I’m surprised that the Bank of Queensland Limited (ASX: BOQ) share price was trading flat today despite telling investors it has withdrawn its profit guidance for 2020.

For context, the broader Australian share market or S&P/ASX 200 (ASX: XJO) was trading up 1.44%.

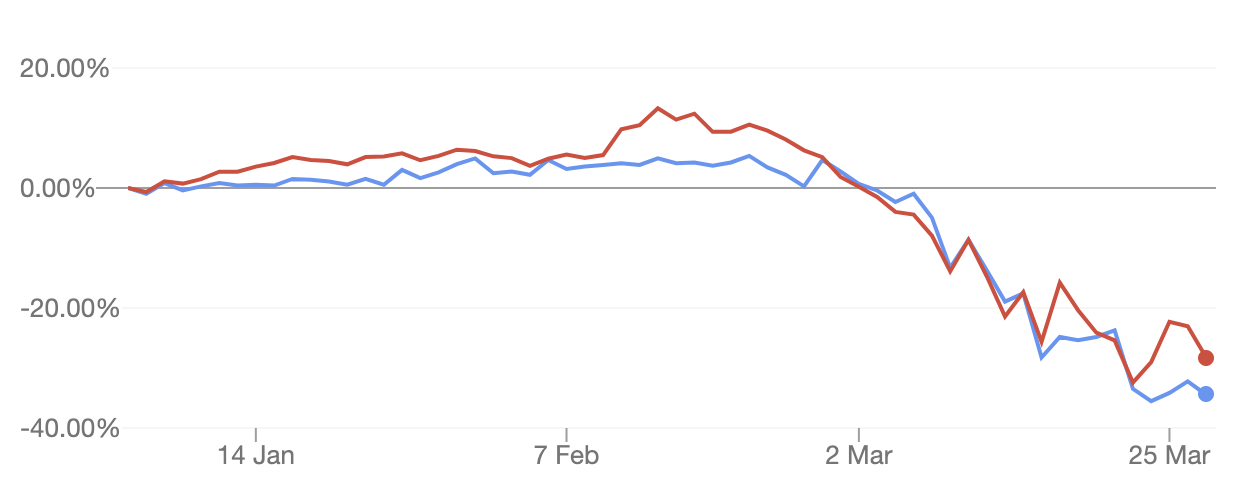

BOQ share price versus CBA share price – 2020

The chart above compares CBA shares, in red, to BOQ shares, in blue. So far in 2020 BOQ shares are down 34% versus CBA’s 28% decline.

Who is BOQ?

BOQ is one of Australia’s leading ‘regional’ banks with more than 180 branches throughout Australia. Unlike many other banks, many of BOQ’s branches are run by their ‘owner-managers’, who are effectively small business owners. Most of BOQ’s loans are mortgages.

In a statement today, BOQ withdrew its 2020 profit guidance because of the “highly uncertain environment” in the wake of the COVID-19 outbreak. In addition, it announced it would not seek an exemption from APRA, the banking regulator, to approve its 12-month profit in relation to its half-year dividend. BOQ also announced some changes/packages with regard to its lending.

While I think the news of withdrawn guidance is ordinarily quite bad news to deliver to shareholders, it seems BOQ shares haven’t reacted too negatively today. This could be because it has already fallen quite far in 2020.

Time to look elsewhere

For years, I’ve held out little hope for BOQ and Bendigo and Adelaide Bank Limited’s (ASX: BEN) ability to really deliver for their shareholders. They are good businesses but unfortunately there is a huge amount of pricing pressure in the mortgage market right now, and the Big Four banks like CBA have a tremendous advantage over the regional banks like BOQ and BEN.

Think about it this way…

As an investor, you have a limited amount of capital.

Whether it’s $10 million, $1,000 or $100,000, you should always take your time to carefully allocate your capital to the most effective risk-adjusted use for that money.

Right now, there are over 2,000 stocks on the ASX, plus managed funds, plus ETFs and around 10,000 stocks overseas.

With a modest upside, lower interest rates and intense competition, do BOQ and BEN shares rank in my top 20 or 30 right now? No way Jose.

2 things I’d buy before BOQ & BEN shares

Below, I’ve listed two alternatives for investors. One for investors focused on income, the other for investors seeking long-term growth, with some income potential. I would use these as a ‘tactical’ exposure to markets (i.e. less than 15% of my portfolio).

Income: Vanguard Australian Shares High Yield ETF (ASX: VHY). If you’re seeking dividend income then for me it’s a no-brainer that you should be buying more than one ASX share to get the income. There are two obvious reasons to diversify:

- Stability in dividend yield over the market cycle, and

- Lower risk profile.

By buying into a low-cost and diversified ETF like VHY you will get exposure to many of the highest yielding dividend shares on the ASX with one investment. Keep in mind, it’s not perfect and there are risks.

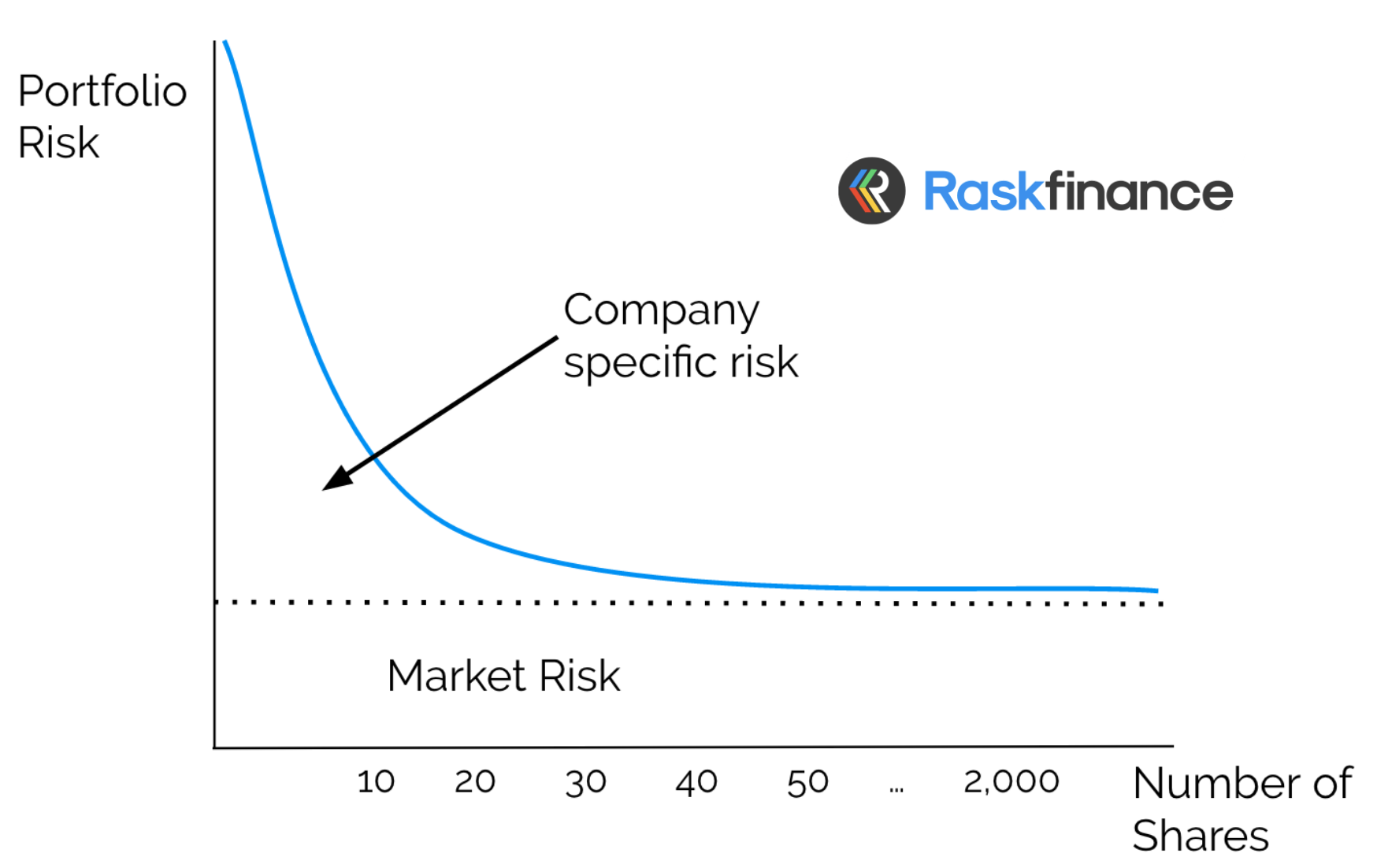

Nonetheless, the following chart from our — FREE — Rask Education ETF investor’s course shows the simple benefits of diversification within a portfolio. After about 30 stock positions in a portfolio, academic studies tell us the company specific risk is greatly reduced.

Source: Rask Education. education.rask.com.au/all-courses

Growth: VanEck Vectors Australian Equal Weight ETF

(ASX: MVW). The MVW ETF is different from the VHY ETF because instead of targeting dividend-paying shares it tries to take the ‘midsection’ of all companies on the ASX and make them equal weight in the portfolio.

The net result is a basket of shares inside MVW which are higher growth, risker risk. However, the ‘mid cap’ shares also pay dividends. You could expect the MVW ETF to experience more ups and downs during a market crash, such as the one we’re experiencing now.

Buy, Hold, Sell

If I owned BOQ, BEN or any of the mid-cap financial stocks for dividend income I’d swap them out and allocate the capital to low-cost ETFs and stocks with far better upside potential over the long run.

My ASX and global stock picks are reserved for Rask Invest members. That said, below, I have provided a link to one of our free investment reports that includes three stocks I’d buy today (or already own). I believe these three stocks could emerge from the current market fall in a better position three-to-five years from today.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing Owen does not have a financial or commercial interest in any of the shares or ETFs mentioned.