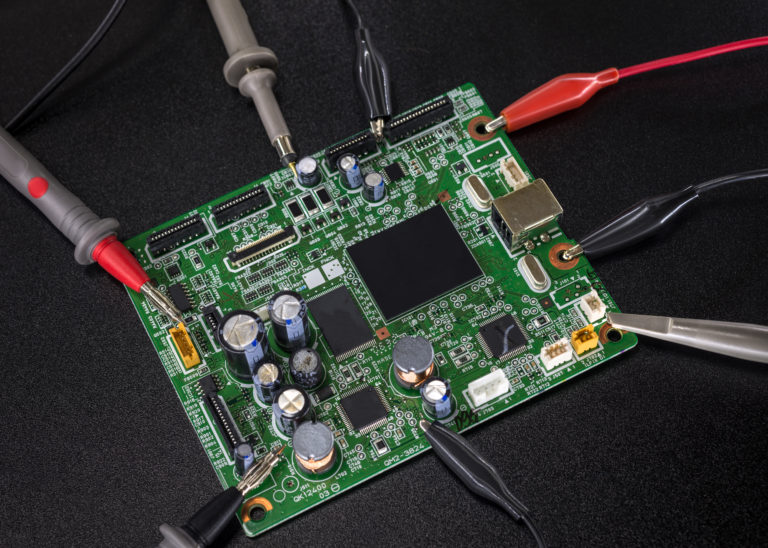

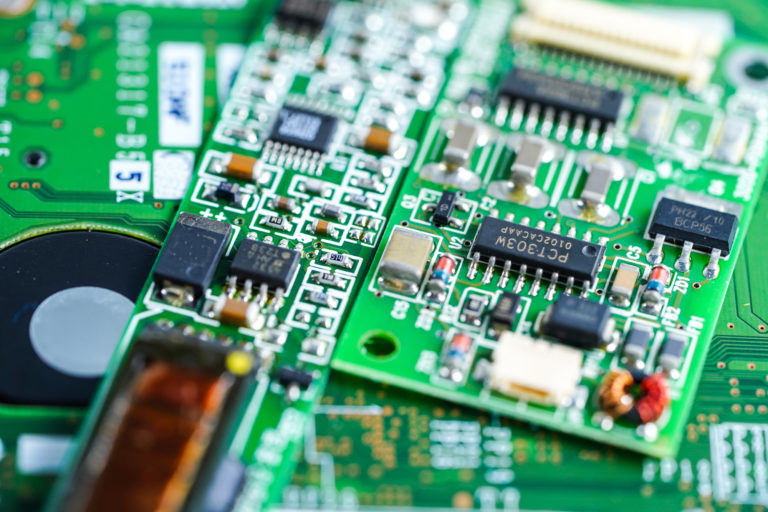

Altium Limited (ASX: ALU) is an Australian multinational software business that was founded in 1985. It now has offices globally in places like San Diego, New York, Boston, Munich, Shanghai, Tokyo and Sydney. Its software focuses on electronics design systems for 3D PCB design and embedded system development. Its services include Altium Designer, Altium Vault, CircuitStudio, CircuitMaker, TASKING and Octopart.

The ASX 200 (ASX:XJO) is expected to open down quite heavily today (around 1.8%), adding onto the pain of yesterday.

If the Australian dollar continues to fall against the US dollar, I think it’s worth looking at shares of CSL Limited (ASX: CSL), Cochlear Limited (ASX: COH) and Altium Limited (ASX: ALU).

The ASX 200 (ASX:XJO) is expected to drop around 1% today. And I’m really excited about it!

The US Federal Reserve has cut the interest rate again, what should we invest in now?

Here’s why I think it’s worth looking at shares of Altium Limited (ASX: ALU) and these two other ASX growth stocks.

The Altium Limited (ASX:ALU) share price has been going from strength to strength since I first considered adding it to my portfolio. Now, I’ve finally caved in to buying shares.

In America there are the FAANG stocks (Facebook, Apple, Amazon, Netflix and Google), here in Oz we have the WAAAX stocks. Are these stocks seriously expensive?

Technology ASX shares have a strong advantage compared to many other industries when it comes to growing profit.

I think it’s important to own a diversified portfolio unless you’re going to go down the route of just owning exchange traded funds (ETFs) as your share investments.