Here’s one quick way you could value Westpac Banking Corp (ASX: WBC) shares. As you’ll see there are many ways to go about valuing a company’s shares, some better than others.

About Westpac

Westpac Banking Corporation, more commonly known as Westpac, is one of Australia’s ‘Big Four’ banks and a financial-services provider headquartered in Sydney. It is one of Australia’s largest lenders to homeowners, investors, individuals (via credit cards and personal loans) and business.

Valuation Models

There are plenty of different methods for valuing a company like Westpac including ratio analysis, dividend models, balance sheet valuation and discounted cash flow analysis.

None of these valuation models is perfect and they require plenty of assumptions that can lead to inaccurate valuations. However, discounted cash flow analysis is generally regarded as one of the more reliable methods.

The problem with DCF though is that it’s very time consuming and requires a lot of forecasting and modelling that makes it unsuitable for a quick and easy valuation. If you want to learn how to do a DCF analysis, the video below is a step-by-step example using Woolworths Group Ltd (ASX: WOW). The Rask Finance website also has instructional videos on all the other valuation techniques mentioned above.

Dividend Discount Model

For fast comparisons and valuations, my go-to method is the Dividend Discount Model (DDM). It’s a very basic model but it can be useful for quickly comparing similar companies.

Basically, a DDM takes the amount of the dividend and divides it by what we call the risk rate minus the growth rate of the dividends. The risk rate is the component that incorporates the stability of the dividend and the likelihood that it can be maintained. There are several different methods for calculating the risk rate that you can read about on the Rask Finance website.

Westpac shares are often talked about as dividend shares because of their high yield (currently 6.75%) and their historical reliability.

Therefore, it makes sense to value Westpac using its dividends.

The Valuation

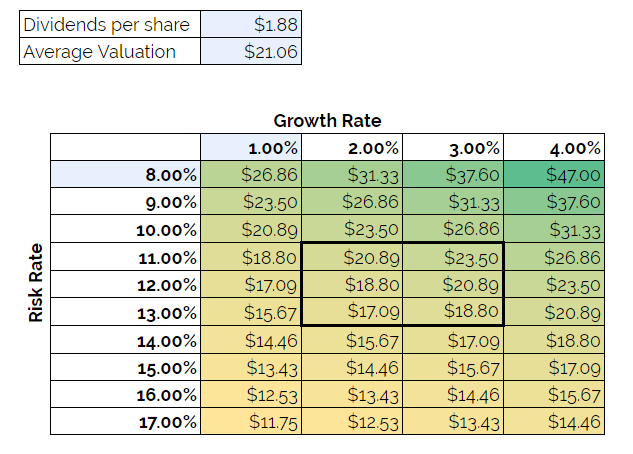

The Westpac dividend has been stable since 2015, paying $1.88 per year. The dividend hasn’t grown since the second half of 2015, but they’ve also avoided cutting dividends, unlike National Australia Bank Ltd (ASX: NAB).

It seems reasonable to assume that Westpac will try to maintain the current dividend amount over the next few years, but if we assume a long-term growth rate of 2-3%, around the rate of inflation, this is the result.

The average valuation is $21.06, almost 25% below today’s share price. That’s also assuming growth that Westpac hasn’t demonstrated over the last five years. In fact, with rate cuts and increasing pressure on net interest margins (NIM), it actually looks more likely that Westpac would cut its dividend before increasing it.

Time To Sell?

As mentioned, this is a very rough valuation and it should be combined with other valuation methods before making any investment decisions. However, it is something to think about before rushing in and buying Westpac shares because of the dividend yield.

I’d rather invest in one of the dividend-paying companies mentioned in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not own shares in any of the companies mentioned.