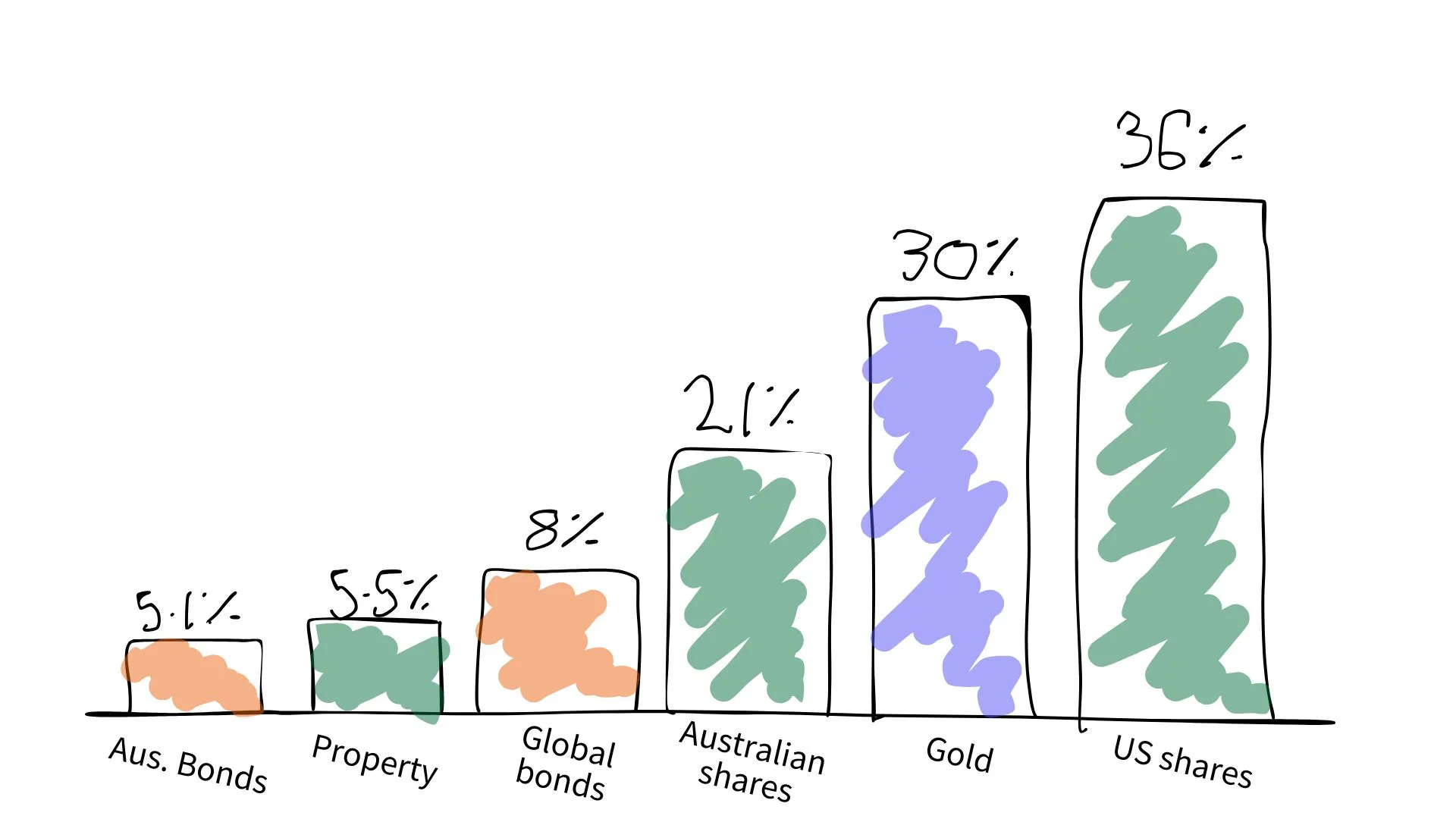

In case you haven’t checked recently, here’s what happened over the past year:

Over the past 12 months, literally every investment has experienced growth, despite negativity everywhere in the news.

As the USA began to cut interest rates (0.75% so far), investors around the globe moved into growth assets (shares, property, etc.), pushing up prices. Meanwhile, the biggest companies (Microsoft, Tesla, CBA, etc.) experienced some profit growth. Australian property remained undersupplied.

This trend also meant government bond investors (like us, at Rask Invest) enjoyed a few percent of growth from our bond ETFs, plus a bit more in the form of income.

Finally, conflict in Europe and the Middle East, along with a US election, drove prices of so-called “alternatives” like gold higher.

Ultimately, these returns are what most people want – families who saved and invested are getting wealthier because they made the decision to stay invested 12 months ago.

Conversely, people who were fearful of politics, over-leveraged by debt in recent years, listened to doomsayers or simply weren’t able to save to buy assets, have fallen behind.

In other words, betting on optimism has worked. Again.

What now?

Over the past few months, I’ve been asked if the massive growth of recent times can continue. By that they meant, will the market keep going up over a 1-year, 5-year or 10-year period?

Over one year, no one knows for sure. So it’ll be safer to avoid the forecasts on telly, radio, social media or in the newspaper. Even if it’s someone you trust (like me), don’t fall for their forecasts. It’s just marketing – it hurts you but elevates their career. That said, based on my research, I’m very doubtful that 30%+ returns from US shares and gold are reasonable. I’m not betting on US shares to return that amount in 2025. But we’re still exposed to some US shares through Terra, Martian & Jupiter. We have part of the portfolio currency-hedged as well, to help smooth the ride. The key risk is people now pile into shares and gold thinking that the past 12 months are indicative of the next 12 months.

Over a five-year time horizon, I think we need to start ‘tweaking’ our traditional way of thinking about growing and maintaining wealth. If your portfolio is heavily invested in just one thing (index funds, ETFs, property, bitcoin, through Super, etc.), try blending in more assets. Start doing it now, acting from a position of strength. Adding some small cap funds or shares, some active investments alongside index funds, don’t just rely on property, etc. For example, something I’ve spoken about with my investment committee in recent months has to do with our Jupiter strategy, which is still very heavily invested in VAS – the Australian shares ETF from Vanguard. There’s a real chance holding too much VAS over the next 5-10 years could be a mistake, given our reliance on no-growth bank shares and iron ore miners. My fear is VAS mightn’t fall, but it might go sideways for quite a while.

Over the next 10 years, I think most of us need to get smarter in the way we think about building a portfolio because I’m not convinced what’s worked since the 1990s will continue to work – as well – in the future. Buying and holding an index fund, or virtually any suburban house, has been an A+ move. Don’t get me wrong, I think those are good things to do, even now. But I don’t think it will produce the same level of returns going forward. It’s about being prepared for all futures, not a specific future.

So is it time to sell out?

No.

I’ve never thought, nor seen in real data, that selling out completely is a good idea.

The people who get scared, sell out and say “I’m waiting for a crash”, are the same people who will be too scared to buy when the market actually falls.

What the actual data suggests, and what I’m advocating for, is blending a portfolio through time, and doing it in a way that makes you feel good – after understanding the risks.

Remember, every decision you make with your wealth will have consequences.

For example, imagine all of the younger people who got out of shares, or didn’t invest, and put their money in cash or an offset account 12-24 months ago. The offset would have generated ~8% over the past year. Meanwhile, Australian shares returned ~23% including franking credits. Maybe the offset account made them feel good at the time. But maybe they would have felt just as good doing half and half.

Or imagine a retiree who moved to “conservative” instead of “growth” inside Super before the US election campaign in 2023. They may have knocked a few years’ worth of spending power off their Super by not being invested.

The key reminder from this email is that markets climb a wall of worry and there are risks in every move we make – even if we do nothing.

A) Do nothing | and expose ourselves to a crash

B) Use cash to buy more gold | but gold could be overvalued

C) Buy more property | but land taxes are coming

D) Add extra to Super | but Super laws are changing

E) Rebalance | but maybe shares keep going up

For me, given the rise of markets and how well our Rask Invest portfolios have performed in 2024, I’m considering introducing more diversification to our portfolios, to ensure we’re not trying to predict the future – just be prepared for it.

You can see what we own by visiting our website, clicking on a strategy, and then viewing the current holdings.

And you can let me know if you have any questions, feedback or advice by jumping into the free and secure Rask community.