Woolworths Group Ltd (ASX: WOW) was founded in 1924 by Percy Christmas, with its first store opening in Sydney’s Imperial Arcade. Woolworths has gone on to become Australia’s largest supermarket business, operating Woolworths supermarkets in Australia and Countdown in New Zealand. It also runs the retail department store Big W as well as liquor stores Dan Murphy’s and BWS. With over 3,000 stores and more than 200,000 employees, it’s one of Australia’s largest employers.

The S&P/ASX 200 has taken a beating to start 2025, down about 7% since January 1st. But 3 ASX shares have bucked the trend, posting strong gains.

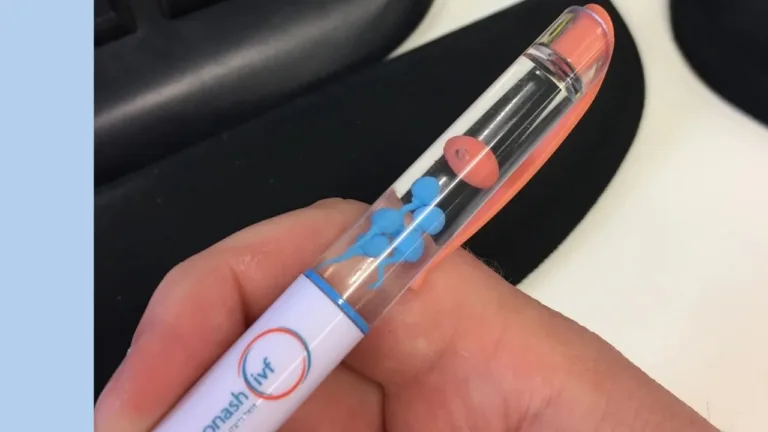

The ASX 200 (ASX:XJO) will open lower today after a slump in the US markets. One of the best business models we’ve seen and Monash IVF drama again

The S&P/ASX200 (ASX:XJO) has fallen today, and BHP Group Ltd (ASX:BHP) and Rio Tinto Ltd (ASX: RIO) are in the crosshairs.

The Woolworths Group Ltd (ASX:WOW) share price has increased 0.9% since the start of 2025. It’s probably worth asking, ‘is the WOW share price priced to perfection?’

Is the Woolworths Group Ltd (ASX:WOW) share price cheap? Here are 3 reasons you might want to consider WOW shares.

The A2 Milk Company Ltd (ASX:A2M) share price is up 35.2% since the start of 2025. It’s probably worth asking, ‘is the A2M share price good value?’

Listed investment companies (LICs) have been around for decades, offering easy diversified exposure for ASX investors. But, do they still offer value in a world of exchange-traded funds (ETF) investing?

Want to value the Woolworths Group Ltd (ASX:WOW) share price? Here are 6 key metrics you need to consider.

The share prices of Woolworths Group Ltd (ASX:WOW) and Coles Group Ltd (ASX:COL) increased over 5% after the release of the ACCC report.