💸 Ready to start investing? Listen to this first! [New Investor Checklist]

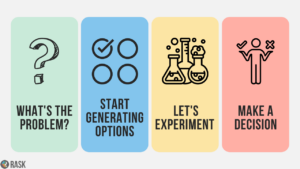

In this episode, we’re going to pull everything from this series together and run you through our pre-investing checklist, to make sure you’re ready to go.

Everything has a price, but not all prices appear on labels.

Morgan Housel

Kate Campbell is a financial educator who loves talking to anyone who will listen about one of our most taboo (but very important) topics: money. You can find her doing everything from writing articles on personal finance, creating free online courses, running the Rask online community and trying her hand at social media. Pretty much anything to do with personal finance, and Kate’s involved.

Kate has also created the Rask FIRE, Career and Automation courses.

Previously, Kate worked at Citigroup, InvestSMART and Timelio, and sharpened her teeth in the industry with multiple financial operations and investment administration roles. She holds a Bachelor of Business Management from the University of Canberra.

Kate also hosts one of Australia’s top-ranking finance podcasts, The Australian Finance Podcast, which attracts 80,000 listeners each month.

In this episode, we’re going to pull everything from this series together and run you through our pre-investing checklist, to make sure you’re ready to go.

In this episode, Kate Campbell, Owen Rask and Tom Wilson from InvestSMART, talk about the pros and cons of investing in shares versus property in Australia.

We have so many options these days when it comes to choosing a brokerage account that it can feel impossible to make a fully informed decision, even if we’ve read all the reviews.

If we can boil everything down to an essential question, it might help us acknowledge that we’re ready to take the first step.

Today’s newsletter is a little deeper than usual, but I want to dive into these more tricky money conversations, even if I don’t have a clear answer for you, because they push us to be curious, reflect on our own lives and ask more questions.

Kate Campbell, Owen Rask and financial adviser Drew Meredith tackle questions ranging from dollar cost versus lump sum investing, getting an 18-year-old interested in investing, what to do after paying off your student loan and what happens to super when you die.

Emma Edwards from The Broke Generation joins Kate Campbell and Owen Rask on The Australian Finance Podcast to discuss the financial comparison trap, our invisible money rules and how she’d use $1,000 to increase her happiness.

With the RBA increasing interest rates again this week, Kate & Owen discuss what’s going on, what it means for your finances and actionable ways to combat inflation.

Kate Campbell, Owen Rask and financial adviser Drew Meredith tackle questions ranging from franking credits and dividend reinvestment plans to starting your investing journey at 30.

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.