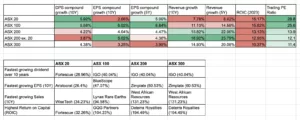

What’s best: ASX 20, ASX 200 or ASX 300 ETFs?

Australian shares ETFs like VAS, MVW, IOZ, A200 & ILC are top performing. But which ETF from ASX 20, ASX 100, ASX 200 or ASX 300 wins?

Vanguard Australian Shares Index ETF (ASX: VAS) provides exposure to the largest 300 Australian shares, based on market capitalisation. This is a low-cost way to access top Australian companies through a single fund.

The Vanguard Australian Shares Index ETF (ASX: VAS) is Australia’s largest ETF — and by a very long way. With $11 billion of investments in the VAS ETF as of July 2022, the next closest index fund ETF is iShares S&P 500 ETF (ASX: IVV) with $5 billion. That’s a huge difference considering there are over 200 ETFs in Australia.

The Vanguard Australian Shares ETF is simple but unique — it buys and holds the top 300 shares on the Australian stock exchange, ranked by size/market capitalisation. VAS tracks the S&P/ASX 300 index, making it relatively unique amongst its peers.

Vanguard is the issuer of the VAS ETF and has decades of experience providing similar types of ETFs and index funds. Other big ETFs provided by Vanguard include Vanguard MSCI International Shares ETF (ASX: VGS) and Vanguard Total US Market Shares ETF (ASX: VTS).

The key alternative Australian shares ETFs to VAS are as follows:

The VAS ETF can be used by investors to get exposure to Australian shares/equities, with a tiny cost per year (0.1%). Basically, buying VAS is like ‘owning the market’ for next to nothing. This is one reason why VAS has proven to be so popular.

Given VAS’ unique focus on the top 300 Australian shares, as opposed to the top 200 followed by most competing ETFs, VAS captures some exposure to the small and medium-sized companies on the ASX. That is, the companies ranked between 200 and 300 in size.

With low costs, diversification, dividend income and franking credits, it’s easy to see why VAS is the most popular ‘Core’ ETF in Australia.

It should be noted that if you own similar ETFs, such as A200, STW, IOZ or MVW, you’re going to have a lot of ‘overlap’ in your portfolio if you own more than one of these ETFs.

If you’re comparing VAS to other index fund shares ETFs, its risk level should be relatively the same.

However, compared to bond ETFs, VAS will be riskier (volatile).

Compared to sector-specific ETFs or thematic ETFs (e.g. ACDC, CLNE. HACK, etc.) VAS should be slightly less risky over a full market cycle given it’s diversified across sectors and company types.

Given it is an Australian shares ETF, investors should consider VAS as part of the ‘risk on’ side of a portfolio and seek to hold the ETF for a minimum of 7 years to ensure the portfolio is given time to produce results in most market environments.

Yes. VAS will pay or ‘pass through’ the franking credits it receives from its holdings. If you’re especially focused on fully franked dividend income you might try something like the VHY ETF (also from Vanguard) as either a complement or replacement to VAS.

***

Cheers!

Owen Raszkiewicz

Founder of Best ETFs Australia, lead analyst of Rask Core

Australian shares ETFs like VAS, MVW, IOZ, A200 & ILC are top performing. But which ETF from ASX 20, ASX 100, ASX 200 or ASX 300 wins?

Australian growth investors tend to focus on the Australian and US share markets, but has the Betashares India Quality ETF (ASX: IIND) been flying under the radar?

The Commonwealth Bank of Australia (ASX: CBA) share price might be up 55% over 10 years. But how fast have CBA’s profits grown in that time?

Owen Rask dives in the latest trading up by RPMGlobal Holdings, a leading global technology provider for mining industry.

The Guzman Y Gomez Ltd (ASX: GYG) share price is falling down after its IPO. Time to sell GYG shares?

Is the VAS ETF doing poorly? Why is Vanguard Australian Shares Index ETF (ASX: VAS) performing so poorly?

We’d all like to invest in high quality companies without the pain of trying to pick them. Can the Betashares Australian Quality ETF (ASX: AQLT) be the solution?

Investing can seem complex when you’re first getting started, but it doesn’t need to be. Here’s why I think the Vanguard Australian Shares Index ETF (ASX: VAS) is a great first investment.

Guzman y Gomez Ltd (ASX: GYG) shares will trade on the ASX on 20 June 2024 at $22. The GYG IPO will be the hottest ASX IPO for many years.

Australian shares ETFs like VAS, MVW, IOZ, A200 & ILC are top performing. But which ETF from ASX 20, ASX 100, ASX 200 or ASX 300 wins?

Australian growth investors tend to focus on the Australian and US share markets, but has the Betashares India Quality ETF (ASX: IIND) been flying under the radar?

The Commonwealth Bank of Australia (ASX: CBA) share price might be up 55% over 10 years. But how fast have CBA’s profits grown in that time?

Owen Rask dives in the latest trading up by RPMGlobal Holdings, a leading global technology provider for mining industry.

The Guzman Y Gomez Ltd (ASX: GYG) share price is falling down after its IPO. Time to sell GYG shares?

Is the VAS ETF doing poorly? Why is Vanguard Australian Shares Index ETF (ASX: VAS) performing so poorly?

We’d all like to invest in high quality companies without the pain of trying to pick them. Can the Betashares Australian Quality ETF (ASX: AQLT) be the solution?

Investing can seem complex when you’re first getting started, but it doesn’t need to be. Here’s why I think the Vanguard Australian Shares Index ETF (ASX: VAS) is a great first investment.

Guzman y Gomez Ltd (ASX: GYG) shares will trade on the ASX on 20 June 2024 at $22. The GYG IPO will be the hottest ASX IPO for many years.