What to expect from the ASX 200 (XJO) today – latest news

The S&P/ASX 200 (ASX: XJO) is expected to trade higher

Rask Media > Telstra Corporation Ltd (ASX:TLS) > Page 25

Telstra Corporation Ltd (ASX:TLS) is our country’s oldest telecommunications business, having built the first telegraph line in 1854. In 2019, it provides more than 17 million retail mobile services, around 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services. Telstra also has operations in eHealth, network applications and subsea cabling.

The S&P/ASX 200 (ASX: XJO) is expected to trade higher

TPG Telecom Ltd (ASX: TPM) capped off a tough year

Telstra (ASX:TLS) is in the news this morning after the

Shares in Freelancer Ltd (ASX: FLN) have been on a

Telstra Corporation Ltd (ASX:TLS) is currently holding its annual general

Tech stocks like Afterpay Touch Group Ltd (ASX:APT) and Wisetech

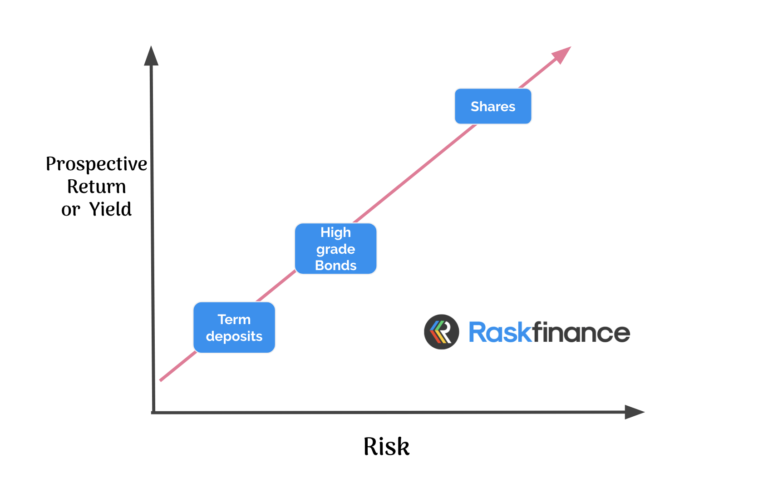

With RBA interest rates at new record lows, here are

The Reserve Bank of Australia has just cut the official

Reserve Bank of Australia (RBA) interest rates will be set

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.