ASX investors just voted: they don’t knead Douugh Ltd (ASX:DOU) shares today

The Douugh Ltd (ASX: DOU) share price looked a little unhealthy on Thursday, falling 12.7%, despite the company saying it delivered “strong growth”.

People underestimate what they can do in five years but overestimate what they can do in one.

Anonymous

You can find everything you need to know in the Rask investment philosophy. These are the exact steps I follow for myself and for the Rask community who trust us.

In short:

The Douugh Ltd (ASX: DOU) share price looked a little unhealthy on Thursday, falling 12.7%, despite the company saying it delivered “strong growth”.

Today the ASX 200 (ASX: XJO) was weighed down by a big sell-off of Zip Co Ltd (ASX: Z1P) shares and Evolution Ltd (ASX: EVN) shares, which sank 14% and 10%, respectively. Z1P shares were particularly hard hit, despite 69,764 trades taking place.

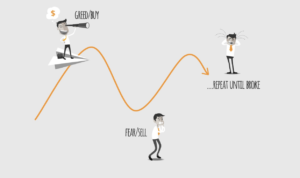

I heard the stock market, or S&P/ASX 200 (ASX: XJO), is about to crash; I should wait, right?

This tutorial from Rask Education answers: how do I invest in ASX growth shares and Australian ETFs to make passive dividend income and growth wealthy. It explains the difference between growth investing and dividend income investing.

You know GameStop Corp. (NYSE: GME). It’s the stock everyone is talking about. How will the GameStop party end?

How do I invest for my children? I want to start in 2021, adding money as I go, with the hope of helping them out when they turn 18, 21 or later in life.

Here’s where I’d invest $10,000 for the New Year (2021). I’d start with an ASX ETF and some individual shares.

I recently sat down with ETF Securities’ Kanish Chugh to pick his brains on three of his firm’s most popular ASX ETFs for 2020, like ETF Securities FANG ETF (ASX: FANG), ETF Securities GOLD ETF (ASX: GOLD) and ETF Securities TECH ETF (ASX: TECH).

Despite COVID-19 and the market crash that followed in March 2020, the Australian share market or S&P/ASX 200 Total Return has returned 0.69% over the past 12 months, according to S&P Global data on Friday.

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.