Take a look at Costco Wholesale Corp (NASDAQ: COST) and its profit & loss, then tell me what you see…

Other than consistent growth across all measures, here’s what I see…

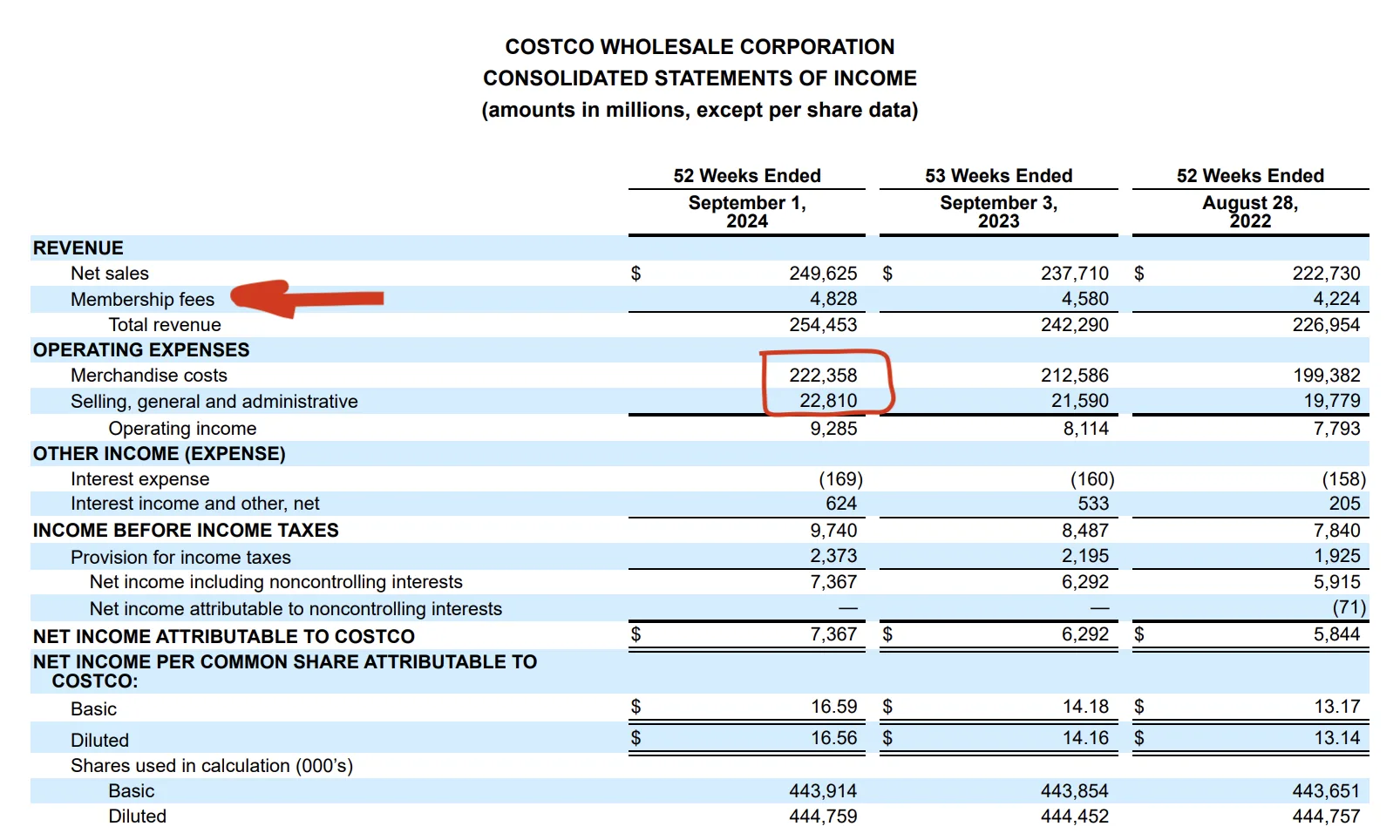

1. A seriously important line that says “membership fees” – it brings in a cool $4.8 billion per year.

2. If you add up the cost of the products it sells (“Merchandise costs”) and “Selling, General & Administrative”, you’ll find the company’s core supermarket business operates on a profit margin of just 1.7%.

Woolworths and Coles tend to operate around 4.6%. In other words – Aussie supermarkets make 3.5x.

Costco’s secret sauce

If you ask a career finance person about supermarkets, they’ll tell you something like:

“In a game of high sales volume, every extra 0.1% of profit margin counts. So go after wider margins.”

You’ve probably seen this type of behaviour in action…

Typical Australian supermarkets, and their suppliers, will shrink the size of their products if they cannot raise prices consistently.

A Sakata missing here, a Coke “Mini” there… it’s not until a few years later we pinch ourselves and we wonder why our $50 isn’t going nearly as far as it did before.

I can remember the days when $100 nearly filled a trolley!

Why Costco keeps winning

If you ask forklift driver turn Costco CEO, Ron Vachris, he would probably tell you the opposite thing to any other supermarket CEO:

Lower your profit margins or offer more value (e.g. larger sizes) whenever it’s possible.

When I crunched some numbers, I concluded Costco is making more profit from selling $65 yearly memberships than it does by selling tonnes and tonnes of hotdogs 🌭

And let’s not forget: people are paying Costco to let them shop. It’s basically crowdfunding, but for a supermarket.

Once a member is inside a warehouse, they reap massive benefits from Costco’s incentive to lower – not increase – prices.

Over time, this shopper-funded business model gets wickedly more impressive, as Costco gains more and more and more purchasing power on products.

Because of that, it attracts more and more and more members, who increase the volume and purchasing power of the business.

Since 2014, membership fees are up 100%.

And since 2005, sales have risen from $120 million to $260 million per warehouse. A compound annual growth rate of 4.2%.

In the most recent reporting period, even after adjusting for new warehouse openings, foot traffic had risen 5.5% in one year. Hinting at even more purchasing behaviour.

Remember, this is happening despite the rise of e-commerce and ‘little’ things like Amazon.

Finally, Costco’s rapid growth in areas like pharmacy, gold and precious metals, and ecommerce, showcase it’s ability to take it’s community-first business model and expand into other critical areas of business. If you trust Costco for 2kg of peanut butter, why not get your prescription filled at lower prices?

Are Costco shares a buy?

Costco is now a $US465 billion behemoth.

In Australian dollar terms, its shares are pricing the company at 27 times the size of Coles. The shares look expensive, on a price-to-profit (PE ratio) of 60x and offering a dividend yield of just 0.4% per year.

That said, when I find a company that breaks all of the rules, has an intensely long-term focused management team, hires from within, puts its clients/customers interests ahead of its own, a great competitive advantage, and an average customer stays for at least 9 years… I’m willing to put some of my valuation work to one side.

So, alongside my diversified core portfolio of Jupiter ETFs, held inside Rask Invest; I’d happily take a very small bite of Costco shares for my satellite – and hope the price falls from here… so I can buy more!

(Psst. To be clear – I think the shares are expensive, and might not outperform the broad stock market over the next three years. But over 5 or 10 years, I think Costco’s best days are ahead of it.)

Now… where did I put my membership card.

Cheers,

Owen Rask

My extra resources for Costco

Costco: If you’re keen to learn more about my take on Costco, and another company I would ‘take a nibble at’ today, take a look at this weekend’s episode of The Australian Investors Podcast. We discuss Costco, NVIDIA, WiseTech, ETFs & more.

Valuation: to learn how to value companies/stocks like Costco or Woolworths, take our free Share Valuation Course (intermediate) or the full Value Investor Program.

Core & Satellite: In case you’re wondering, I still own individual stocks, alongside my core ETFs. There are many reasons I do it – view the Rask Investment Philosophy to learn more, including how we identify stocks to buy.

Podcast timestamps

00:00 – Investors podcast

05:00 – Tesla stock collapses

09:00 – NVIDIA’s latest quarterly

14:30 – Magellan (ASX:MFG) or Platinum (ASX:PTM)?

19:50 – YouTube comment of the week

25:40 – WiseTech (ASX:WTC) is cheap?

30:10 – Costco’s stock is impressive

32:30 – Costco is customer first

35:40 – Owen’s big news

36:00 – Rask Financial Advice

41:00 – Weekly investor Q&A