Scentre Group (ASX: SCG) owns and operates 41 Westfield shopping centres in Australia and New Zealand, with Scentre’s interest valued at $39.1 billion, many of the shopping centres are owned in partnership with property investment institutions. According to Scentre Group, more than 535 million visits were made to its centres in 2018.

The S&P/ASX 200 (INDEXASX:XJO) is expected to brush aside a negative lead from overseas markets and open higher on Friday. Here’s what’s making headlines.

The S&P/ASX 200 (INDEXASX:XJO) is expected to open higher this morning. Telstra (ASX:TLS), Qantas (ASX:QAN) and Scentre (ASX:SCG) are in the news.

The S&P/ASX 200 (INDEXASX: XJO) is set to rebound on Thursday after US markets snapped a three-session sell-off overnight. Here’s what’s making headlines.

The S&P/ASX 200 (INDEXASX: XJO) is set to tumble when the market opens this morning after US stocks fell again overnight. Here’s what you need to know.

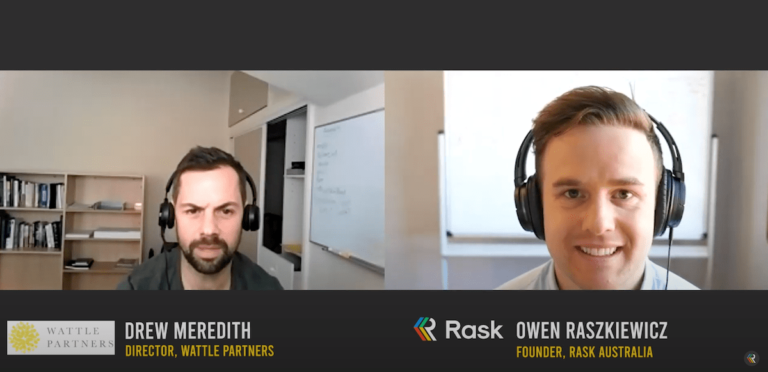

Drew Meredith from Wattle Partners and Owen Raszkiewicz from Rask Australia share their best and worst from Reporting Season, including QBE Insurance (ASX:QBE), PointsBet Ltd (ASX:PBH) and more.

The S&P Dow Jones Indices has announced the changes to the various S&P/ASX Indices. The changes will happen on 21 September 2020.

The Scentre Group (ASX:SCG) share price has shot up 6% after reporting its FY20 half year result.

ASX blue chips have attracted investors for decades. But are they even worth investing in these days?

Scentre Group (ASX:SCG) shares are down more than 2% after revealing a preview of its upcoming FY20 half year result to the market.