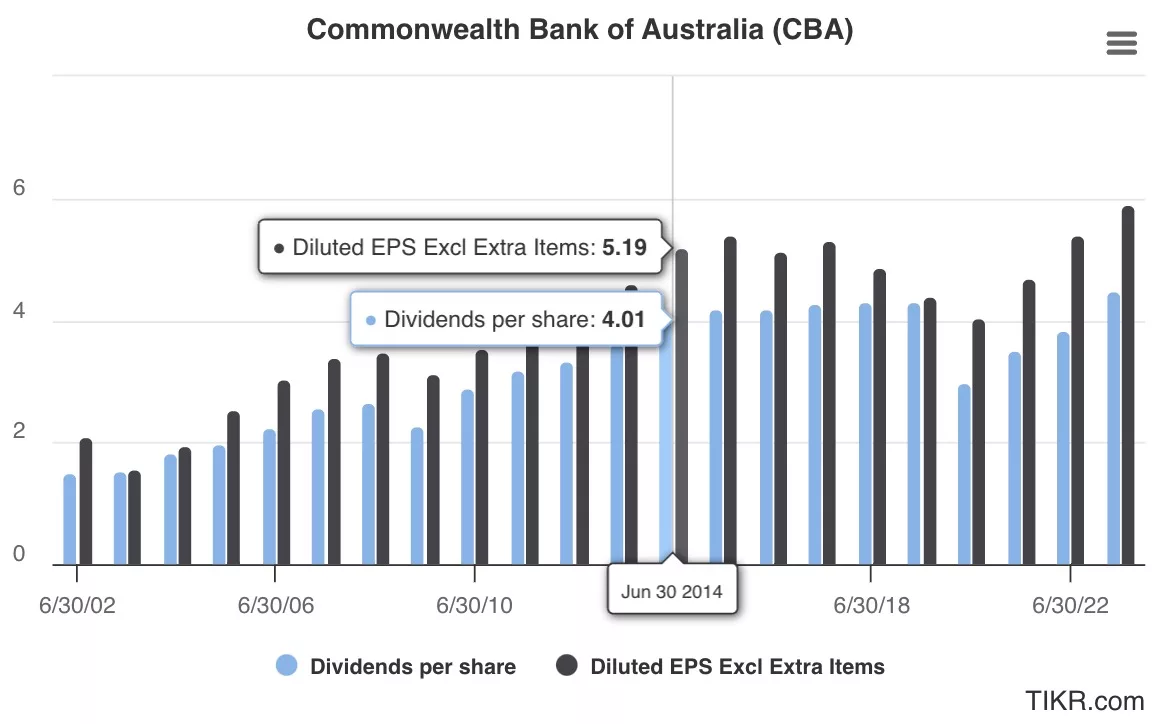

The Commonwealth Bank of Australia (ASX: CBA) share price may be up 55% over the past decade, but how fast do you think CBA’s profits have grown in that time?

a. 25%

b. 50%

c. 75%

d. 100%

The answer: 13%.

Over 10 years, CBA’s profits (or earnings per share – which is the best way to measure any business’ performance) have grown around 1.3% per year. And, believe it or not, I’m being generous. I’m excluding “extra items.”

How about CBA’s dividends per share?

How fast do you think CBA’s dividends have grown?

The answer: 12%.

I think you’ll agree that no company can grow its dividends faster than its profits, forever. Since dividends are paid from profit. So if you keep paying more and more dividends, eventually you’ll stop growing (since you’re not reinvesting profit), run out of profit completely or… maybe you can get ‘creative’.

I’m convinced that the boards of some Aussie companies, such as CSL Limited (ASX: CSL), are eager to please their dividend hungry shareholders (or risk getting fired) but know they still need to reinvest in their businesses for the long term.

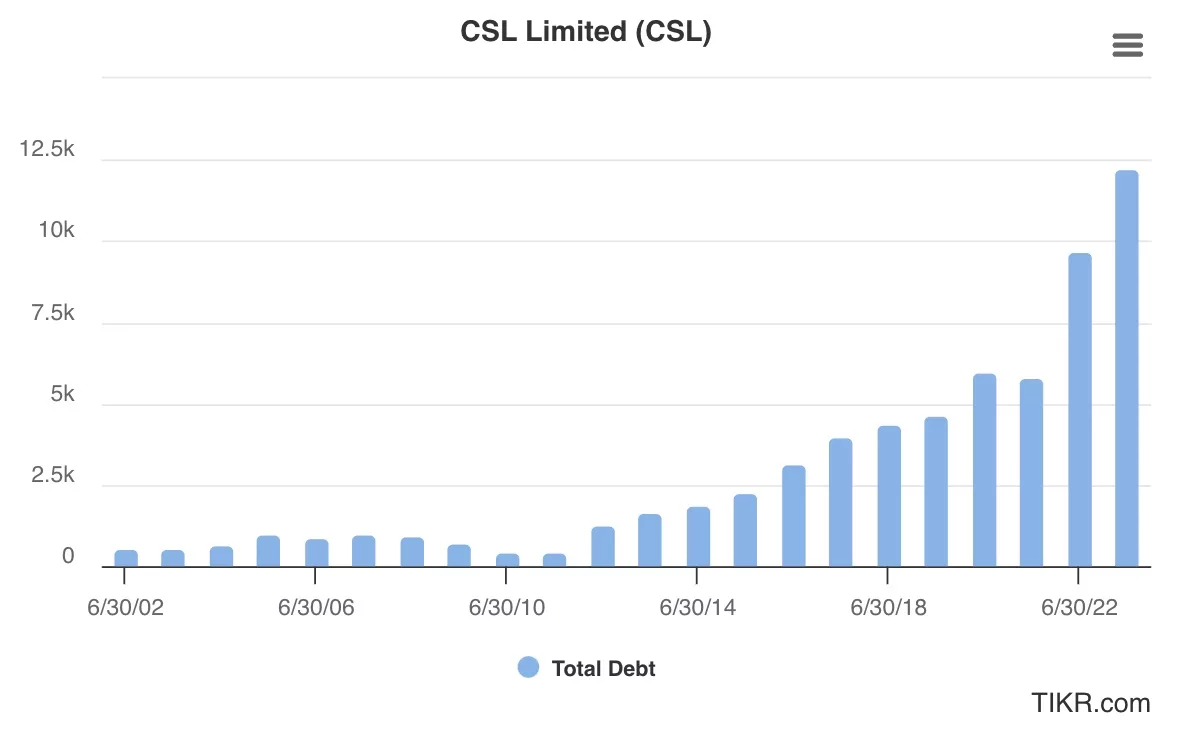

CSL was able to grow dividends in recent years by taking on way more debt, instead of using its profit reserve (which it reinvested in growth) to pay dividends. I covered CSL many times for Selfwealth LIVE and then Rask LIVE (which is making a comeback this month!).

Take a look below…

CSL’s total debt has ballooned

However, CSL’s debt is not the salient point. It’s not what I want you to know after reading this article…

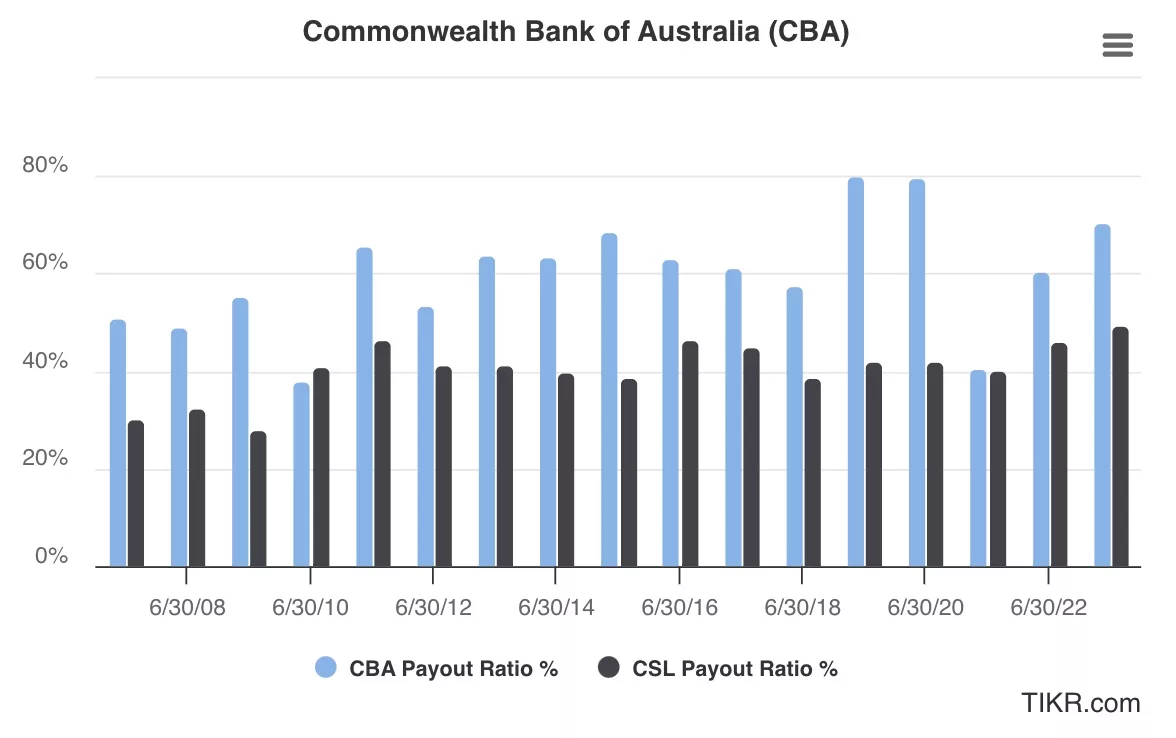

Compared to CBA, CSL’s payout ratio, which is the percentage of CSL’s yearly profit paid out as dividends to shareholders, hasn’t exceeded 50% since 2006.

This meant CSL always had at least 50% of its yearly profit left over to invest in sustaining its operations and long term growth.

The chart above, which shows CSL’s total debt, clearly shows some cheeky financial engineering that shareholders need to be aware of. Especially before they infer that the company can continue to grow profits and dividends, as it has recently.

CBA is close to maxing out its payout ratio

Back to CBA…

Covid gave CBA and its banking brethren, like National Australia Bank (ASX: NAB) and Westpac Banking Corp (ASX: WBC), the political opportunity to cut dividends. Had they tried to do it any other year, the board would have faced revolt from the army of retirees, shareholders and pension funds which rely on it for income.

However, aside from this Covid ‘blip’, you can see from the first and third charts I included, above, CBA is quickly getting back to paying as much of its profit as dividends as it did pre Covid. Anything between 70-80% of bank profits paid as dividends (“payout ratio”) is considered the upper limit. Before Covid, CBA was stretched thin in terms of paying out more in dividends. Luckily it made some big divestments to fund the extra amounts of dividend.

So what’s the difference between now and pre Covid for CBA?

CBA’s profits are not growing. And it’s not divesting anything.

We already know that CBA’s profit growth over 10 years is not beating the rate of inflation (it’s growing at 1.3% versus inflation of ~4%).

This means, in 10 years, your CBA dividends will be buying you far less at the grocery store than it is today. This is why growth is VITAL.

The problem & the opportunity

In short, the core problem is the very thing that made CBA a truly amazing stock over the past 30 years – a consistently growing dividend payment – is stalling out.

With the bank no longer gouging customers on financial planning, insurance and sub-par investing services, they’re left with competing for the lowest price (on interest rates) for property buyers and business owners, who are seeking loans.

Put simply, CBA may be an ‘okay’ investment, in terms of modest growth plus income. However I think it’ll struggle to beat the market. And, worse still, I think it’s very unlikely to meaningfully increase its dividend over time.

Therefore, you have a few options:

- Look for consistent dividend payers which are growing – companies like Washington H. Soul Pattinson & Co. Ltd (ASX: SOL), Macquarie Group (ASX: MQG) and Wesfarmers Ltd (ASX: WES) spring to mind as great dividend companies with some growth.

- Build a core income portfolio from top (and growing) ETFs – such as Vanguard Australian Shares Index ETF (ASX: VAS), VanEck Australia Equal Weight ETF (ASX: MVW), or the Vanguard High Yield Dividend Shares ETF (ASX: VHY).

- Blend your slowing CBA shareholding with more sustainably growing companies – for example, US companies like Microsoft Inc (NASDAQ: MSFT) or Apple Inc (NASDAQ: AAPL) might not pay huge dividends now, but they’re growing fast. In fact, despite both being $5 trillion companies – each 23x larger than CBA – they’ve risen 227% and 347%, respectively, over the past 5 years.

While an index fund ETF like VAS, MVW or Betashares Australia 200 ETF (ASX: A200) will not ‘outperform’ the market, since they simply track the stock market, they offer franking credits, growth and diversification across dozens of dividend-paying and growth companies.

Meaning, you get a natural mix of growth and dividends with one investment. That’s why we hold both VAS and VHY inside Rask Invest – and why I am currently considering VanEck MVW to sit alongside them.

Bottom line – please don’t rely on CBA to do anything like it did in the past 20 years, in the next 20 years

If you have any questions for me on this research, or want to make some stock suggestions, come and join me and hundreds of investors in the free Rask Community.