Australian ETFs for income: A200, YMAX, CRED & EX20

Given the rise of the Australian share market, where can an investor find passive income from shares or ETFs in 2025?

The Betashares A200 ETF provides exposure to the largest 200 Australian companies, based on market capitalisation. Unlike many other Australian shares ETFs, A200 uses the Solactive Australia 200 Index. This is virtually the same thing as the indices provided by S&P/ASX, as it also uses a market capitalisation weighting.

Given the rise of the Australian share market, where can an investor find passive income from shares or ETFs in 2025?

The best time to start investing is always now. Whether you’re new to shares or an experienced investor, here are 5 ETFs to consider in 2025.

If you’re looking to start investing in 2025, here’s an option that will serve you much better than buying Commonwealth Bank of Australia (ASX: CBA) or BHP Group Ltd (ASX: BHP) shares.

The Australian share market is well-known for its big dividends. Is the Vanguard Australian Shares High Yield ETF (ASX: VHY) the best way to take advantage?

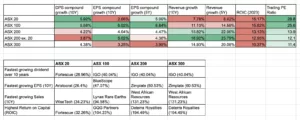

Australian shares ETFs like VAS, MVW, IOZ, A200 & ILC are top performing. But which ETF from ASX 20, ASX 100, ASX 200 or ASX 300 wins?

The Commonwealth Bank of Australia (ASX: CBA) share price might be up 55% over 10 years. But how fast have CBA’s profits grown in that time?

Investing can feel complex, and with over 300 exchange-traded funds (ETFs) on the ASX, how do you know where to start? Diversified ETFs could be the answer.

If there’s one thing the Australian share market is known for, it’s paying big dividends. Here’s how the VanEck Australian Resources ETF (ASX: MVR) could boost your income.

Have you thought about investing with debt? Here’s a full review of the Betashares Wealth Builder Australia 200 Geared (30-40%) Complex ETF (ASX: G200) and all the pros and cons.

Given the rise of the Australian share market, where can an investor find passive income from shares or ETFs in 2025?

The best time to start investing is always now. Whether you’re new to shares or an experienced investor, here are 5 ETFs to consider in 2025.

If you’re looking to start investing in 2025, here’s an option that will serve you much better than buying Commonwealth Bank of Australia (ASX: CBA) or BHP Group Ltd (ASX: BHP) shares.

The Australian share market is well-known for its big dividends. Is the Vanguard Australian Shares High Yield ETF (ASX: VHY) the best way to take advantage?

Australian shares ETFs like VAS, MVW, IOZ, A200 & ILC are top performing. But which ETF from ASX 20, ASX 100, ASX 200 or ASX 300 wins?

The Commonwealth Bank of Australia (ASX: CBA) share price might be up 55% over 10 years. But how fast have CBA’s profits grown in that time?

Investing can feel complex, and with over 300 exchange-traded funds (ETFs) on the ASX, how do you know where to start? Diversified ETFs could be the answer.

If there’s one thing the Australian share market is known for, it’s paying big dividends. Here’s how the VanEck Australian Resources ETF (ASX: MVR) could boost your income.

Have you thought about investing with debt? Here’s a full review of the Betashares Wealth Builder Australia 200 Geared (30-40%) Complex ETF (ASX: G200) and all the pros and cons.