Time To Exit Appen (APX) Shares?

I had to pinch myself today as shares of market darling Appen Ltd (ASX:APX) slumped 10%.

People underestimate what they can do in five years but overestimate what they can do in one.

Anonymous

You can find everything you need to know in the Rask investment philosophy. These are the exact steps I follow for myself and for the Rask community who trust us.

In short:

I had to pinch myself today as shares of market darling Appen Ltd (ASX:APX) slumped 10%.

The Rio Tinto Limited (ASX: RIO) share price will be one to watch tomorrow with the release of the miners’ half-year financial report.

Over the past week, month and year, the Australian dollar (AUD) has continued to fall while the Apple Inc (NASDAQ:AAPL) stock price has continued to rise.

For once it seems the Altium Limited (ASX:ALU) share price is trading lower today than the broader ASX 200 (INDEXASX: XJO) which is up 0.4% as I write this.

Should you invest in Super, a managed fund, index fund, ETF, robo adviser, with your adviser or in individual ASX shares?

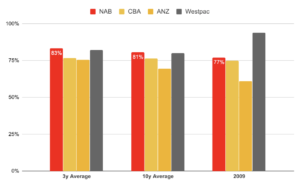

The Australia and New Zealand Banking Group (ASX:ANZ) share price has left a lot to be desired for investors over the past five years, falling from ~$33 five years ago to its current $28.

Expert analysts might say the Westpac Banking Corp (ASX:WBC) share price is worth just $19. If you’re playing along, Westpac shares are priced at $27.50.

I’m about to tell you why knowing what the Commonwealth Bank of Australia (ASX:CBA) share price is doing today, tomorrow or next week is pointless.

The Australian share market or ASX 200 (INDEXASX: XJO) has been one of the best-performing markets in the world over the ultra-long-term.

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.