Who is the better investor: Peter Lynch, from One Up on Wall Street fame, or Warren Buffett, Berkshire Hathaway Chairman?

In this Australian Investors Podcast with Owen Rask, Global X ETFs Australia’s Marc Jocum gets into the weeds on the company’s new Exchange-Traded Fund (ETF), S&P World ex Australia GARP ETF (ASX: GARP).

This episode is sponsored by Global X Australia, as part of its very long-term advertising partnership with Rask.

GARP episode topics covered

- Better investor: Warren Buffett or Peter Lynch?

- Why isn’t there a ‘Warren Buffett ETF’?

- What is GARP investing?

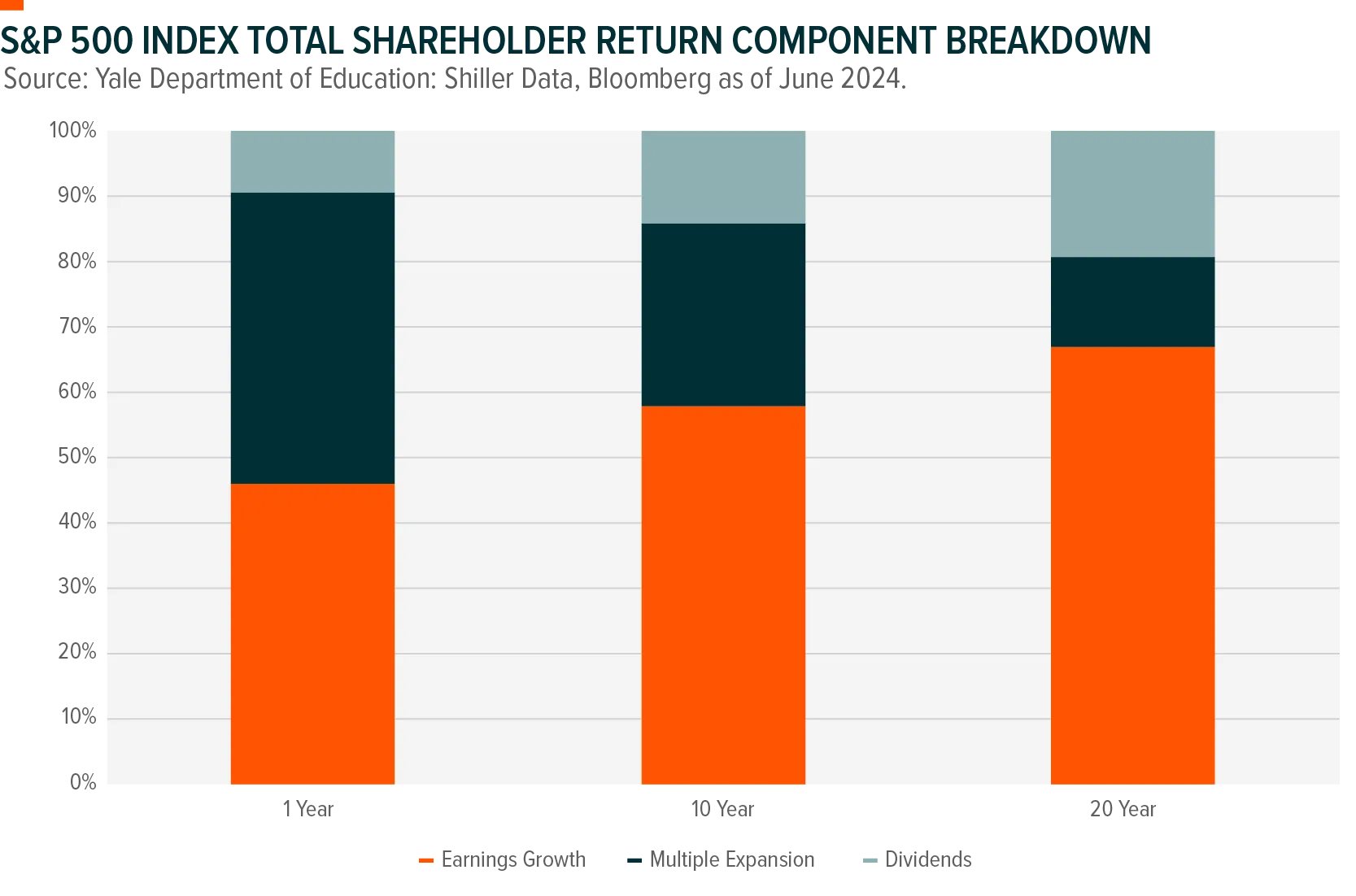

- What drives stock prices over 10+ years?

- What’s better: FANG stocks or GARP investing over a 10-year horizon?

GARP talking points with Marc Jocum

Hey Marc! Welcome back. How’s this for the first question on a podcast…

Imagine I hand you a special “raygun” that you point at any investor and make them 18 again. In front of you stands two of the most famous investors in history, Warren Buffett and Peter Lynch. You point, click, and – pew pew – they’re both 18 again. If you could invest $1 million with them right now, for 20 years (until 2044), who would you choose and why?

Okay, Marc, you’re an ETF expert. You invest in them, you study them… but you also create them. Why isn’t there a ‘Buffett ETF (ASX: BUFF)’?

Ok, Marc – let’s start at the beginning. What is a “GARP strategy”? Pull the acronym apart, tell us where it comes from, etc.

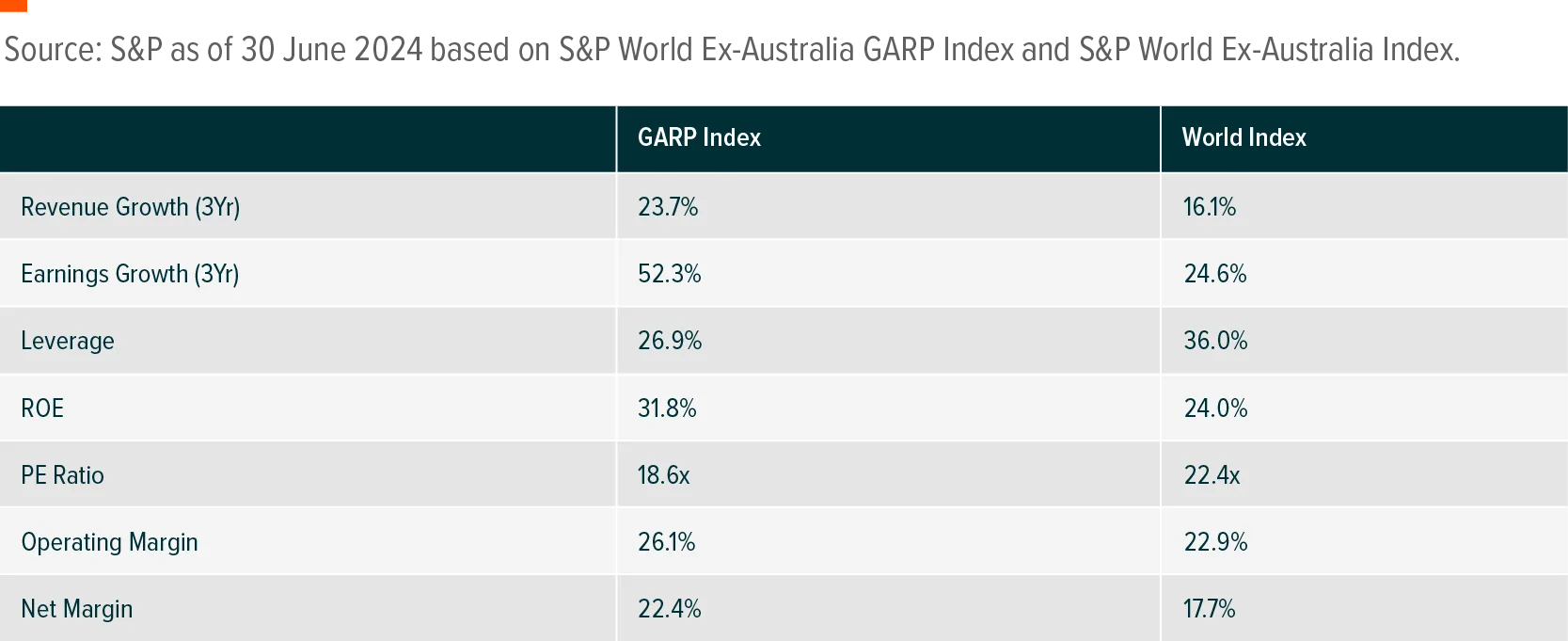

Can you pull out the factors used to construct GARP?

Did any of the following chart surprise your Marc?

Marc, do you think a GARP strategy would work well in Australia?

What are the risks of holding GARP?

Let’s go to where the rubber meets the road, Marc. If you had to take $5,000 and invest it in FANG+ or GARP over until 2034 (10 years), which would you choose and why?

Finally, Marc, you and I will be back on in a few weeks’ time to continue our debate of property v shares or ETFs, so people can send us their questions, feedback or… heckling – send it now! In the meantime, where would you direct people to learn more about GARP investing?