“Diversify your portfolio, specialise your career.”

This was the advice given to us on The Australian Finance Podcast many years ago, by Associate Professor Sam Wylie.

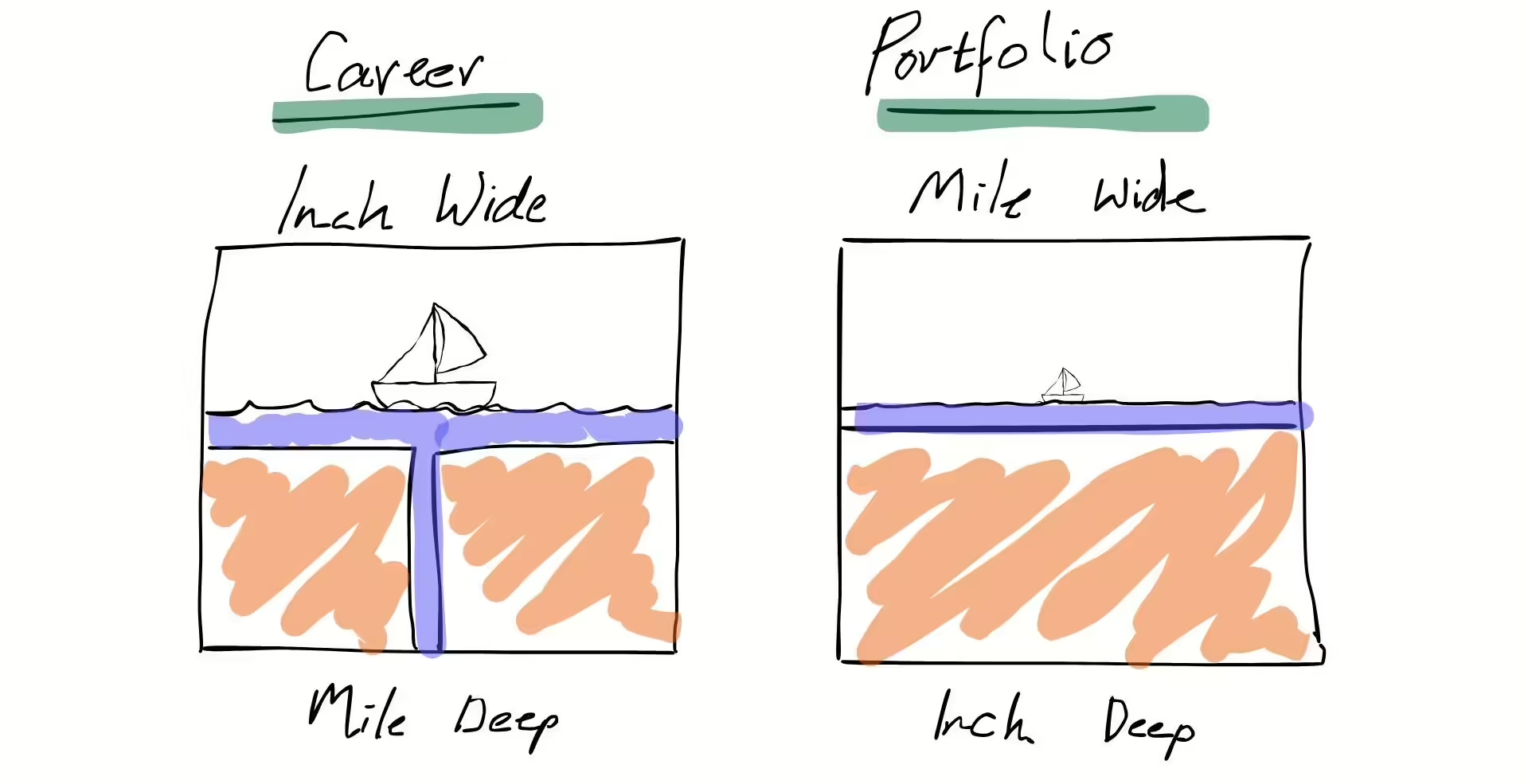

In other words, go an inch wide, mile deep with your career.

And a mile wide, inch deep with your wealth.

Let’s understand this better…

Specialise in your career

We should all aim to be highly skilled and specialised in our careers. Why?

People will pay us much more to be a specialist than a generalist. For example, a doctor can work on the hospital ward and earn $250 per hour. Or she can become a specialist and earn $250 every 10 minutes.

You could choose to be a construction labourer, earning $35 per hour plus Super, or undertake a plumbing apprenticeship to charge $80 per hour – for life.

Obviously, these choices – including the sacrifice and risk required to specialise – are far more important than how well you can budget, which ETF you invest in, or even which property you buy.

The reason specialisation works is because the more specialised you become, the more money you will make from your knowledge – not from your labour. Labour can come from anywhere, including overseas.

However technical, specialist knowledge is rare and magnifies your value to a customer or employer.

In a creative or technical industry (design, engineering, healthcare, finance, etc.) your specialised skills can get you paid 2x or 3x more than average – and even then you might be undervaluing yourself.

Reed Hastings, co-founder of Netflix, used to work with Bill Gates, co-founder of Microsoft. In Hastings’ book, No Rules Rules, Gates was recorded as saying:

“A great lathe operator commands several times the wages of an average lathe operator, but a great writer of software code is worth ten thousand times the price of an average software writer.”

So why don’t more people specialise?

Most people don’t put in the effort to do a four-year apprenticeship or risk going to university for an extra two years (on top of the study already done). And most people aren’t prepared to read a business book and take notes after putting the kids to bed.

“A bird in the hand is worth two in the bush”, as they say. So it makes sense many people don’t want to risk the extra effort of going in search of a better job.

Most people would rather earn $35 per hour right now as a labourer than study or go to trade school for four years, then try and become one of, say, Victoria’s 23,000 licensed plumbers.

Most of us would rather watch Season 4 of Slow Horses on Apple TV instead of reading Atomic Habits by James Clear.

(Tip: both are very good – though Season 3 of Slow Horses was better.)

Bottom line: you should specialise in your career. By doing so, you will become a long-term investor in yourself and compound faster as life goes on. Investing in yourself pays the best dividends.

Diversify your portfolio

Generally speaking, the opposite of specialisation is true for your money.

Having some property, some shares, some bonds, part ownership of a business and some Super, is a wonderful combination. I can’t think of any better.

By automating and/or outsourcing a diversified portfolio, it means you’ll be able to spend less time on financial admin. That allows you to invest more of your time and effort to generate income – further fuelling your career – or towards more important parts of your life, like family and fun.

To be clear, having a concentrated portfolio can result in great outcomes – but only if you are extremely patient, self-aware and inquisitive (my guess: less than 0.5% of people).

Charlie Munger, the billionaire investor and educator, preferred extreme concentration – he once said he read Barron’s for 50 years and got one good investment idea.

You can also get lucky with money. This happened to Bitcoin followers between 2014 and 2022. It was a complete fluke. As Angus told us last week, no-one can value Bitcoin – but that won’t stop them drinking their own Kool-Aid.

Finally, some people believe they can time their way in-and-out of investments. They call it a “trading strategy”. At its core, these people believe they can make a handful of investments to ‘speed up’ the returns on offer from a simple and diversified portfolio.

I dare say these people probably never last more than 12 months in a career, either.

For Aussies aged between 21 and 34, some data suggests you could earn $7,500 more by making the switch. However, Barber & Odean (2000) found people who trade their investments more often will underperform by 6.5% per year. Ouch!

Furthermore, Marshall et al (2008) from Massey University found the 5,000 most popular trading rules don’t work. Yikes.

Warren Buffett said it best: “You can’t produce a baby in one month by getting nine women pregnant.”

Study after study after study shows that the best outcomes for most people comes from diversifying their wealth and not betting on a handful of things that might come true.

Specialise in your career.

Diversify your investments.

That’s what I do.

Owen Rask

Niche investment writer & podcast host

Chief Investment Officer of Rask Invest