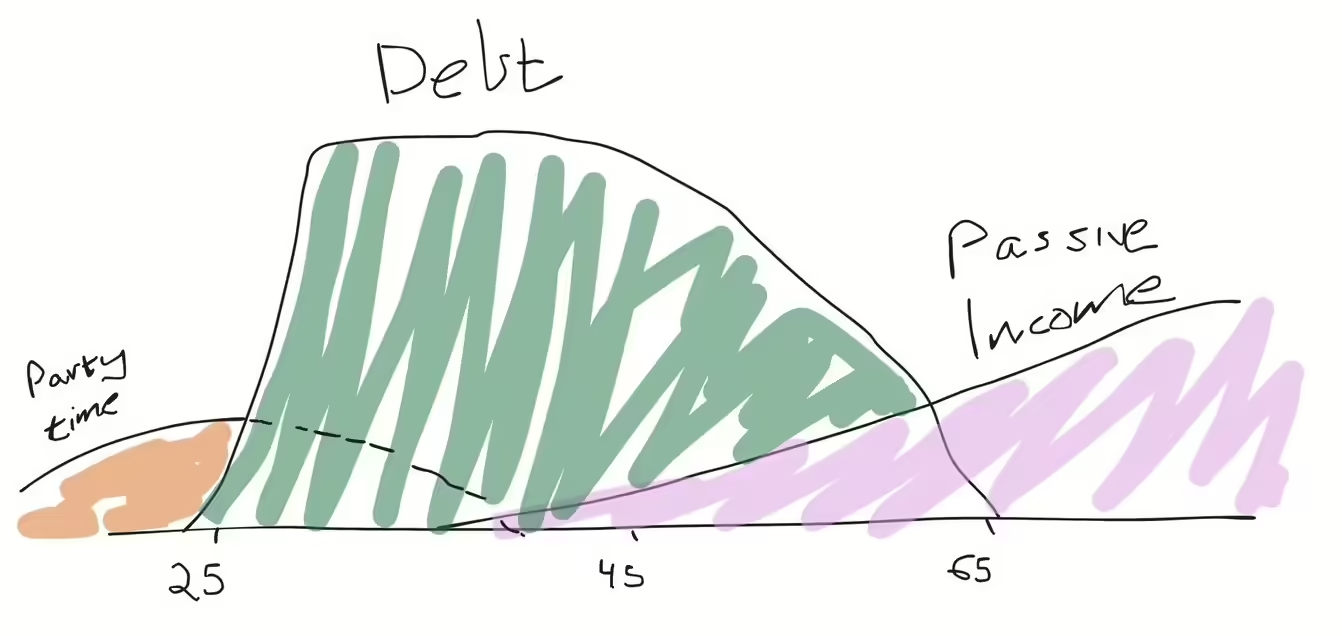

If I break the (best) financial plan into two parts, this what it looks like:

- Until 45 – maximise your debt.

- After 45 – maximise passive income.

In a picture:

To be clear: by “debt” I mean “good debt”.

Good debt is when you pay interest against something that goes UP in price and pays income. For example, shares, ETFs and property.

Bad debt is when you pay interest for things that fall in price or pay no income – car loans, TVs, crypto, holidays, etc.

But isn’t all debt ‘bad debt’?

No.

In times gone by, well-intentioned people would say things like “pay down your mortgage as quickly as you can”.

This ‘traditional’ wisdom comes from a good place, backed by lived experience with 15% (or more) in mortgage interest rates paid by a single income.

What’s wrong with that?

Once you understand the tax deductibility of interest, you’ll probably agree that paying down a mortgage on your home and being completely debt-free might feel wonderful (and for most Australians, that is nirvana). But it’s not the optimal strategy on paper.

For the Rask community – given most of us have above-average financial literacy, we work professional jobs, run businesses or have a trade background – paying off a mortgage can be bad advice.

[Note: what I’m about to say next is NOT for everyone. It involves risk. So speak with one of my chosen financial advisers, get your income protection and life insurance reviewed by Skye, partner with a great mortgage broker, get your accounting structure correct to minimise taxes, and ensure your partner wants to pursue this strategy – it’s not for everyone.]

Set up correctly, using your borrowing capacity to invest in income-producing assets may allow you to grow wealth much faster. If you have a secure income, equity in your property, good savings habits, a long-term investing mindset and a decent level of financial literacy – you should spend time understanding how things like equity release, debt recycling, and investing in income-producing assets work.

If you do it correctly (e.g. following the advice of an accountant who understands investing), you can maximise your tax deductions for interest on the equity you withdraw from a home loan, receive tax-effective franking credits, and grow your capital base.

There are risks, like the bigger loan you will have to repay, and poor investment decisions get magnified…

ETFs in retirement

Since 1990, when mortgage interest rates were ~20%, until now, the most popular strategy has been to redraw any equity you have in your home and buy an investment property.

As interest rates fell, your property (typically 5-6 times your salary) went up in price >> producing more equity you could then withdraw >> and your savings rate increased because rates fell.

Throw in a second wage for most households, a shortage in housing, rapid wage growth and population increases… and it’s no wonder property prices went way up.

However, 34 years later, it’s NOT the same trade.

With interest rates already low-ish, increasing land taxes, increasing investor taxes, vacancy taxes, lower rental yields, borrowing caps, and higher property prices, buying more properties is a suboptimal way to invest. Especially in retirement.

(Note: even in the “accumulation phase” you’ll probably be better off having one good property than two mediocre places.)

As you head towards retirement you should be maximising your passive income potential since you’ll soon be living off your nest egg.

So, after 45 – 50, you should be maximising your Super contributions (assuming you’re not going to hit the $3 million tax-free limit) and slowly begin to remove investment property exposure.

Instead, you should be increasingly allocating your capital towards debt-free investments that pay passive income.

In my opinion, the best income source is the Australian share market, since our companies pay big dividends – with franking credits.

However, you do not want to be risking your retirement on individual stocks.

You shouldn’t be forced to make your choice of Weetbix or VitaBrits (with Metamucil, of course) based on the latest profit report by CSL, CBA or Fortescue.

A far more effective, lower risk and easy-to-manage way to extract income from the Australian share market is via the use of exchange-traded funds (ETFs).

ETFs ‘suck’ your income from dozens, if not hundreds, of stocks (or bonds, or bank accounts, etc.) rather than one.

They’re also low cost, highly regulated and have been used for decades. In fact, the first ASX 200 ETF was listed in Australia in 2001.

Finally, a typical Australian shares ETF pays around 3.5% plus franking credits, while the best dividend ETFs pay nearly 5% with franking credits.

Given the cost of buying an ETF with a HIN-based broker is $5 or less (Rask Invest starts at $4.40), the upfront costs of using ETFs for passive income versus property are stark.

If that wasn’t enough, the average management fee of Australian ETFs is under 0.5% per year whereas a property manager charges around 10% of your rental income, according to REA Group.

So, is it any wonder ETFs have now been invested in by 2,000,000 Australians and the use of passive income ETFs in retirement for Rask investors is exploding?

I don’t think so.

That’s why I recently sat down with Marc Jocum of Global X ETFs (a long-time Rask advertising sponsor) to offer us 10 Reasons Why ETFs Are Better Than Property (In Retirement).

I hope you enjoy the show!

Owen Rask