P 500 ETF (ASX: IVV).

IVV ETF overview

Listed in 2007, the IVV ETF is iShares’ cornerstone ETF in the Australian market. Its stated aim is to provide Australians with low-cost exposure to the US stock market, and as of September 2024 it had more than AUD$8.5 billion in funds under management.

As the name suggests, the IVV ETF tracks the S&P 500 Index.

The S&P 500 is an index of the 500 largest companies (measured by market capitalisation) traded across the New York Stock Exchange (NYSE), the Nasdaq (NASDAQ), and the Chicago Board Options Exchange (CBOE).

It covers most of the largest and most successful companies in the world. Think companies like Amazon.com Inc (NASDAQ: AMZN), Berkshire Hathaway (NYSE: BRK), and Alphabet Inc (NASDAQ: GOOG) who you might know as Google.

Together these 500 companies are considered the benchmark of the US market because they cover more than 80% of the total US market cap.

So, what’s inside this ETF?

Sector exposure

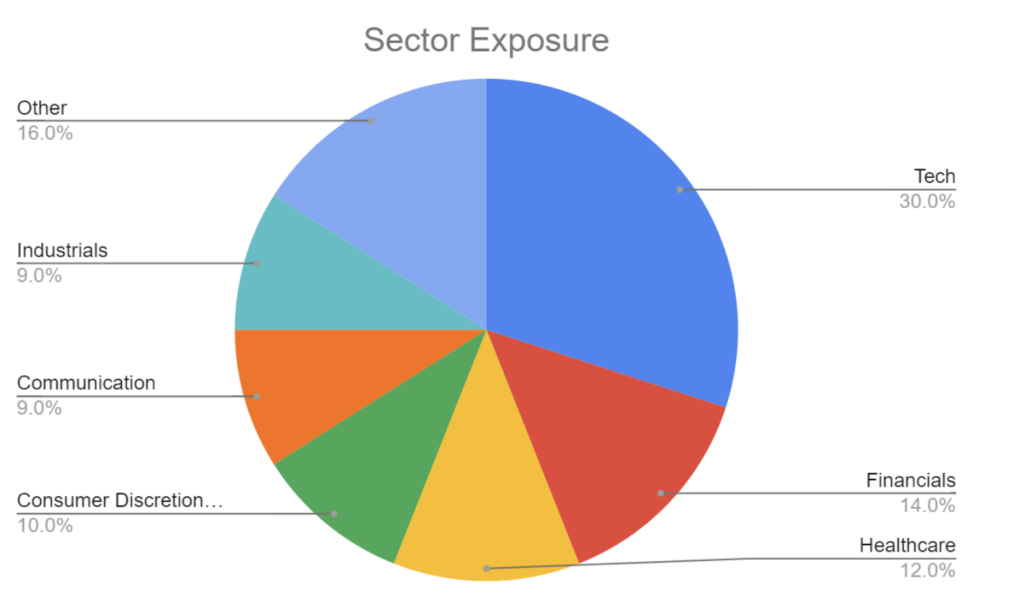

The IVV ETF covers all sectors of the US market but is heavily weighted towards technology shares. While it varies day to day, IVV’s sector exposure typically looks something like this:

It’s a certainly weighted toward ‘high-growth’ sectors, which has helped the S&P 500 Index to return a touch over 10% per year from 1957-2023.

Of course, past returns are not a reliable indicator of future returns, but this should give you some indication of why most investors like to get some exposure to the US market.

A few other key things to know about the IVV ETF:

- It’s got a very low management fee – 0.04% per year. That’s $40 for every $10,000 invested

- It pays quarterly dividends (but has a pretty low average annual yield – around 1.1%)

- It’s domiciled in Australia

Episode recorded at 12:30pm on the 24th September 2024.