Why WHSP (ASX:SOL) is a solid share for COVID-19 uncertainty

I think WHSP (ASX:SOL) is a solid ASX share for all of the COVID-19 uncertainty. I’d be pleased to buy shares today for a number of reasons.

Changes are happening - please bear with us while we update our site. Click here to give us your advice and feedback.

ASX dividend shares are some of the best in the world, given their yield and the fact that many Australian companies offer their dividends with franking credits.

Below, you’ll find share research and analysis on some of Australia’s best (and worst) ASX dividend shares, stock ideas and the latest news from Rask Media — delivered daily.

I think WHSP (ASX:SOL) is a solid ASX share for all of the COVID-19 uncertainty. I’d be pleased to buy shares today for a number of reasons.

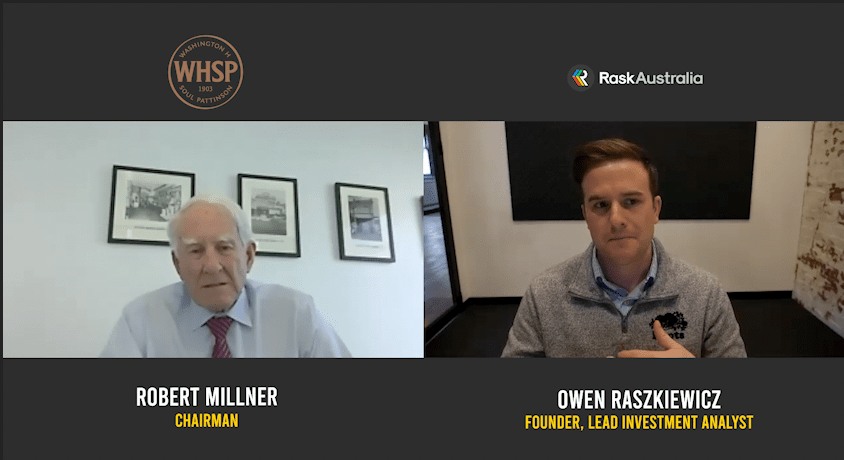

Robert Milner of Washington H. Soul Pattinson & Co. Ltd (ASX:SOL) and Brickworks Ltd (ASX:BKW) took some time to sit down for The Australian Investors Podcast and talk about life, being one of Australia’s most business leaders and, of course, his investment process.

While the tech sector has skyrocketed in recent months, ASX bank shares haven’t enjoyed a similar rebound. Is this an overreaction or are bank shares fairly valued?

Origin (ASX:ORG) reveals FY20 charges costing over $1 billion due to commodity prices, the impacts of the COVID-19 pandemic and a shift to renewables.

Woodside Petroleum (ASX:WPL) has announced a profit hit of US$4.37 billion, largely due to impairments.

After getting whacked in the lead up to the COVID crash of March 2020, the Woolworths Group Ltd (ASX: WOW) share price has held its own.

The Credit Corp (ASX:CCP) share price is up around 5% after releasing an update for FY20.

Telstra (ASX:TLS) could claim to be the safest blue chip on the ASX during COVID-19. Is it the most defensive share idea?

The S&P/ASX 200 (INDEXASX: XJO) is expected to open higher today according to data from the Sydney Futures Exchange. Here’s what you need to know.

I think WHSP (ASX:SOL) is a solid ASX share for all of the COVID-19 uncertainty. I’d be pleased to buy shares today for a number of reasons.

Robert Milner of Washington H. Soul Pattinson & Co. Ltd (ASX:SOL) and Brickworks Ltd (ASX:BKW) took some time to sit down for The Australian Investors Podcast and talk about life, being one of Australia’s most business leaders and, of course, his investment process.

While the tech sector has skyrocketed in recent months, ASX bank shares haven’t enjoyed a similar rebound. Is this an overreaction or are bank shares fairly valued?

Origin (ASX:ORG) reveals FY20 charges costing over $1 billion due to commodity prices, the impacts of the COVID-19 pandemic and a shift to renewables.

Woodside Petroleum (ASX:WPL) has announced a profit hit of US$4.37 billion, largely due to impairments.

After getting whacked in the lead up to the COVID crash of March 2020, the Woolworths Group Ltd (ASX: WOW) share price has held its own.

The Credit Corp (ASX:CCP) share price is up around 5% after releasing an update for FY20.

Telstra (ASX:TLS) could claim to be the safest blue chip on the ASX during COVID-19. Is it the most defensive share idea?

The S&P/ASX 200 (INDEXASX: XJO) is expected to open higher today according to data from the Sydney Futures Exchange. Here’s what you need to know.

Want to level-up your analytical skills and investing insights but don’t know where to start? We can help. Join 40,000+ Australian investors on our mailing list today and we’ll send you our favourite podcasts, courses, resources, investment articles and podcasts every week. Delivered to your inbox every Sunday morning. Grab a coffee and let Owen and the team bring you the best investment insights every week.