Got tax-effective franking credits to calculate? You’ve come to the right place!

Try out our free franking credits calculator. You’ll find the calculator below our Franking Credits Explainer video.

For a full run-down on franking credits and dividend investing, read my full blog post, “What Are Franking Credits?”

Use our free franking credits calculator to estimate your tax/franking credits at the ATO. Don’t forget, a franking credit is just a tax credit stored under your name at the Australian Tax Office.

One of the most common investing mistakes is searching for investments with ‘the biggest yield’ or ‘largest dividend percentage’. This is a mistake because you’re robbing Peter (growth potential) to pay Paul (income).

This is why you are ALWAYS better off focusing on total return, which means income plus growth. While you won’t get franking credits for selling 5% of your holding in a stock (e.g. ASX: BHP shares), you will get the capital gains discount if you hold for more than 12 months.

What I mean is, you’re far better off investing in proven businesses/shares for the long run, and just selling part of your holding as you need to, than just chasing growth. This is why many professional investors tell you to target ‘high-quality companies’, since they can grow (by reinvesting in themselves) and pay a modest dividend.

Successful long-term investing in businesses is a tested way to grow wealth. To discover how, try our free online investing programs and courses. From value investing to budgeting to ETFs, we have you sorted – and again, they’re free. Click here to take one of our free courses.

Yes, you get dividends and franking credits from Exchange-Traded Funds (ETFs). This is one of the reasons why we use two dividend-paying ETFs inside our investment portfolios – view our investment holdings by going here.

For further reading on this topic, see our guides:

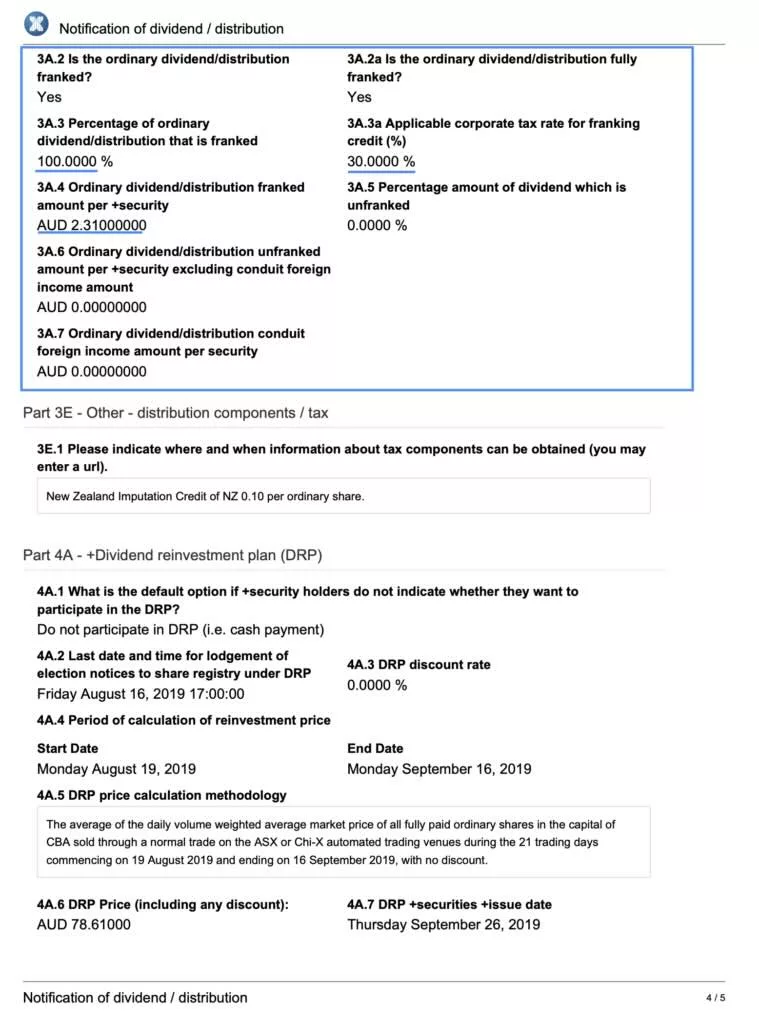

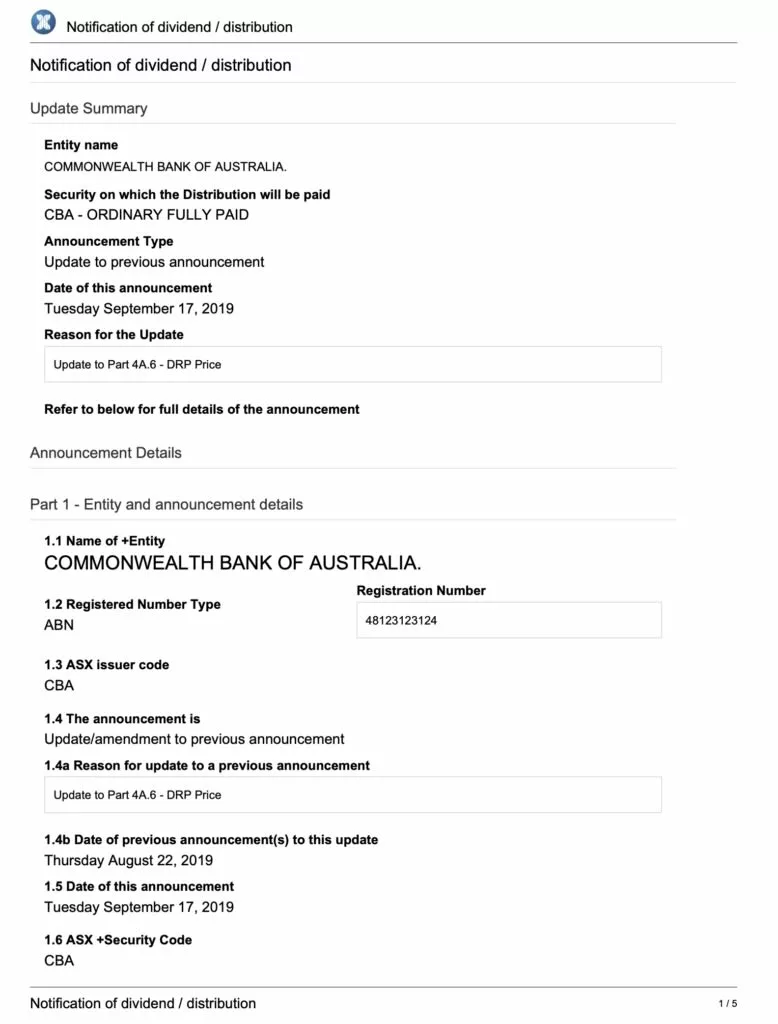

The amount of franking credits you may be entitled to can be found in your company’s ASX market announcements.

In particular, the dividends and franking credits will be declared to the ASX in a form called a “Notification of Dividend / Distribution”.

Below, I’ve included an example of the dividend and franking credits information provided to CBA shareholders via an ASX announcement. Take note of the information I’ve highlighted with the blue rectangle.

To find the dividend form, or any other dividend information, check the ASX website, company website or annual report, or log-in to your brokerage account. See my post “10 Australian share broking accounts“.

Once you log into your brokerage account navigate to the page for the company or share you’re searching for, then use the “announcements” or “news” tab to find recent dividend announcements.

Write the amount of your franking credits down on a sheet of paper or record them in a spreadsheet. Take that document to your accountant.

Alternatively, you could use third-party portfolio software to track some or all your franking credits and investments. However, it’s good practice to double-check their figures.

Once you have your franking credits sorted, you should then consider taking one of our free investing courses, like our free valuation course. After interviewing Australia’s best investors, I’ve realised that investing successfully requires us to continually learn new skills and valuation techniques.

(coming soon)

Download

See how your investments could grow.

View calculator

Calculate franking credit dollar values and gross dividends.

View calculator

Find out how much you need to invest every month to achieve your goal.

View calculator

Estimate your monthly mortgage repayment.

View calculator

How long will it take to pay off my credit card or personal debt?

View calculator

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.