Everyone has an opinion (or conspiracy) about Donald Trump’s Tariffs. Unlike many, I actually think there is a lot of method to this ‘madness’.

This article first appeared in my free weekly investor newsletter, the day before the market crashed 6.5%. Over 50,000 Australian investors read it every Sunday. If you like this discussion, create a free Rask account and join us.

~~~

Never underestimate the man who overestimates himself.

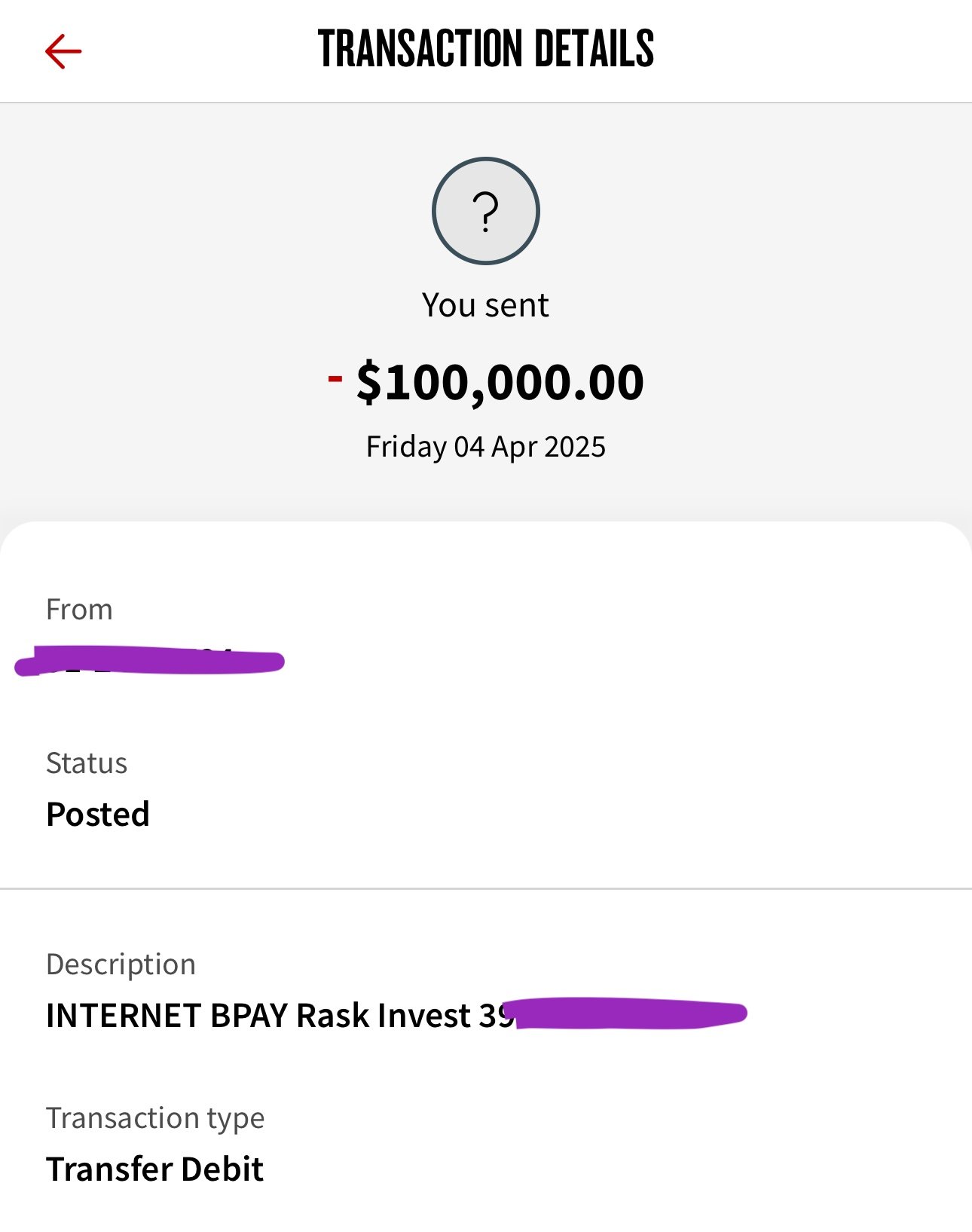

Nonetheless, this week I’m committing to $100,000 into Rask Invest.

In fact, my money has already been sent!

Read on to discover why…

“Worth $85,000 in four weeks.”

Just a few days ago, I posted on Twitter/X that I’ll be investing $100,000 of my family’s money into ETFs, via Rask Invest.

One of the first commenters (respectfully) said, “[it’ll be] worth $85k in four weeks.”

They were implying that the world is totally uncertain.

Trump.

Tariffs on penguins.

Trade wars…

Actual, terrible, wars in Ukraine and Gaza…

Russia’s dictator being nasty (as usual)…

Poland buying more weapons and stocking mountains of gold to protect themselves in case of further tension with Belarus (a Russian proxy country).

European countries are recommissioning bunkers inside mountains and buildings…

Peter Dutton has kicked a footy into a cameraman…

The Australian dollar fell 4.8% in one day.

Apple shares are down 13% in 5 days…

It’s all pretty scary right now…

Or is it?

I’m thinking…

Could we ask for more reasons to invest now?

Yes. Times are uncertain.

But to me, now seems like a wonderful time to be a long-term investor and prove to yourself that you have what it takes.

Not just to stay invested – but to keep investing at lower prices.

As the saying goes, “everyone is a long-term investor until the next market crash.”

The thing is, this isn’t even a real market crash.

The ASX 200 Total Return (ASX: XNT) is still UP ~2% from this time a year ago.

The S&P 500 is down 2.5%.

But the iShares S&P 500 ETF (ASX: IVV) – the ETF I own and recommend – is up 8.5%! (Thanks to currency movements.)

But is it safe to invest?

“In the short term, stocks are risky to own. In the long term, they’re risky not to own.”

The reason stocks do better over the long run is because the short term returns are not guaranteed, like a term deposit. You do better because you take the risk. Academics call this a “risk premium”.

And in every moment of heightened uncertainty, like now, no-one knows the future.

This is why the best investors I know always seem to invest more based on faith, than fact. And this is unsettling to most people who want certainty before acting.

In the darkest moment, betting on Rask’s “brighter future” idea seems so much more risky than clicking on the Sky News “journalism” that reads, “Another bloodbath on ASX after Trump’s Liberation Day wipes $3 trillion off US”.

But here’s the thing: the more you zoom out – the more things make sense.

Not just in stocks*, but in politics too.

(*As we know, the Australian stock market has returned over 10% per year in the past 120+ years – despite World Wars, a Great Depression, floating of the Australian dollar, Cold War, etc..)

What’s Trump really up to?

I want you to imagine for a moment that you love your country.

And you love and believe in democracy. You believe that allowing people to freely vote for their leaders (like Australians are about to), who will govern and protect the country, is the right thing.

Let’s also imagine you’ve also been an investor all of your life. So you understand business and negotiation. The media made you a celebrity because of it.

And now, you’ve just stepped foot into the world’s most powerful office. You are now the US president in 2025.

The first thing you do is start looking at the world today, and what’s been happening…

Over the past four decades, China – a country that removed the requirement to put a limit on the time a person can be President – has completely dominated you economically and through control, coordination and your free trade agreements has surpassed you in so many ways.

Your biggest adversary (Russia) has just invaded another democracy (Ukraine), which peacefully gave up its nuclear weapons in 1994 – with guarantees from the UK, Russia itself and your predecessors for its security.

Europe and the entire world (including Australia) have relied on your national defence spending to bring economic and relative geopolitical stability to the world, free trade, economic freedom, currency transfers, and technology.

Meanwhile, you’ve gone completely into debt so people are now questioning whether your currency (USD) deserves to be the global standard for trade… and China is trying to form its own currency bloc.

What should we do, Dear President [of the world’s only true democratic superpower]?

Firstly, you would probably be pretty pissed off. How did it come to this!

Second, you would probably want to take back control and stop allowing everyone to run loose on their trade, on their wars, with their botched politics, and so on.

Third, you would probably want the world to know that you won’t stand for it anymore.

And, finally, you’ll want everyone to pay for their fair share, right? You’re a businessperson after all.

Are tariffs bad?

Tariffs are blunt economic tools. In principle, they’re designed to “protect”, or rather “prolong”, a local industry, like automotive, until it eventually gets squashed by better overseas competitors (say hello to Australia’s “Luxury Car Tax”).

So Tariffs can be very stupid (especially when applied to islands filled only by penguins).

And tariffs can be potentially dangerous for many economies (e.g. a lower Aussie dollar could increase our import costs).

Finally, tariffs can cause all sorts of weird competition imbalances, lots of inflation, and (obviously) lots of uncertainty for the financial system (homeowners, retirees, businesses, banks, investors, etc.).

So, on balance, yeah – tariffs don’t make a lot of sense.

That said, they could be a wicked negotiation tool.

After all, what else are you going to do, Dear President, to wrestle back some control?

Maybe you can join a convention that requires unanimous support to have an outcome.

(Which, by the way, includes the countries who are taking advantage of the current system – the ones who don’t act like real democracies.)

No, “to hell with that!” you say.

It’s time to cause a stir. And let people know.

It’s time to make the world think you’re completely nuts. Off the rails.

An economic numpty who taxes penguins.

Because you want to seem so crazy that they have no choice but to take you seriously.

Or else… “who knows what the President will do next!”

How can I invest in these conditions?

I can offer no certainty of where stocks will go this year.

Just as I said to you in December. But no-one else can, either.

If inflation hits, do you really want term deposits and property? If the stock market bounces back, will you regret selling and paying tax? If Poland stops buying gold, will your ETF fall?

In full truth, I don’t know if the US dollar will still be the global reserve currency in 2030 or 2040 (note: this is probably the biggest risk for all Australian investors). But…

Here’s what I do know:

1. The world rewards capitalism. Even in China (with handbrakes), an economy is just a free-flowing marketplace of people, businesses, ideas and technology. This is what moves a society forward.

2. To move forward, we need to incentivise innovation and founders to create companies and products to solve bigger and trickier problems (hence why communism is still going out of favour).

3. The stock market is the only place any one of us can go to invest in these two things, securely and transparently. That’s why it’s been the best investment for 100+ years.

4. Unlike the GFC, World Wars and Great Depression-era in stock markets, this is a self-inflicted, small (so far), downturn. This too shall end.

5. Australia is awesome. Our financial system is secure, extremely well regulated, safe and thriving – and it’s all backed by an amazing democracy, great healthcare (hey, USA – back off our PBS!), people, entrepreneurs, culture and defence force.

6. Most people should get professional help if they want to invest through uncertainty. If you’re freaked out by the current market uncertainty, get expert financial advice – or simply let me and the team invest for you so you can get back to living your life. The fees are bugger-all in comparison to what you’ll lose by not investing or selling out of fear.

~~~

That’s it for this week. I’m excited to put more money to work for my family as the world becomes a better place for all.

Until next Sunday.

Onward & upward,

Owen Rask