Warren Buffett is the world’s greatest investor and keeper of value,

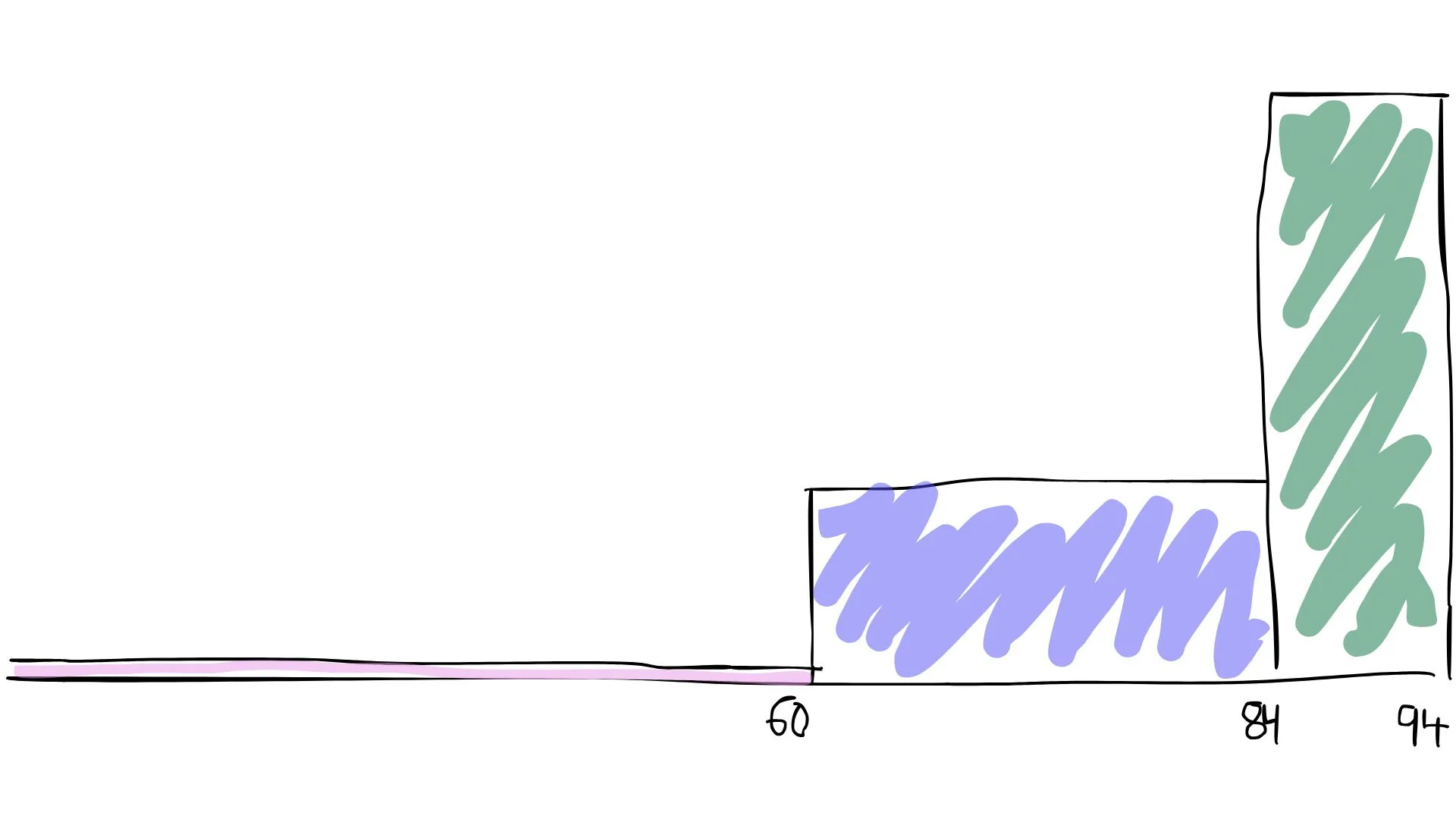

Buffett’s $142 billion wealth, divided into three stages of life, looks like this…

It took more than 60 years, probably thousands of books, multiple businesses and much of his life spent away from family, for Buffett to make his first $1 billion. (That’s the pink area, above.)

What’s totally crazy about this story is he made $80 billion in the next ~25 years.

In other words, by 85 or so, Buffett had made at least 80x more money than in the first 60 years. Imagine spending one-third of the time on something, to get an 80x better return.

Less effort, more reward.

(That’s what I call leverage – something I’ll come back to in a few weeks.)

You have probably read a similar statistic about Buffett in Morgan Housel’s great book, The Psychology of Money. However, as shown in the chart above, the Buffett story continues…

In the past 10 years, Buffett’s wealth has nearly doubled again.

Today, we look at Buffett and think ‘wow, he’s incredibly rich’ but it’s a journey that’s 94 years long, with every new year being worth multiples more than last.

How does that happen?

It happens because the money that money makes, makes more money.

But let us not forget that life is about more than money. Being “wealthy” is about more than dollars – it’s how you invest your money, time and effort that truly counts.

And time is one of those you can never get back.

When Jason Kotchoff, software engineer and founder of Stocklight, first appeared on Rask, he told us that the most valuable resource in the world is time.

‘Rupert Murdoch would give you $1 billion for another year of life,’ he said. Implying that all the money in the world couldn’t make him younger, and time was something he couldn’t get back.

During a recent panel interview, Jeff Bezos, the founder of Amazon, and 50% richer than Buffett, made a similar comment.

He remarked that all the money in the world wouldn’t stop people putting meeting after meeting after meeting in his calendar. To the point where he lost control of his most precious resource. Time.

‘I hate being over-scheduled’, he remarked. ‘We all have the same amount of time in the world… I like to have some freedom of movement.’

Used intentionally, time is a superpower in your life, and in your business.

But time can also make you a villain.

Reportedly, Buffett left very little time for anything but investing his money. Fortunately, he was an exceptional investor – but imagine if he got a few calls wrong. Was it worth it?

Jeff Bezos stepped away from running Amazon in 2021. He now owns a yacht that cost more than $US500 million just to build.

Every week, in my business, I use timeboxing in my Google Calendar. And, similar to some of the rules used by Bezos before he stepped back, Mondays are ‘no meeting’ days – no one can book me. This is the time I gain perspective.

And for my mental health, I used to set ‘worry time’ in my calendar. This is the time reserved for worrying, journalling and/or making a life list (yes, it’s a proven and very effective way to destress).

How can you use time more intentionally to get the life you want? Let me know in the community.

In my mind, we all have superpowers to unlock. Time, empathy, leverage, and perspective are four that spring to mind. All of them can supercharge your journey.

Onward & upward,

Owen Rask

Founder & Chief Investment Officer