Thanks to recent changes in the law, the financial planning profession is now highly credentialed. To call yourself a financial planner in Australia and appear on the official MoneySmart website, you must meet very high standards of education, experience, ethics and alignment. A qualified financial adviser can offer you holistic advice, covering everything you need from cashflow to investing and aged care; or once-off “scaled” advice, covering just specific parts (e.g. retirement planning). It is vital you know who is, and who isn’t, truly qualified to offer personalised advice before engaging with someone you think might be an expert.

You want to find a financial planner, who you can trust? Someone to help you manage your nest egg and/or help your family? Well, that’s easier said than done.

I — Owen Rask — know how hard it can be. You think…

‘Are they qualified to give me the advice I need?’

‘Are they just trying to sell me something?’

‘I heard X, Y, Z horror story on the radio…’

Below, I’ve tried to offer you two simple options to find a financial planner:

![]()

Our chosen accumulator financial advice partner (18 – 50) is Everest Wealth, led by Alex Luck, Scott Taylor and Daisy Magor.

Alex Luck. Alex has been in the financial services industry for over 10 years and draws on his knowledge, education and experience in both the accounting and financial planning fields to provide advice in a clear, concise and effective manner. At the heart of Alex’s practice lies a deep commitment to his clients’ best interests. By fostering open and transparent communication, Alex builds strong relationships founded on trust and mutual respect.

Over the course of his career, Alex has had the privilege of assisting a diverse array of clients with their financial aspirations. Whether it’s crafting a robust investment portfolio, devising a comprehensive property plan, or addressing intricate financial challenges, he approaches each client’s unique situation with unwavering dedication and a commitment to delivering personalised solutions.

Scott Taylor. Scott has been in the financial services industry for over 10 years previously working with financial advisers to help them build efficient and sustainable businesses whilst educating them on new areas of advice. His passion is now helping young people starting out in their careers to get ahead and reach their goals. Scott believes that financial planning extends beyond mere numbers; it’s about understanding individuals’ unique aspirations and tailoring strategies that align with their goals.

Scott firmly believes that financial planning is a deeply personal journey. It’s about discovering your individual aspirations and tailoring a financial roadmap that speaks to your goals. Whether you’re dreaming of homeownership, starting your own business, or traveling the world, Scott is here to help you navigate the financial landscape with confidence.

Daisy Magor. Daisy has been in the financial services industry since 2015 and has experience working with a large array of clients ranging from SMSF’s to small business clients to young Australians just starting out in their financial journey. Daisy is passionate about combining a deep understanding of traditional principles with a keen awareness of emerging technologies, Daisy leverages cutting-edge tools and platforms to provide tailored solutions for our clients.

Our chosen pre-retiree financial planning partner (51 – 60) is Northeast Wealth, led by entrepreneurial and experienced financial adviser, James O’Reilly.

Mariana Subasic, Bachelor of Business, CFP. Pilates obsessed. Loyal. Long time bachata enthusiast. Plant lover. Unhealthy obsession with crime docos / thrillers. Sun chaser. Likes to make people laugh.

James O’Reilly, Master of Applied Finance (Investment management / Financial Planning). Proud father. Daily learner. Climbing cyclist. Chin Chin enthusiast. Lover of amusing animal videos. Spirited snooze alarm advocate. Pragmatic Saints supporter.

Rask’s team is led by Owen Rask, the Founder of Rask. The team has over 50 years of industry experience spanning investments, superannuation, tax optimisation and planning, business owners, and risk. Learn more about the Rask Advice team.

Life insurance isn’t always high on the to-do list. You might already be a convert, or you (or your partner) might need a nudge. Skye switches things up.

Personalised advice from qualified and experienced insurance advisers – Skye isn’t a cookie cutter comparison service.

They don’t want you to sign on the dotted line without being informed and comfortable with your decision.

Bringing the conversation to you – Say no to driving to an office for meetings and piles of paperwork, Skye will meet you online.

Upfront and transparent – They’re always straightforward and never recommend insurance you don’t need.

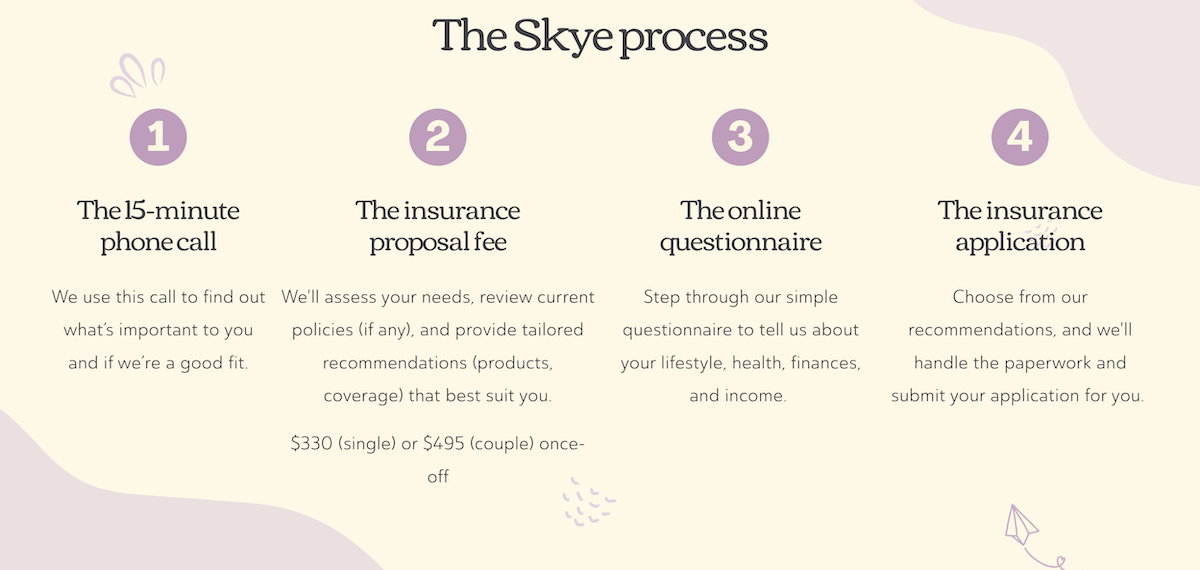

There’s a four-step process to getting insurance, which you can see below.

Click here to book a free call.

You don’t have to go through us to find a good financial planner. If you choose to go it alone, here’s what we think you should look out for when choosing a financial adviser:

Want to level-up your analytical skills and investing insights but don’t know where to start? Join 50,000 Australian investors on our mailing list and we’ll send you our favourite podcasts, courses, resources and investment articles every Sunday morning. Grab a coffee and let Owen and the team bring you the best insights.

Here you go: A $50,000 per year passive income special report

Join more 50,000 Australian investors who read our weekly investing newsletter and we’ll send you our passive income investing report right now.

Simply enter your email address and we’ll send it to you. No tricks. Unsubscribe anytime.

Unsubscribe anytime. Read our Terms, Financial Services Guide, Privacy Policy. We’ll never sell your email address. Our company is Australian owned.