Best and worst from ASX Reporting Season: QBE, SCG, PBH, RUL & more!

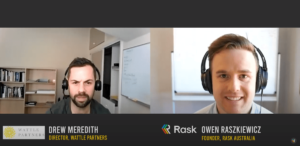

Drew Meredith from Wattle Partners and Owen Raszkiewicz from Rask Australia share their best and worst from Reporting Season, including QBE Insurance (ASX:QBE), PointsBet Ltd (ASX:PBH) and more.