Have you thought about investing with debt? Here’s a full review of the Betashares Wealth Builder Australia 200 Geared (30-40%) Complex ETF (ASX: G200) and all the pros and cons.

Investing with debt

First of all, why would anyone consider investing with debt?

Investing with debt is called leverage and the basic idea is that it allows you to amplify your returns by increasing the amount of money you have invested. There are a few reasons why this can be a bad idea.

The most obvious one is that you have to pay interest on the debt, so your return would be reduced by the amount of interest you’re paying. But the biggest risk is that leverage amplifies both your gains and losses.

Let’s look at a very simple example (we’re not considering fees or taxes here).

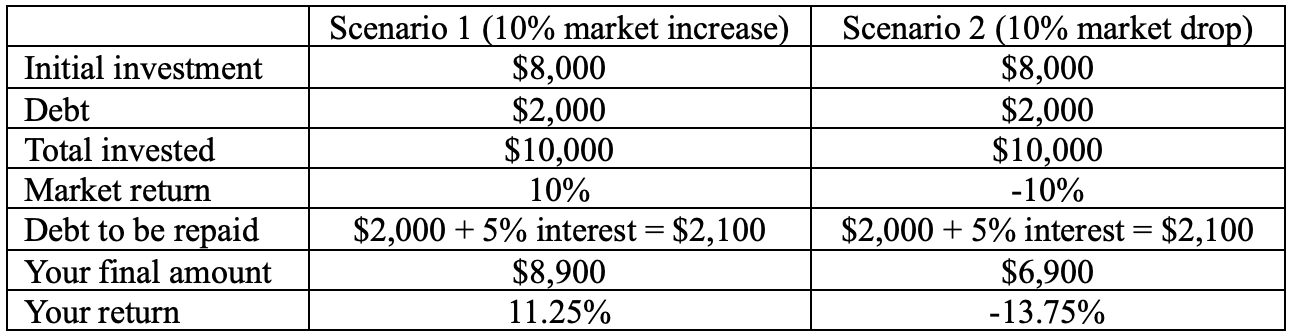

Imagine you had $8,000 to invest and used $2,000 of debt to bring your total invested amount to $10,000. If the market goes up by 10% over a year, you now have $11,000 minus the $2,000 debt (because it has to be paid back and with, say 5% interest on the loan, or $100). So, you went from having $8,000 to having $8,900. This means the market went up 10% but, by using leverage, you got an 11.25% return.

But, let’s look at it the other way. Say the market drops 10%. You now have $9,000 minus the $2,000 debt and the $100 interest, leaving you with $6,900. Suddenly, that 10% market drop means a 13.75% drop in your portfolio.

The key thing to remember here is leverage works both ways and can increase your gains and losses. If the above example doesn’t make sense, I wouldn’t look into leverage any further.

The G200 ETF

Some investors will manage their own leverage (take out the debt themselves) but this is incredibly risky and opens up the possibility of margin calls. A margin call is when you’re forced to add more funds to your investment because the value of your equity (the amount you invested before debt) has decreased and the leverage is now too high. Your broker will make you add more funds to rebalance the level of debt being used.

This can mean being forced to invest more at a time when you don’t have the funds or the desire.

Arguably a better way to invest with leverage would be to use a geared exchange traded fund (ETF) like G200. The Betashares G200 ETF is a leveraged version of the Betashares Australia 200 ETF (ASX: A200). It uses debt to try to achieve amplified returns (143% to 167% of the A200 returns).

The benefits of using an ETF is that Betashares manage the debt internally. There are no margin calls and they manage the complicated rebalancing to maintain a debt level that stays as constant as possible.

Owen and Kate recently spoke to the Senior Investment Strategist at Betashares, Cameron Gleeson about the G200 ETF (as well as some other geared ETFs) to understand the risks, advantages, and who it’s for.

Who is it for?

So, who could consider using debt in their portfolio?

If you’re investing with a short time horizon (less than 10 years) then the risk is almost definitely higher than the potential reward. A poorly timed market crash could lose you a significant amount of a retirement nest egg or a house deposit.

If you’re a young investor who’s looking for growth and has a very long time horizon (decades) then it could make a lot more sense. If you’re investing in your 20’s or 30’s with the intention that this money is for retirement and is going to sit long enough to be able to ride out any short-term volatility then a small amount of leverage could be beneficial.

Like any other tactical or growth ETF, it’s probably best to consider a geared ETF as a small part of a bigger portfolio. I personally wouldn’t be comfortable to have half my money sitting in a geared option, but it could make sense as a smaller satellite position for the right investor.