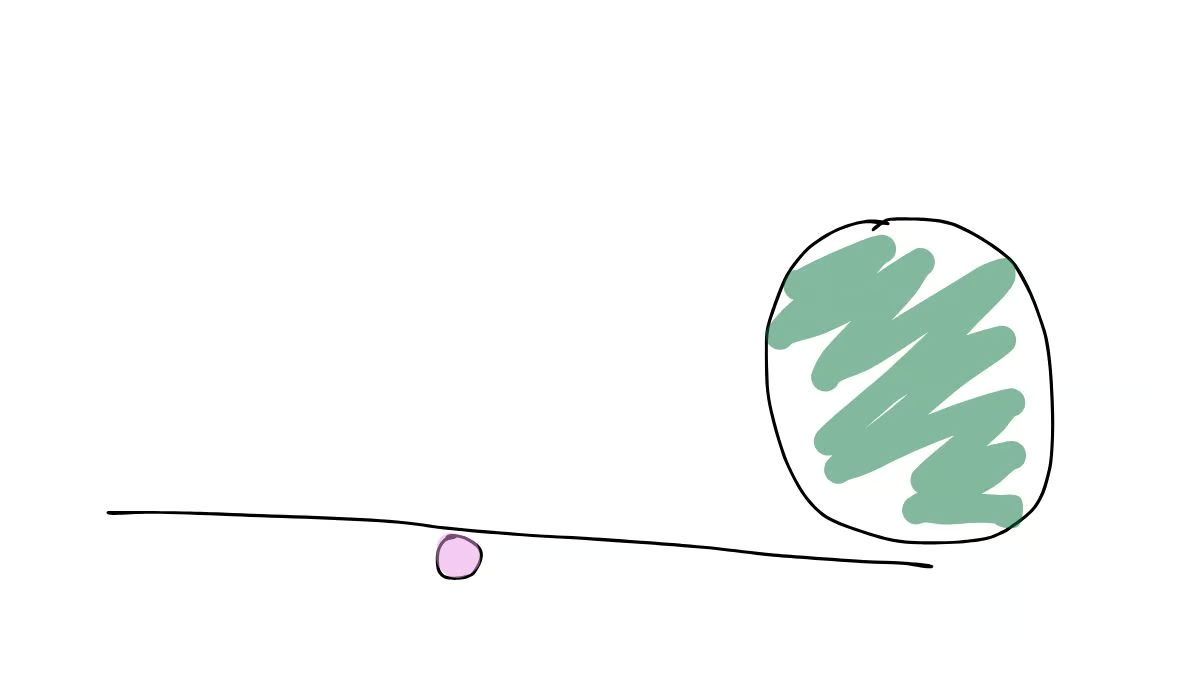

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

Those were the famous words said by Archimedes, the Ancient Greek Mathematician.

In finance, the phrase “leverage” is usually reserved for telling you that someone is using debt.

For example, I can put down $100,000 as a deposit to get a decent $500,000 apartment – thanks to $400,000 of debt.

In other words, my exposure is 5x what I chipped in.

This means, if my apartment goes up 10%, to $550,000, that’s a $50,000 gain. But, really, I’ve made a 50% gain on my original deposit ($50k / $100k = 50%).

Same effort, but 5x the return.

When I come across rules like this, I think to myself, I wonder if there are other areas of life where I can apply this principle.

For example, imagine if you could go from $100,000 in salary to $200,000 with only 20% more effort applied. Maybe you take work on a Saturday, find a more valuable career, go to night school once a week, etc.

Or perhaps you have a strained relationship with your partner and you’re not on board with one another’s plans. Is it worth taking a 10% risk that you lose the connection, for a 2x better relationship?

Now let’s imagine if we combined these effects.

Twice the income, a united relationship resulting in double the deposit… and a bank willing to lend 5x your annual salary, allowing you to invest in a better property… which goes up even faster.

That’s $200,000 x 5 = $1,000,000 borrowed + $200,000 deposit.

The $1.2 million house goes up 15%. Now it’s a $180,000 return.

Taking calculated risks and thinking probabilistically is what separates the best investors and business owners I know.

For more information on when to use financial leverage, see this recent article – The Best Financial Plan Has 2 Parts. For more information on using debt recycling, equity release or investing in shares using debt, follow the links.

For more information on operational leverage (explained below), and how to find hidden companies that display this type of leverage, read my research report on a small ASX-listed company I wrote about a while ago. Then study how the share price has tracked, and what’s happened to the business since then.

Operational leverage is the reason why NVIDIA makes around $2 million of profit, per employee, per year. NVIDIA was able to sell more GPUs this year, but using the same amount of people and costs as last year. Way more profit, same costs.

To better understand how to find companies with embedded leverage, I recommend using tools like Porter’s Five Forces, which I covered in “Step 2: Competitive Advantage” of our (now free) Value Investor Program 1.0. Porter’s Five Forces is shown below.

Finally, even if you’re not investing right now, in your career, choose to dig deeper. Specialise again, and again, and again. Become irreplaceable with technical skills.

In other words, leverage your skills. If applied correctly, it could make you 2x or 3x more valuable than the next person. Meaning you get paid 50%, 100% or 200% more than a similar person in your industry.

This is extremely common amongst engineers, plumbers, doctors and lawyers who invest a little bit more in themselves to specialise. But I believe anyone can do it.

If you have already discovered ways to leverage your money, career or skills, please share it with us in the Rask community.