I’m getting a serious case of déjà vu here.

Shares in perennial loss-making company AMC Entertainment Holdings Inc (NYSE: AMC) have increased nearly 100% in its last day of trading, bringing their year-to-date gain just above 3000%.

And no, I’m not talking about the ASX listed packaging company Amcor PLC (ASX: AMC) – Although to be honest, I wouldn’t be surprised if Aussie’s started buying up its shares because they got the ticker confused.

AMC share price

Squeeze gets squoze

AMC’s shares have just experienced something similar to that of Gamestop Corp’s (NYSE: GME) which occurred earlier this year.

They’re both companies that have underperformed in recent years, with the situation deteriorating even further from the onset of COVID-19.

AMC has 585 movie theatres across the US and 97 in Canada and a few other countries, with the majority running at either a reduced capacity or completely closed. It’s therefore pretty easy to see why such a large proportion (>20%) of the company’s shares are being shorted.

Retail investors have been buying up AMC’s shares to take advantage of what’s known as a short squeeze.

You see, as retail investors push up the price, those who went short (mainly large institutions) are forced to close out their positions, which creates even more buying pressure and a higher share price.

Not so blockbuster results

It would be hard to argue that AMC has many characteristics of a quality business, especially with its current market cap of just under $28 billion.

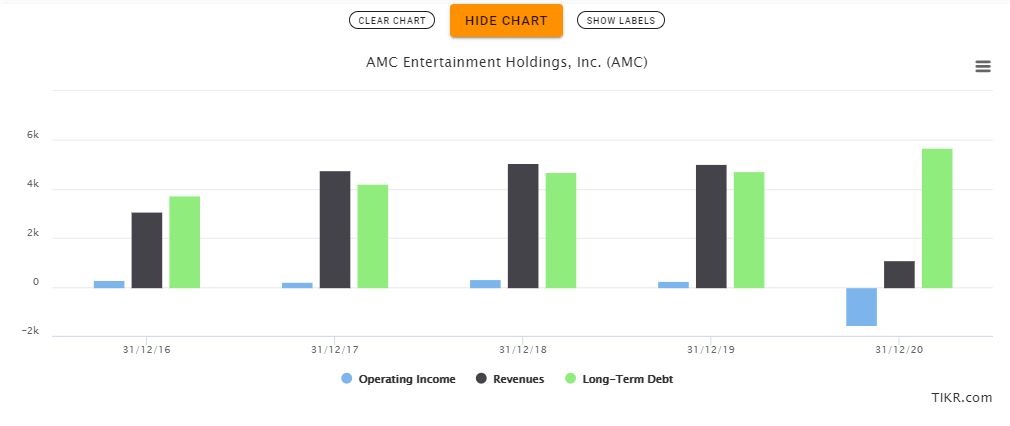

AMC has had negative earnings and free cash flow growth for years, debt had risen to over $10 billion and the general thematic around cinemas has deteriorated immensely.

AMC has taken advantage of the recent rise in the share price and has been issuing new shares to pay down its debt and survive its most recent $1.3 billion negative free cash flow year.

While the above image doesn’t include the recent share issue, AMC now has around 450 million shares outstanding, which at the current share price gives the comical market cap of $28 billion.

In what can only be described as a bizarre version of a loyalty program, the company announced it was making plans to offer rewards to investors for attending its theatres, including a free large popcorn when they attend their first movie this coming summer.

While I acknowledge the exorbitant prices charged for these type of things, it would be hard to argue this is a worthwhile trade-off for being a shareholder at these levels.

Now, of course, the above financials have mostly been irrelevant to those who’ve bought shares recently on the basis of a short squeeze. But for those interested in searching for investable companies, you’ll probably come to the conclusion that AMC doesn’t resemble that of a high-quality business.

How the movie ends

The ongoing battle between retail investors and institutions is a cause I don’t have a problem getting behind.

Institutions have always had a huge advantage over retail as they’ve had better research capabilities, access to pre-IPO companies and a much bigger influence in moving the market. For this reason, it’s probably fair that retail investors are able to take some of that power back.

However, investors wanting to join the AMC party at these levels should be aware that at this stage of the meme-stock lifecycle, this is where most of the risk is.

I can say with 100% certainty that AMC’s shares will not go up forever, and there are unfortunately going to be a lot of people holding the bag when the music stops.

The amount of euphoria currently around AMC’s shares is a pretty clear indication of what stage the cycle is at in my view.

Investors interested in buying in now should realise that many people promoting the stock have been likely been holding from a much cheaper entry point where there was far less downside risk than compared to current levels.

One only has to look at what happened to GME’s shares to realise what can happen from here. Even though its shares have been trending up again recently, there are likely to be many who bought at the top with their investment still underwater today.

For some share ideas that align with our Rask investment philosophy, I’d recommend getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.

To read about companies that align with our philosophy, click here to read: My top 3 ASX software shares for June.