The Fortescue Ltd (ASX: FMG) share price is down 21% this year and 41% over the past 12 months. While Fortescue is known to be a great ASX dividend share, below I’ll share a far better idea to buy today.

FMG share price

As you can see above, the Fortescue share price has been a downwards slide. Since 2022, iron ore, Fortescue’s #1 product and a steel-making ingredient that is shipped almost exclusively to Chinese steel mills, has fallen from $150 per tonne to $102 per tonne today. It has no control over its prices.

Keep in mind, Fortescue’s grade of iron ore is below the industry standard – so it’s products are a discounted rate on the spot price.

Fortunately, given Fortescue is an exceptionally good iron ore miner – and comparable to juggernauts like BHP Group Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO), albeit less diversified – it still makes good profit margins on the ore it digs and ships. Gross profit margins hover about 45%, give or take – which is exceptionally good for any volume-based, capital-intensive business model.

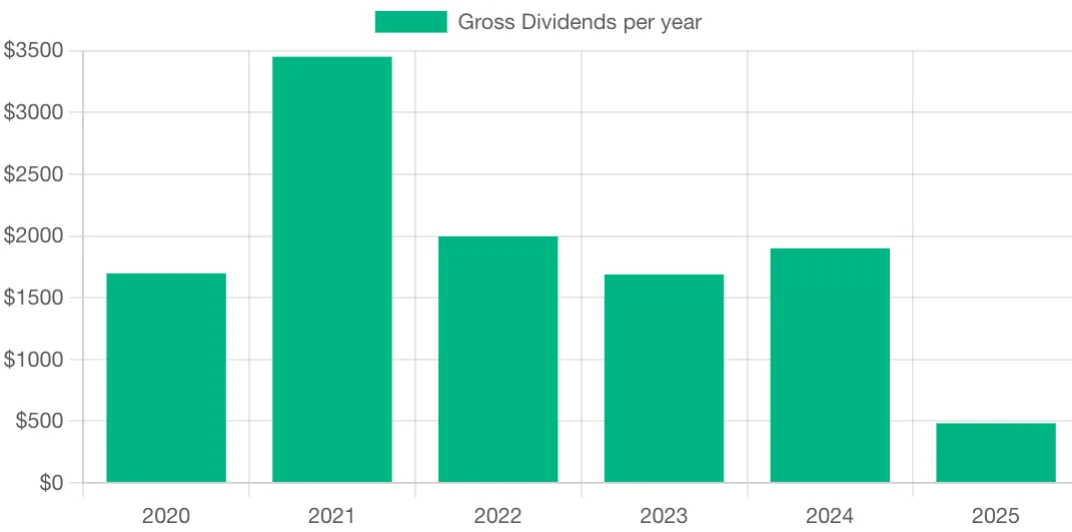

Fortescue dividends

The FMG dividends chart above comes investor reporting software Navexa, the tool we use at Rask (and the community does to) to track portfolios and manage tax.

It shows that for every $10,000 invested in FMG shares over the past 5 years, you would have received around $1,650, then nearly $3,500… but now it’s back below $2,000.

Unfortunately, the outlook isn’t any better.

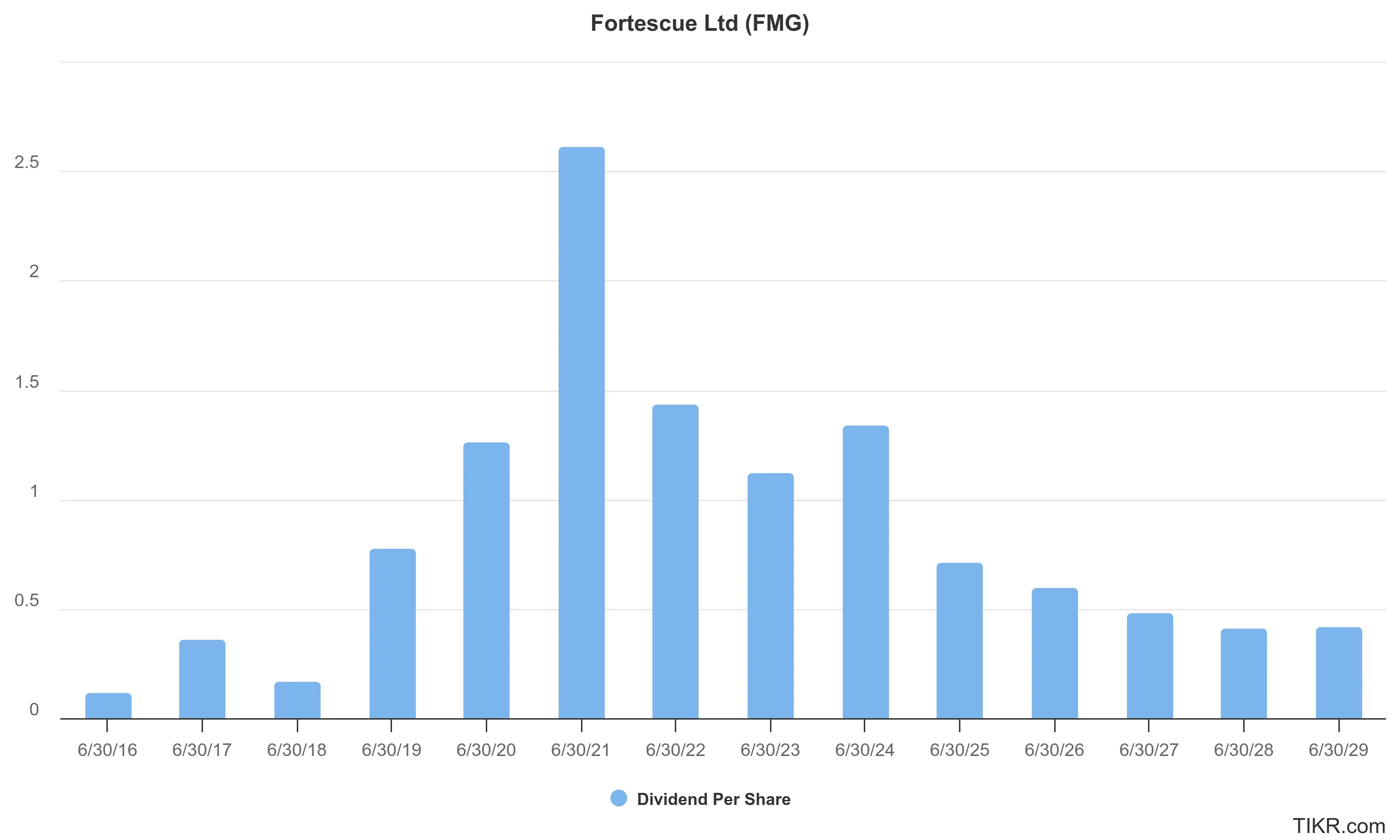

FMG dividend forecasts

According to analyst consensus forecasts pulled by Tikr, Fortescue is expected to pay fewer and fewer dividends, per share, over the next five years.

What I’d buy instead

It still surprises me how many Australian investors use a single stock for income. I get it. As a professional investor who has built a track record on buying individual companies and shares. I get it.

Buying great companies and holding for long haul is awesome. I still buy individual companies. For example, yesterday I told the online Rask community that I plan to buy some shares of Costco Wholesale (NASDAQ: COST) and WiseTech Global (ASX: WTC).

However, most of my individual shares only go into my Satellite allocations. Not my core portfolio. If my Core is 75-80% of my combined portfolios, this means the volatile individual companies/stocks, like Fortescue, would be, maybe 2.5% overall weighting.

Instead of buying something like Fortescue “because I like the company” or “Twiggy has delivered”, please, I urge you – consider using a more diversified income approach.

For example, in our Rask Invest portfolios, we holding Vanguard High Yield Australian Shares Index ETF (ASX: VHY). It’s an ETF which holds Fortescue (3% weighting), but also another 60+ Aussie dividend stocks.

Right now, you can get a 5% estimated dividend AND you’ll get some franking credits. The core difference is you are not exposing yourself to a single stock’s performance, whether iron ore goes up or down, China x USA x Australia trade wars, and so on.

I think FMG is a great business, and a great dividend stock. But it is miles and miles when compared to the benefits of taking a simple, low-cost, ‘whole-of-portfolio’ approach with something like VHY blended into the core.

Challenge my ideas in the Rask community (I’m online today), send our senior team an instant message (bottom right corner) or grab a free version of my passive income report below.

I welcome your feedback and challenges.

You can also view our full portfolio holdings, strategy by strategy, by clicking on the Rask Invest portfolio pages.