Are ANZ, CBA & NAB shares still dirt cheap?

With bank shares up another 3% today, thousands of income-hungry investors are asking if ANZ Banking Group (ASX: ANZ) shares seriously overvalued, expensive… or just fairly priced.

People underestimate what they can do in five years but overestimate what they can do in one.

Anonymous

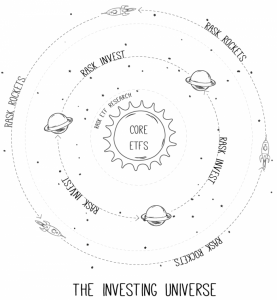

You can find everything you need to know in the Rask investment philosophy. These are the exact steps I follow for myself and for the Rask community who trust us.

In short:

With bank shares up another 3% today, thousands of income-hungry investors are asking if ANZ Banking Group (ASX: ANZ) shares seriously overvalued, expensive… or just fairly priced.

Last year, one of Australia’s leading investors and fund managers walked into my office for a recording of The Australian Investors Podcast.

At Rask Australia, we believe an investment strategy and process should change when the facts change, as John Maynard Keynes famously said.

Knowing what is — or isn’t — a good price to pay for a company like Macquarie Group Ltd (ASX: MQG) isn’t easy — especially in the current environment with COVID-19 and other economic uncertainties.

If you’re looking for an ETF in the International fixed interest sector, the BetaShares Sustainability leaders Diversified Bond ETF – Currency Hedged ETF (ASX: GBND) is probably an ETF you’re considering.

If you ask me attempting to put an exact valuation on Westpac Banking Corp (ASX: WBC) shares is impossible. That said, the research and valuation process is arguably the most important part of successful investing, so it should not be neglected.

ASX bank shares have pushed the ASX 200 higher today as the market reacts to extra Chinese stimulus, more positive share market momentum, the government’s JobMaker program, and rising expectations of a return to normal.

The Tyro Payments Ltd (ASX: TYR) share price was trading higher yet again today, following the release of its latest trading update during COVID-19. Tyro shares have more than tripled since March 2020.

One Diversified ETF you might be looking at is the Vanguard Diversified Conservative Index ETF (ASX: VDCO).

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.