In this Australian Investors Podcast episode your host Owen Rask speak with Doug Morris, the CEO of Sharesight, to discuss the most traded stocks and ETFs in Australia, where AI could take your investing and the most popular brokers.

About Doug Morris

This episode with Doug Morris, Managing Director of Sharesight, is brought to you by The Australian Shareholders Association, Australia’s largest not-for-profit investing and corporate governance community.

Doug has been with Sharesight for 11 years, and became CEO in 2015. Sharesight is used by 400,000+ investors to track and monitor investment portfolios for tax and performance. In this episode we’ll discover the most widely traded companies and ETFs in Australia and discuss the latest in investing tools.

Topics covered today

- The rise of ETF investing

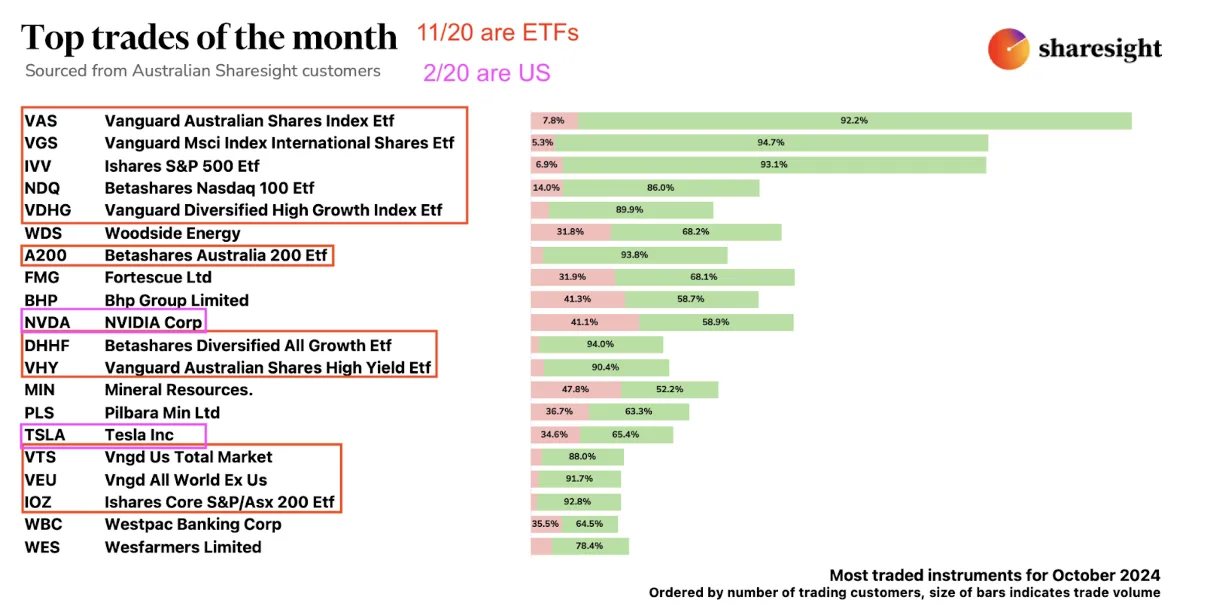

- 20 most traded ASX shares & ETFs

- Investor trends of 2024

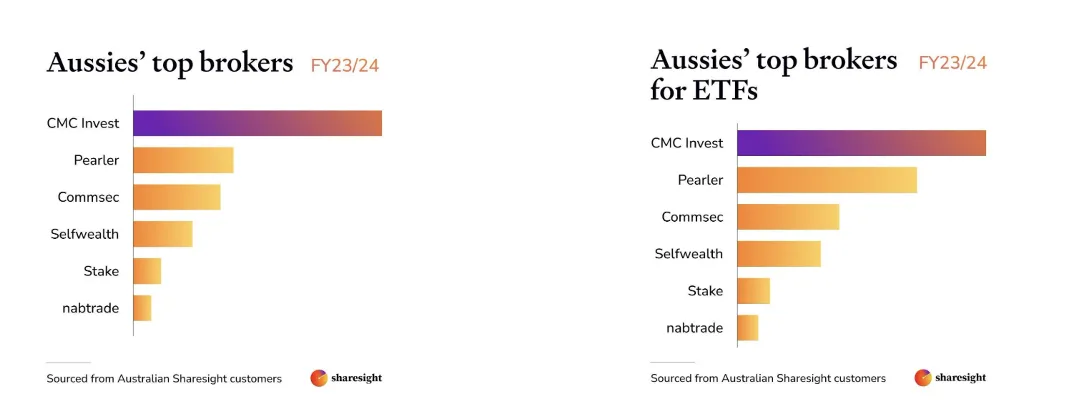

- Most popular share brokers in Australia

- Doug’s one bold forecast for 2030

Podcast questions with Doug Morris

For anyone who hasn’t used, or heard, about Sharesight, can you give us the bird’s eye view, Doug?

I remember when Sharesight was starting out. Way back in the day. The tax reporting was easily the most attractive element, and shrewd investors would also use benchmarking to self-reflect and determine that they should probably just use ETFs. What are the most used ‘newer tools’ Doug? I know there’s like a geographic tool for visualising things now? Plus future income…

How is Sharesight being used with respect to ETF investing? I have this pretty high conviction belief that over 90% of direct investment and adviser investment will be via ETFs at the end of this decade. How does Sharesight play in that space?

I’d like to just have a bit of fun and step through the 20 most traded investments in Australia. We can riff on each and try to understand why they are where they are…

Do any of the trends you see in the data, throughout all of 2024, challenge or confirm your existing beliefs in any way?

How about brokers, Doug. We can see from Sharesight data that CMC and Pearler are the top 2, edging out Commsec. Does that surprise you?

On the technology side, where are you guys focused? Is AI something you’re focused on?

Doug, if I could ask you to make “one big and bold” forecast for the year 2030, given all of your accumulated technology and investing wisdom, what would it be?