ASX 200 (XJO) morning report – JBH, NEA & CCL shares in focus

The S&P/ASX 200 (INDEXASX:XJO) is poised to rise when the

Rask Media > Altium Limited (ASX:ALU) > Page 10

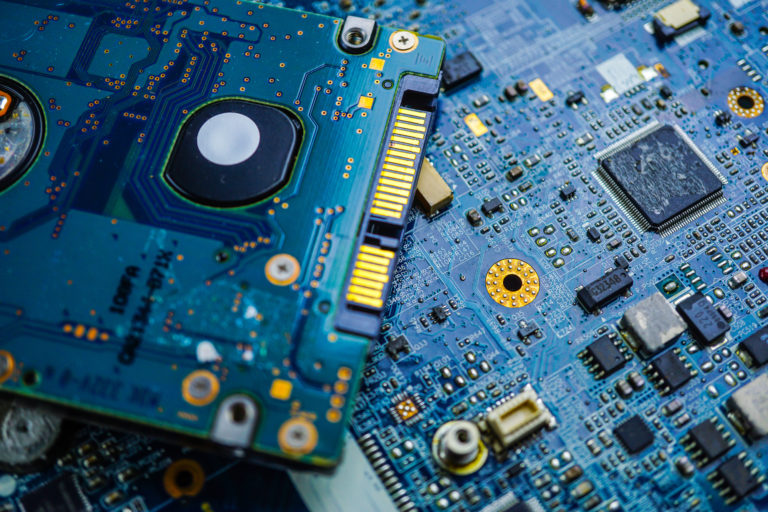

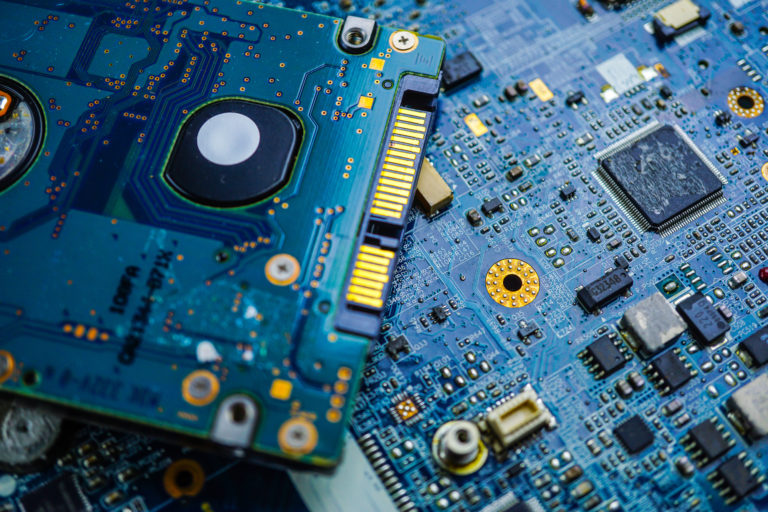

Altium Limited (ASX: ALU) is an Australian multinational software business that was founded in 1985. It now has offices globally in places like San Diego, New York, Boston, Munich, Shanghai, Tokyo and Sydney. Its software focuses on electronics design systems for 3D PCB design and embedded system development. Its services include Altium Designer, Altium Vault, CircuitStudio, CircuitMaker, TASKING and Octopart.

The S&P/ASX 200 (INDEXASX:XJO) is poised to rise when the

The Altium Limited (ASX:ALU) share price has had a muted

If you’re looking for ASX tech exposure, is BetaShares S&P/ASX

A vaccine-led economic recovery through 2021 continues to look promising

I think it’s a good idea to think about ASX

I think it’s a pretty difficult investing environment right now,

There are some high quality ASX tech shares that I’d

Could the Altium Limited (ASX:ALU) share price still be a

Quite a lot has changed valuation-wise since I last wrote

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.