Get ready for some catchy tunes as Coles Group Ltd (ASX: COL) bring back its Down Down price reduction program to regain market share from Woolworths Group Ltd (ASX: WOW). This is great for consumers but what about the Coles and Woolworths share price?

As you can see below, Mr Market is more optimistic about Woolworths as its experienced stronger growth across key metrics.

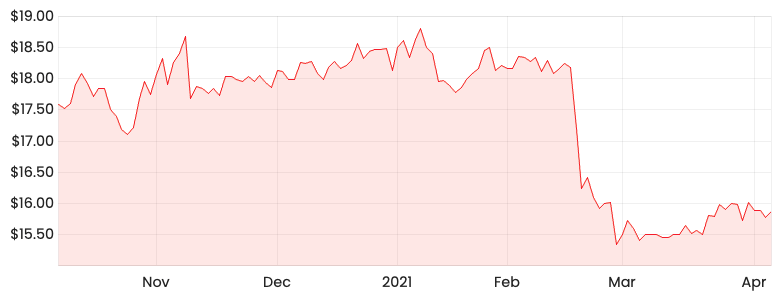

COL share price

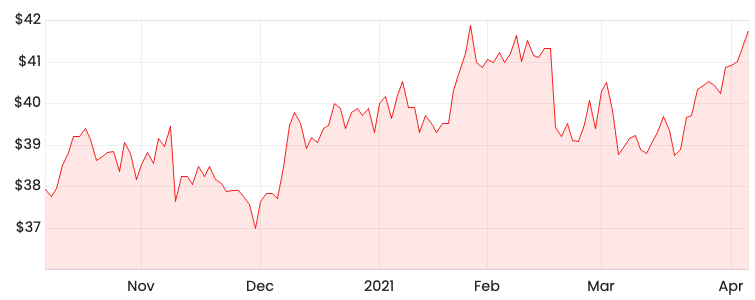

WOW share price

The return of the Down Down slogan

Coles has decided to cut prices on more than 250 products for months at a time rather than a week or two.

Since January, Coles has reduced prices of branded and private label products by 5% to 35%. According to the Australian Financial Review, some analysts believe this move is to recover the market share lost to Woolworths and IGA retailers in the second half of 2020.

Historically, Woolworths has often tried to narrow the price gap so it doesn’t lose too much market share to Coles in such campaigns.

Woolworths rolls out new tech

While Coles attempts to claw back market share through discounts, Woolworths has been rolling out a new piece of tech.

WooliesX developed technology that enables loyalty program customers to scan and pay for items using their smartphone. The current total number of Woolworths stores with this technology is around 25.

The Scan & Go technology allows customers to scan products on their smartphone as they shop, securely pay in the Woolworths app, and skip the checkout as they leave the store. It essentially makes it easier and faster for customers to shop.

It appears Coles is lagging behind as there have been no announcements of any trials or roll-outs of similar technology.

My thoughts

I think it will be difficult for Coles to regain lost market share in the current environment due to a smaller store footprint, especially since more Aussies are shopping locally.

Price wars often do not end well, especially for competitors that have a smaller market share.

Also, Woolworths seems to be at the forefront of rolling out new technology to improve the overall shopping experience. I reckon this could be a big game-changer, as it not only improves the overall customer experience but will potentially reduce labour costs.

The return of the Down Down price reduction program may provide a temporary boost in Coles’ gain on market share but I struggle to see how this will be sustainable over the long term.

Another competitor to keep an eye on is Aldi, as outlined in my previous article.

If you are interested in other ASX share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.