Finding the best online trading account to buy or sell shares in Australia can be scary. Believe me; we know that buying shares in Australia for the first time is a daunting task. Commsec, Pearler, Selfwealth, Stake, Vanguard Personal Investor, Superhero, Sharesies… where do I even start!

Please note: the brokerage prices, costs and information we’ve included here is a guide only. And the fees and charges change regularly. Refer to the broker’s website to read its fee schedule, product disclosure statement (PDS) and financial services guide (FSG).

In Australia, if you want to buy shares or ETFs, you will generally need to use a broker to facilitate the transaction.

Our main market in Australia is called the Australian Securities Exchange (ASX). Think of it like a farmers market, with various products for sale and shoppers and vendors roaming around. The main difference is that you can sell the apples you just purchased to other shoppers.

However, to buy anything from the market, you need to use a broker. This ensures an orderly operation of the marketplace and greater transparency for all involved.

What is a brokerage account?

You’ll need to create an account to place an order through a broker. However, because of the financial rules in Australia, you will need to provide more than just a secure password. The broker is also required to collect information like your address, DOB and identification documents.

A brokerage account allows you to place orders to buy and sell shares and ETFs and does all the work behind the scenes once you place an order. Instead of directly paying the seller for the shares you just bought, you provide your broker with your money, and they’ll transfer the funds on your behalf.

How do you open a brokerage account?

Basically, an investor applies to an online stockbroking company to create an account, link a bank account to fund it, and presto – it’s time to buy and sell shares. It’s a tiny bit more complicated than that, but you get the idea.

Most of Australia’s major banks have a stockbroking arm that allows customers, and customers of other banks, to trade shares on the Australian Securities Exchange (ASX). Major brokerage platforms in Australia include names like CommSec, Nabtrade and SelfWealth. When the account is funded, an investor needs to find the share they are looking for and submit an order.

The broker sends that order to the market, and hopefully, the buy order is matched with a seller. You’ll get a trade confirmation almost straight away, but the settlement of a trade can take a couple of days to be processed by the ASX.

Can I have more than one online trading account?

Most brokerage accounts give you access to one exchange, like Australia’s ASX share market.

However, some brokerage firms and accounts can give you access to more markets from one country. For example, some brokers allow you to log in just once and trade stocks on both the Australian and US markets.

Brokerage account or robo adviser?

Generally, a robo-adviser (such as SixPark, InvestSmart or Stockspot) will provide you with an expertly run portfolio and make investment decisions and trades on your behalf. However, it is likely that they will set up a brokerage account in your name to make the trades, so make sure to ask!

Broker versus managed fund differences

A managed fund is generally an investment vehicle that invests your money into various asset classes, through a unit trust, at the fund manager’s discretion. You don’t usually need a brokerage account to invest in a managed fund.

What can I buy in a brokerage account?

A brokerage account allows you to buy and sell investment options listed on the ASX, including shares, ETFs, REITs, bonds, LICs and hybrids.

After opening a brokerage account, many investors have difficulty deciding what to invest in first. For peace of mind, learn more about investing in shares and ETFs with our courses on Rask Education before diving into the market.

We’ve also put together a guide with 22 ASX share ideas for 2022!

Fees for trading shares explained

When you buy or sell shares, brokerage fees (e.g. $20 to buy or sell) are automatically taken out of the money in your brokerage account.

Sometimes brokerage fees can be in dollars (e.g. a $10 brokerage fee for an investment of $1,000) or a percentage (e.g. 0.1% for an investment of $10,000).

In addition to brokerage, a normal fee charged by all brokers, you could be paying account-keeping fees or fees for extra services you don’t use.

Don’t be afraid to shop around because some brokerage accounts don’t charge ongoing account fees or, at the very least, they are optional.

Finally, be sure to check the fees on the bank account that funds your brokerage account and take note of the interest you’ll earn when you have spare cash that is waiting to be invested.

Compare the top brokerage accounts

Like many things, brokers come in all shapes and sizes, so think about what features you need!

For some people, it’s essential that their brokerage account comes with data on companies, including financial statements or news.

Some brokerage providers will also give you access to analyst buy/hold/sell ratings and price guides, although this may incur an additional fee.

Last but not least, you want to make sure that your chosen broker is easy to use because even though we have the technology for an amazing user experience, many brokers are still years behind.

Let’s dive into each of these key considerations below.

Fees

As mentioned earlier, you’ll have to pay brokerage fees on any brokerage account that allows you to buy and sell ASX-listed securities. The brokerage fee will differ depending on the platform you choose, and sometimes there’s a reason some platforms are a lot cheaper than others (see the HINs vs custodians explanation further down).

However, you may need to keep your eye on other fees for things like premium research, data and phone orders.

Data & live pricing

Believe it or not, not all the data you see on brokerage platforms is live and can be delayed (e.g. by 10 or 20 minutes), as brokers have to pay extra to the ASX for live data.

Some platforms charge extra for this live data or offer delayed pricing. Keep this in mind during your comparisons and consider if this is important to you and your investment style.

User experience

Many brokerage platforms are available in Australia; some are much more user-friendly than others. If being able to trade within seconds via your mobile app is important, use this as a filter when comparing brokers.

Research

Some of the larger brokers give you free access to broker research on large ASX-listed companies and price guides. While you should take most of this research with a grain of salt, it can be a helpful tool to use in your investment process.

International

Finally, some brokers have built-in platforms for you to trade in other international markets like the NASDAQ or LSE through the same account. You might also choose to use multiple brokerage accounts to give you the international market access you need.

HINs vs custodians: does it matter?

Yes, we think it matters.

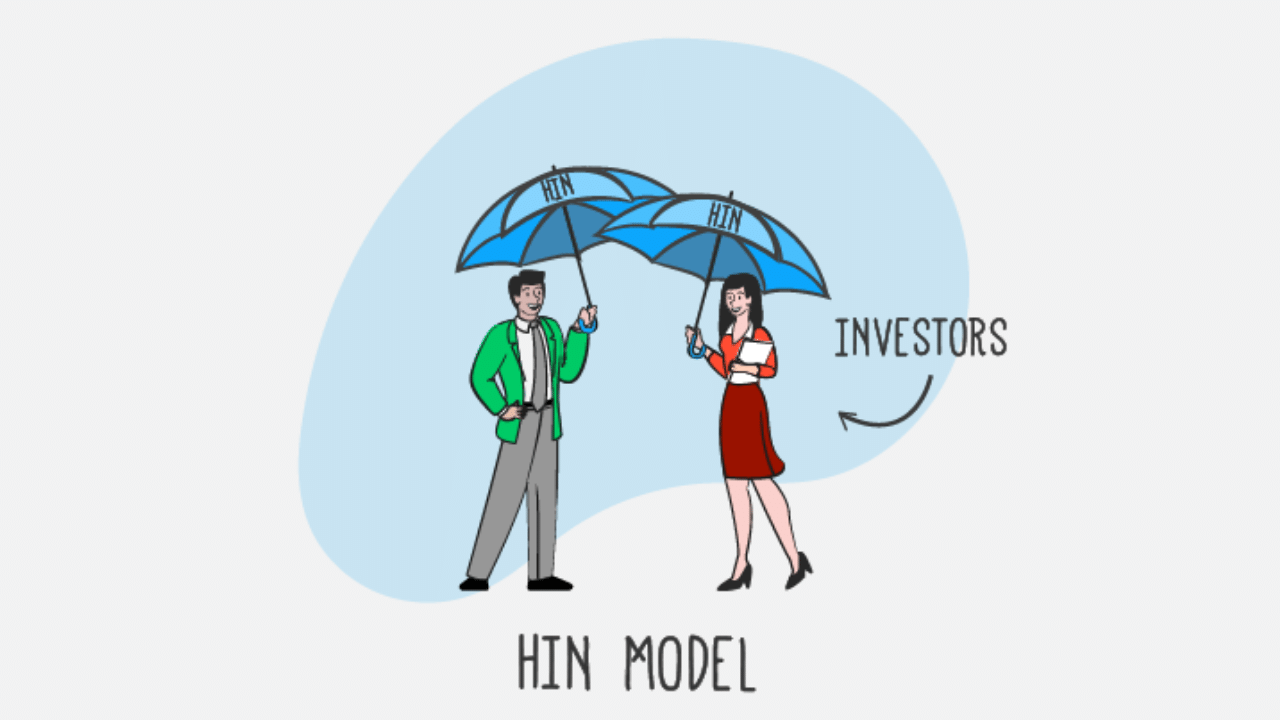

One overlooked consideration is whether or not the broker provides CHESS-sponsored ASX trades. CHESS stands for the Clearing House Electronic Subregister System, which is the name of the system used by the ASX to enable it to transfer shares between buyers and sellers.

If you want to hold shares on the CHESS register, a CHESS-sponsored broker must issue a Holder Identification Number (HIN) similar to an account number. The HIN is essentially the ID number used to track all your trades and holdings. You directly hold these shares via your personal HIN.

Pros of CHESS Sponsorship brokers

- Direct ownership – you are registered as the owner of the shares with the ASX rather than with the custodial broker. If the custodial broker goes bust, you must play by the custodian’s rules to recover your shares if any funds remain. Whilst this has occurred, it’s quite rare, so it depends on the level of risk you are willing to take.

- Easier to switch brokers – your individual HIN allows you to transfer to other brokers easily.

- Voting rights – you have the right to vote at general meetings, whereas some custodial brokers do not pass on this power to shareholders.

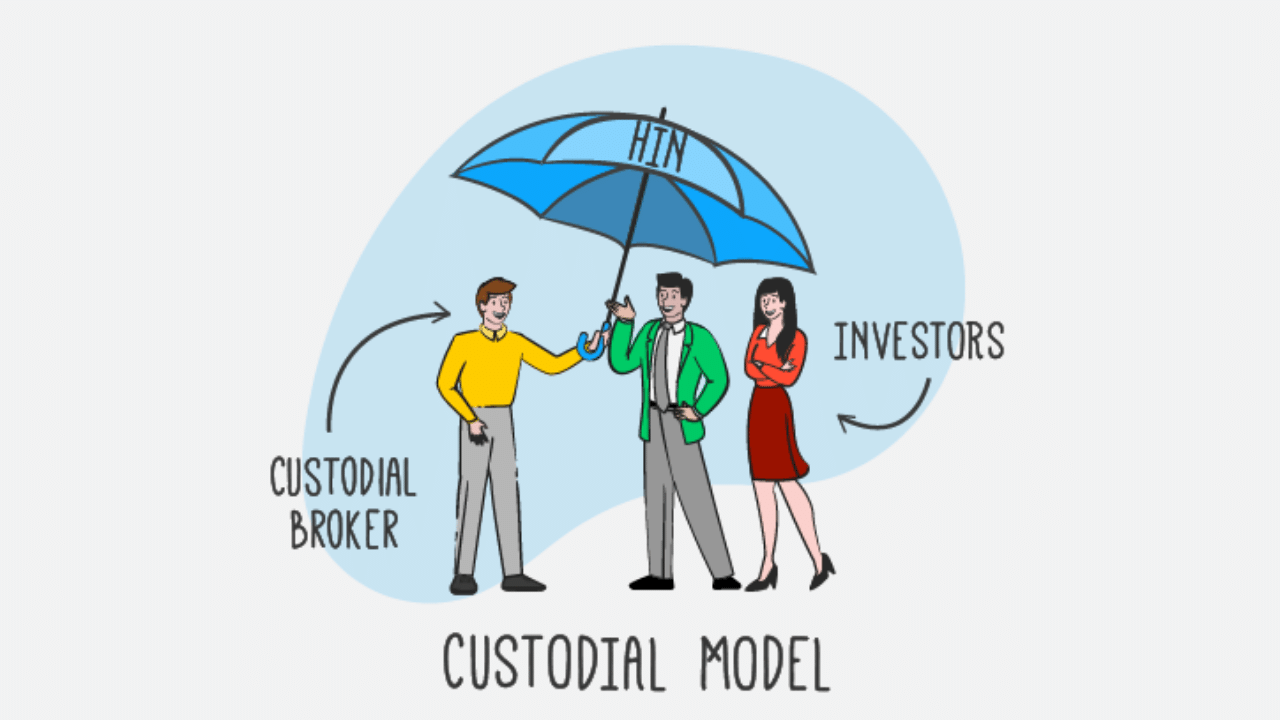

The other option is to choose a broker that is not CHESS-sponsored, where a custodian holds the shares on your behalf. The custodian is a separate entity that serves to solely hold shares on your behalf alongside everyone else who uses the same broker.

Instead of issuing you with an individual HIN, this custodial broker uses its HIN. You can think of the custodial broker’s HIN as an umbrella with each person’s holdings underneath.

Pros of non-CHESS Sponsored brokers

- A wider range of products and asset classes – funds in a custodial model are pooled with other accounts enabling custodial brokers to offer more products and asset classes such as fractional investing and overseas assets.

- Cheaper fees – since funds are pooled with other accounts, custodial brokers are able to offer more competitive fees or lower trading costs.

Our Rask Education piece on HINs & Custodians: What’s the big deal? provides further details.

Popular Australian brokerage platforms 2024

Now that we’ve covered the basics of brokerage platforms in Australia let’s dive into some of the popular brokerage platforms in Australia right now.

Many of these details in this video were believed to be correct on 12 November 2022, but please ensure that you check the most up-to-date details via the provider’s website directly.

Pearler

Pearler is a fairly new Australian player focused on serving long-term ETF investors who want to automate their investment strategy. Pearler also provides investors with their own HIN.

- Key Features: Automated investing, shareable portfolios, micro-investing, and brokerage-free ETFs (VanEck, ETF Securities and eInvest only) for investments held for over one year.

- Fees: $6.50 AUD per Australian trade ($5.50 if you prepay), $6.50 USD per US trade

- Markets: ASX & US

- HIN-sponsored ASX shares & ETFs ✅

Stake

Stake is an innovative Australian company, best known for opening Aussies up to the US markets with fractional share trading, and low-cost ASX trades.

- Key Features: Low cost brokerage (note FX fee below), great app experience and fractional US shares.

- Fees (US): $3 USD per trade, but note a 70bps FX fee when moving your AUD to USD and optional Stake Black premium service for $12 per month.

- Fees (ASX): $3 AUD per trade

- Markets: NYSE, NASDAQ and ASX.

- HIN-sponsored ASX shares & ETFs ✅

Selfwealth

SelfWealth (ASX: SWF) is a listed Australian platform offering flat-fee online trading. Selfwealth also provides investors with their own HIN.

- Key Features: Australia’s first low-cost brokerage and third biggest overall, access to Australian and US markets & portfolio research tools.

- Fees: $9.50 AUD per ASX trade (flat fee), $2 USD per US trade (flat fee) and FX Spread 60bps.

- Markets: ASX, NYSE, NASDAQ & Hong Kong

- HIN-sponsored ASX shares & ETFs ✅

CommSec

CommSec is a brokerage platform operated by a division of the Commonwealth Bank of Australia (ASX: CBA). It has been around for a very long time and it’s the biggest brokerage platform in Australia by a long way.

- Key Features: Very established platform, access to many markets and investment options and broker research.

- Fees: If you use a CommSec cash account (CDIA) (they’ll ask you if you want to get a CDIA when you join CommSec), the below fees apply for Australian trades:

- $10 (Up to and including $1,000)

- $19.95 (Over $1,000 up to $10,000 (inclusive))

- $29.95 (Over $10,000 up to $25,000 (inclusive))

- 0.12% (Over $25,000)

- Markets: ASX, LSE, NYSE, NASDAQ & access to a large number of global markets (see brokerage and FX fees for each market here International Shares – trade on over 25 global share markets).

- HIN-sponsored ASX shares & ETFs ✅

Superhero

Superhero is a new entrant to the Australian brokerage scene, with a focus on getting young Australians into the market (both ASX & US). They use a custodial model (rather than issuing you a HIN), which allows them to cut the cost of brokerage.

- Key Features: Australian minimum purchase $100 AUD, US minimum purchase $10 USD (fractional shares), and great user experience.

- Fees: $0 brokerage to buy ASX ETFs, $5 brokerage on ASX shares, $0 Brokerage on U.S. Shares and ETFs, with a 70 basis points (70bps) FX fee when you transfer currencies.

- Markets: ASX, NYSE & NASDAQ.

- Custodial model for ASX shares & ETFs ☂️

Vanguard Personal Investor Platform

Vanguard Personal Investor Platform is the new brokerage platform designed and created by one of the world’s leading fund managers, Vanguard.

- Key Features: ASX shares and Vanguard funds in one place, $500 minimum investment amount (or $200 for autoinvest/ongoing), trusted global brand (fees will probably fall in time), and no minimum on additional investments into Vanguard managed funds.

- Fees: $9 flat brokerage to buy non-Vanguard ETFs and direct shares, $0 fee on Vanguard managed funds & ETFs, plus an account fee of 0.10% per year on ASX direct shares.

- Markets: ASX shares & ETFs, along with Vanguard managed funds.

- Custodial model for ASX shares & ETFs ☂️

Sharesies Australia

Sharesies is one of New Zealand’s biggest brokerage platforms — it’s truly massive. Here in Australia, Sharesies is an ‘up-and-comer’ that is packing a punch by offering access to thousands of different types of investments in one place.

- Key Features: ASX, Kiwi and US shares and ETFs with the smallest minimum balance and trading amounts we’ve seen — users can buy part of a share with just 1 cent!

- Fees: 1.9% transaction fee, which is capped depending on each market (see below)

- ASX: capped at $6 AUD per order

- NZ: capped at $25 NZD per order

- US: capped at $5 USD per order

- Markets: ASX, US and Kiwi shares and ETFs (a 0.6% currency fee will apply when you transfer currencies)

- Custodial model for ASX shares & ETFs ☂️

Time to open and start ASX trading

The short answer is that the amount of time it takes to start trading depends on which broker you choose or even who you bank with.

If you choose a broker which is supported or owned by your bank, it might be quicker to set up because you might not have to fill in ID documents or wait for your funds to clear. Meaning you could be up and running within a day. Other broker accounts can take longer to activate, get funded and start trading (i.e. 2-5 working days).

Some international share brokers have a fully automated on-boarding program, and some even have apps for iOS and Android. However, most legacy overseas share trading platforms are terribly designed.

Depending on the broker you choose, it could take as little as a day or up to 10 days to activate and fund a new international share trading account.

Buying US shares from Australia

Although you’d think it would be convenient to buy and sell all of your shares in one account, including your Australian (ASX) and international shares (e.g. NYSE, NASDAQ, FTSE), unfortunately, it’s not always that easy.

Due to the different regulations between Australia and overseas markets (USA, Europe, etc.), not all online share brokers will enable you to buy and sell shares from international markets. For example, most Australian brokers won’t let you buy or sell shares of US-only companies like Apple and Microsoft.

Most of the more modern brokers that Rask listeners, members, students or subscribers follow are Stake, Superhero, Pearler, Commsec & Selfwealth. Each of these platforms offers easy access to Australian and US shares in one account — with the exception of Commsec, which has a horrible user experience for international share trading.

It’s also worth noting that many ETFs, or Exchange Traded Funds, are available on the ASX that invest in international shares and US companies. Vanguard, BetaShares, iShares, VanEck and ETF Securities offer international exposure through their ETFs, which you can easily purchase through your Australian broker. For example, you might use your Australian (ASX) approved brokerage account to buy an ETF like iShares S&P 500 ETF (ASX: IVV), which then invests in the largest 500 US shares.

If you’re only trading ETFs, you might not need international share trading activated in your brokerage account.

Want to discover Australia’s best ETFs? Our Best ETFs website has the full list of Australian ETFs available.

Our #1 tip with brokers

Before you fully commit to a broker, why not give it a test drive? That is, open an account but don’t put your money in. This will help you make sure you think buying and selling using the platform/app is straightforward. Also, test drive their customer service team by giving them a call and asking about the reporting they can provide you at tax time — trust us, having good tax reports will make your life so much easier. See our guide on tax: How tax works on shares in Australia.

Finally, don’t forget we highly recommend reading the broker’s Product Disclosure Statement (PDS) or speaking to your financial adviser if you’re concerned.