Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished down -1.37% to 7065.20.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX was knocked today, following Asian markets deep into the red after the US Federal Reserve held rates unchanged overnight, but kept the door ajar for another hike this side of Christmas.

While there wasn’t a lot of new news coming from Jerome Powell and co, the dot plot projections implied that rates are unlikely to be cut by as much as previously thought during 2024, and that has rattled markets.

While this fits our rhetoric of “higher for longer,” Asian/Emerging markets are more influenced by higher yields (US 2 years hitting the highest level since 2006 overnight at 5.18%), hence the weakness today across the region.

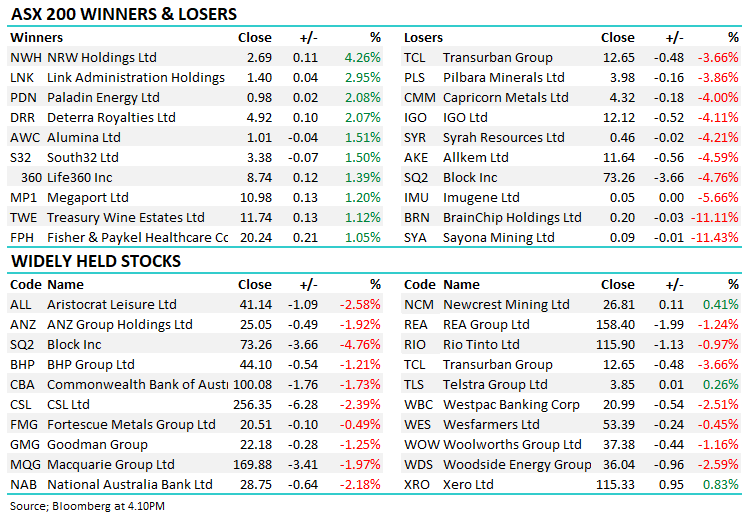

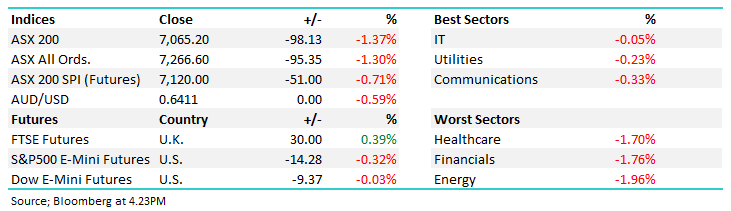

- The ASX 200 hit -98pts / -1.37% to 7065, now trading at a 10-week low.

- The Tech Sector (-0.05%) showed the most resilience today, supported by a small gain in Sector heavyweight Xero Limited (ASX: XRO), +0.83%

- Sectors closed more than 1% lower – Energy (-1.96%), Financials (-1.76%), Healthcare (-1.70%), Industrials (-1.60%), Materials (-1.25%) & Real Estate (-1.10%)

- 75% of the ASX closed lower today, although there were a few sporadic pockets of strength, Paladin Energy Ltd (ASX: PDN) +2.08%, Treasury Wine Estates Ltd (ASX: TWE) +1.12% & Ramsay Health Care Ltd Fully Paid Ord. Shrs (ASX: RHC) +0.8% were green in our Growth Portfolio.

- Listening to Powell this morning, the Fed clearly remains data dependent, and while employment and inflation are tracking in the right direction, economic growth has been a lot more resilient than they thought it would be.

- That leaves the question of whether the current policy is restrictive enough for the prevailing conditions. There is no doubt inflation is tracking in the right direction, and there is more slack coming into the labour market, however, there is a long list of things that could turn the dial here, including Energy prices, strikes and the like.

- Ultimately, they’re in wait-and-see mode, although 12 of the 19 members did see one more rate hike before Santa arrives. Whatever the case, the clear implication is that rates are near a peak, the heavy lifting has been done, and while we might see some finessing, we think we’re near enough to the top!

- Across the ditch, the NZ economy grew at +0.9% in the 2Q, more than 2x expected – Harry just back from a trip there explains that!

- South32 Ltd (ASX: S32) +1.5% also bucked the trend today, a tough period for S32 however the worm is showing clear signs of turning – one worth keeping a the radar.

- Transurban Group (ASX: TCL) -3.66% was down after regulators ruled that it cannot proceed with a bid for Melbourne’s East Link toll road. It’s the first time the ACCC has stood in the way of Transurban, opening the door for competitors to enter the market.

- Deterra Royalties Ltd (ASX: DRR) +2.07% was one of the better performers today on a broker upgrade, the royalty stream now ‘overweight‘ according to Morgan Stanley (NYSE: MS), with a $5.50 PT

- Iron Ore fell -1.5% in Asia.

- Stocks across the region also did it tough – Nikkei 225 (INDEXNIKKEI: NI225) down -1.37% and Hang Seng -1.13%

- US Futures are lower, off around -0.3%.

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Broker Moves

- 29Metals Ltd (ASX: 29M) Raised to Overweight at Morgan Stanley

- IGO Ltd (ASX: IGO) Cut to Underweight at Morgan Stanley; PT A$11.60

- Deterra Raised to Overweight at Morgan Stanley; PT A$5.50

Major Movers Today