It’s not difficult to become a millionaire, here’s how you might do it with the help of Aldi.

Little Bits, Lots of Times

Everyone wants to become wealthy but it’s not easy, or else we’d all be millionaires already! Sadly we can’t all invent the next Facebook or Snapchat.

But, that doesn’t mean it’s impossible to become a millionaire.

Three of the most important household expenditure categories are:

- accommodation,

- transport and

- food

It’s not easy to change accommodation and a car is necessary for a lot of Australians (although a Mercedes is not necessary). However, food can be a quick change and make a huge difference to a budget.

How to become a millionaire with Aldi:

According to MoneySmart, Australian households spent a staggering $666 billion on general living costs in 2016. That works out to be around $26,640 per person! Of the total, $12.6 billion was spent on meat alone – holy cow!

MoneySmart also said that a single person under 35 spent an average of $122 per week on food & drink (excluding alcohol), a young childless couple spent $239 on food and drink whilst a family with young kids spent $336 per week on food and drink. Remember, those are just averages.

According to research done by Choice Magazine last year, an Aldi shopping basket was about 50% cheaper than leading-brand products sold at Coles and Woolworths (ASX: WOW). When just comparing private brand versus private brand Aldi was still 10% cheaper.

So, for the single young person if they exclusively shopped at Aldi they could save perhaps 33% a week, or $41. This works out to be $178 a month and $2,132 a year. Here’s the fun part…

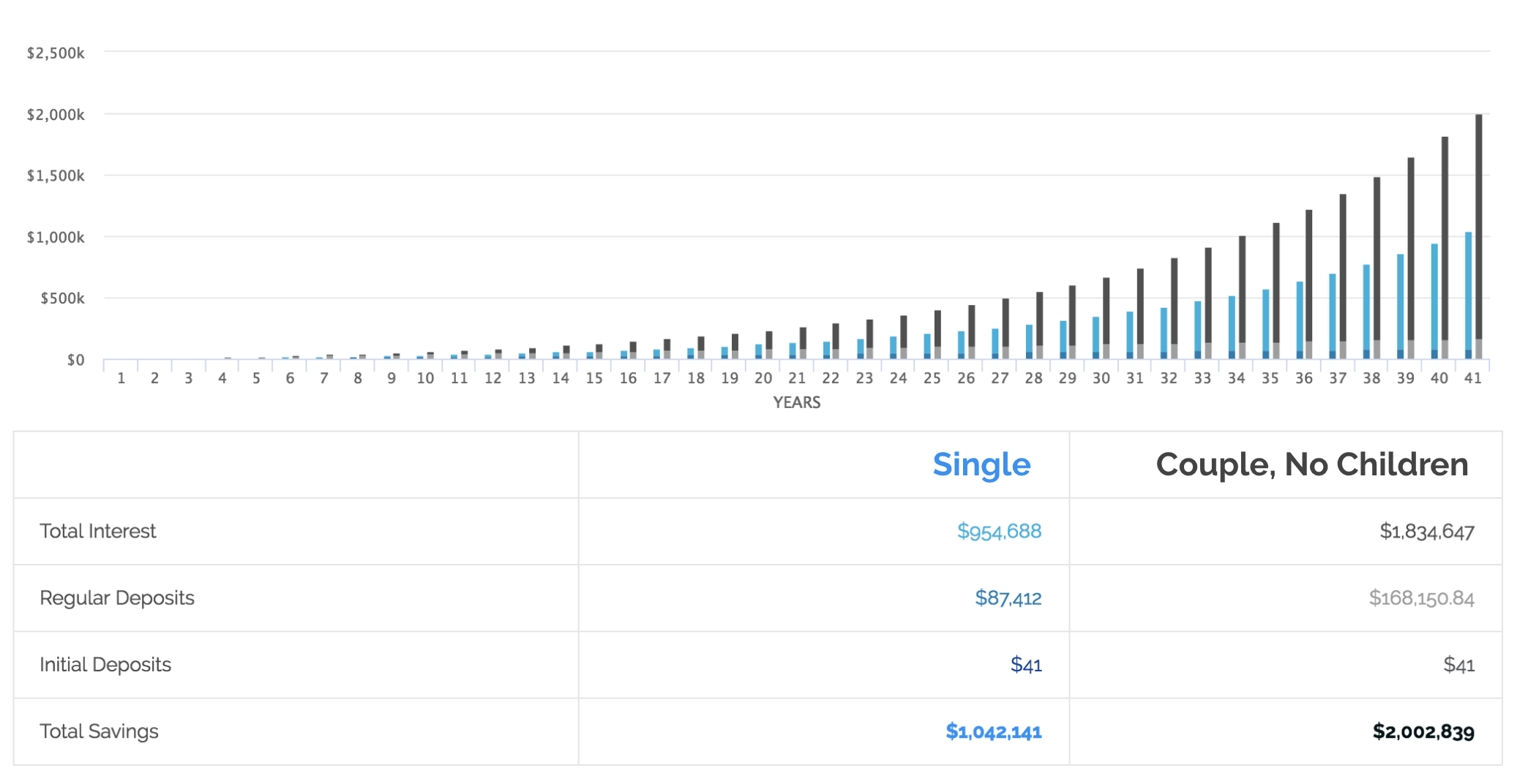

Using the clever Rask Finance Compound Interest Calculator, if the money saved was all put towards long-term investments like shares or property growing at 10% a year, the $41 a week would be $1 million in 41 years.

Compound Aldi Interest

The childless young couples, saving 33% off their grocery bill or $79, would make $1 million in 34 years using the same calculations.

The family with kids, who save 33% or $110, would have $1 million in 31 years.

Of course these figures exclude taxes, inflation and all that fun stuff. But these calculations don’t even include the $22, $39 and $35 per week spending on alcohol that the respective households supposedly pay for.

Next Steps

41 years sounds like a long time, right?

Here’s the catch: Many people who understand their budget and invest in their careers don’t have to wait that long. For example, the guest in the podcast episode below has an incredible story of hard work, money and getting rid of the mortgage by 30.

What he did next is even more impressive…

Financially Free At 30: Lessons From Australia’s Best* Investors

The Rask Group’s Australian Investors Podcast is fast becoming Australia’s #1 podcast for serious investors and those tackling financial goals head-on.

It provides unique insights from Australia’s best investors, entrepreneurs, authors and financial thinkers. Download the latest episode free on iTunes, Castbox, YouTube or wherever you choose to listen.

*As voted by us