WiseTech Global Ltd (ASX: WTC) was founded in 1994 by Richard White to provide software to the logistics sector. Since then it has grown to become a global provider of logistics software, claiming to service 19 of the top 20 logistics companies globally. WiseTech makes money by charging its customers on a ‘per use’ basis rather than as a subscription model. Meaning, WiseTech directly benefits as its customers grow their businesses.

The S&P/ASX 200 (ASX:XJO) finished 0.1% lower on Thursday as Westpac (ASX:WBC) and Nufarm (ASX:NUF) shares were in the news.

The Afterpay Ltd (ASX:APT) share price is sinking as interest rate worries send share prices lower globally. Other ASX shares are also down.

The benchmark S&P/ASX 200 (ASX: XJO) increased 9% over 2021 buoyed by the performance of the following six shares within the index.

Joe Magyer has been one of Australia’s best investors over the past decade, leading Motley Fool Pro then Lakehouse Capital as Chief Investment Officer. He joins Owen Rask for a special investors podcast episode.

Interest rates may be rising sooner than expected. But there are some reasons why higher interest rates could be good.

With the markets nearing all time highs, we’re going to find value amongst the ASX’s most pricey companies using the Saasy Lynch Indicator.

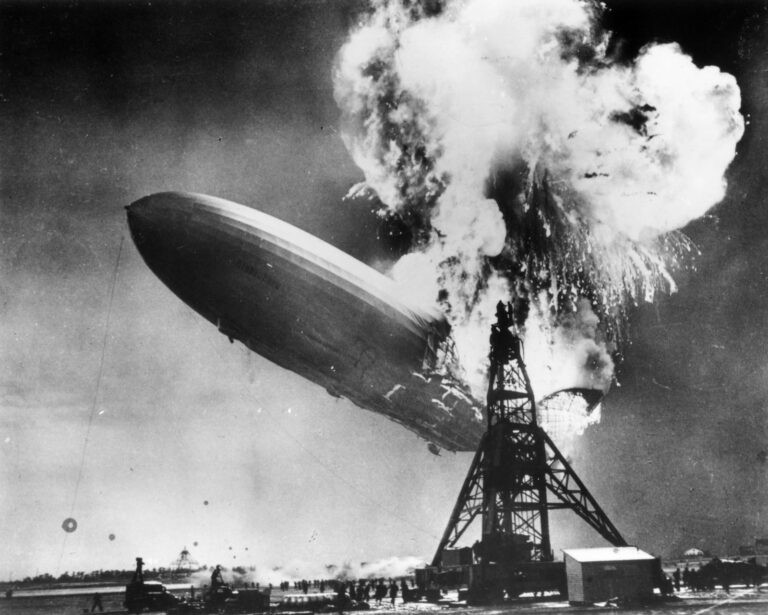

ETF Securities has launched the Hydrogen ETF, up 15% in the two weeks since inception, but is it priced to be the next Hindenburg?

Like the sounds of Software-as-a-Service (Saas), workflow platform and recurring revenue? Let’s dive into Whispir Ltd (ASX: WSP).

With ASX reporting season coming to a close, here are my top ten performers from the last month of reporting.