2 ASX shares I’d buy if the US election causes a selloff

The US election is almost upon us. There are some

Rask Media > Altium Limited (ASX:ALU) > Page 12

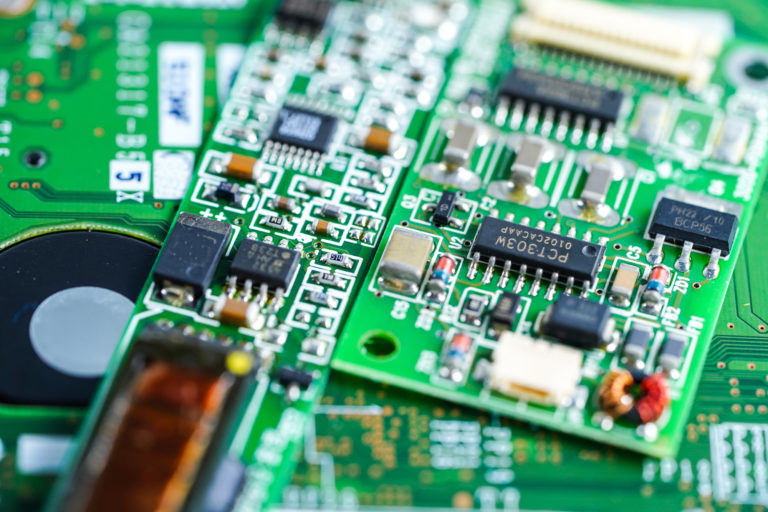

Altium Limited (ASX: ALU) is an Australian multinational software business that was founded in 1985. It now has offices globally in places like San Diego, New York, Boston, Munich, Shanghai, Tokyo and Sydney. Its software focuses on electronics design systems for 3D PCB design and embedded system development. Its services include Altium Designer, Altium Vault, CircuitStudio, CircuitMaker, TASKING and Octopart.

The US election is almost upon us. There are some

Recently, I asked the entire Rask Media team to share

With volatility expected in the coming weeks due to the

2020 has been wild so far, with Covid-19 presenting a

The A2 Milk Company Ltd (ASX:A2M) share price has fallen

Altium Limited (ASX:ALU) shares have stagnated significantly recently. But here’s

There has been more selling of technology shares. The NASDAQ

Altium Limited (ASX:ALU) has announced a mixed FY20 result to

I’m looking forward to reading a number of results during

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.