Wow, it’s been 10 years since Coles Group Ltd’s (ASX: COL) ‘Down, Down, prices are Down’ campaign. Well, the share prices are down for both Woolworths Group Ltd (ASX: WOW) and Coles, why is this so?

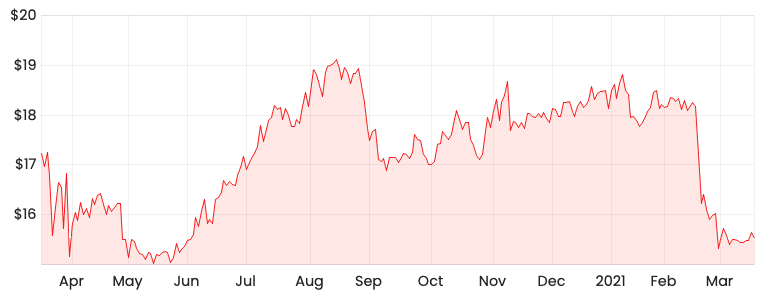

A year on since COVID, the share price for both Coles and Woolworths has returned to COVID levels.

COL share price

WOW share price

Pitfalls of short-term thinking and herd mentality

As Owen Raszkiewicz highlights in the Rask Investment Philosophy, the stock market is a vehicle for transferring wealth from the impatient to the patient. However, most people tend to think short-term, especially in such a fast-paced world we live in at the moment.

This is natural because the human brain tends to prefer to think short-term as long-term thinking requires more effort and time.

A classic example is my regret for not spending more time on finding the best superannuation fund when I first started working, it just seemed like too much work and I didn’t have that much money at the time. Well, I’m definitely paying the price for not thinking of the long-term compound effects of deploying funds in a more superior superannuation fund.

In the case of Coles and Woolworths, both businesses were massive beneficiaries of COVID. However, investors naturally got spooked by the COVID lockdown as share prices plummeted.

It’s easy to make judgements in hindsight but I think most long-term investors would have been thinking, “People will still need to buy staples and groceries”. People did indeed buy staples and groceries and bought more of it due to the lockdowns.

Coles and Woolworths recorded unprecedented levels of growth after COVID and lots of investors flocked to what was ‘hot’. I don’t think many of these investors were considering whether this unprecedented growth would be sustainable.

Both Coles and Woolworths recorded slower rates of growth for the half-year (HY21) relative to 2H FY20 when COVID propelled record growth. It appears the market expected more of the same COVID induced growth, hence the recent sell-off.

Down, down prices are down – is it time to buy?

The supermarket industry is highly competitive and cyclical with small margins. I tend to steer away from price-takers and prefer to invest in businesses that are able to lift prices.

On a comparative basis, it appears Woolworths is capturing more of the market share with its store count (1,052) being well above Coles’ (824). Also, Woolworths online sales almost doubled to $1.8 billion compared to Coles’ less flattering increase of 48% to $1 billion.

This probably explains why the sell-off since the HY21 results was much steeper for Coles.

Investors should also be mindful of the potential growth of independent stores along with smaller competitors like Aldi

and Costco. As more people become more accustomed to working from home, people may prefer to visit their local independent stores.

If you are interested in other ASX share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.