The Woolworths Group Ltd (ASX: WOW) share price continues to climb up, can its data-driven approach be a game-changer?

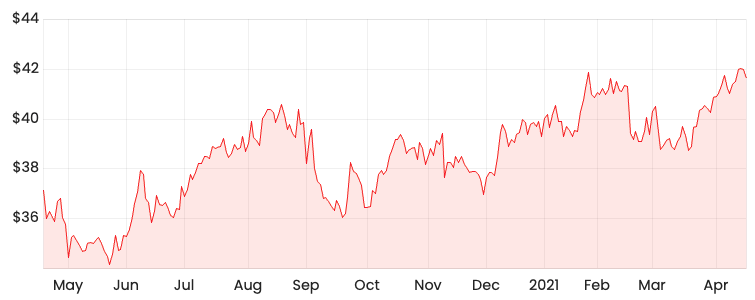

WOW share price

Data is the name of the game

Woolworths has taken a higher equity stake (75%) in data science firm, Quantium. Woolworths paid $223 million to shift its stake from 47% to 75%.

An impressive name but what does it do?

Quantium develops data science solutions to enable organisations to make better decisions on pricing, ranging, store layouts and promotions to attract and retain customers.

According to the Australian Financial Review, Woolworths has a call option to buy out the remaining 25% stake in three years.

Once the transaction is completed, Woolworths will establish a new business unit called Q-Retail, which aims to provide advanced analytics and retail capabilities.

Opportunity for growth

As Coles Group Ltd (ASX: COL) continues to fight for Woolworths’ market share, it’s encouraging to see it is finding other avenues to accelerate growth.

Woolworth has recognised that the pandemic induced demand will likely taper off. As a result, Woolworths is using third parties to optimise its store network, IT, supply chain, data, media capabilities and rewards programs.

I think this is a prudent and sound approach to growing the business.

In saying this, investors should also monitor the return on capital to determine whether it is using capital effectively.

If you are interested in other ASX share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.