The S&P/ASX 200 (ASX: XJO) finished the week on a positive note, moving 0.5% higher on Friday and retaking the 7,000 point level.

Every sector was higher barring materials, with Fortescue Metals Group Limited (ASX: FMG) and BHP Group Ltd (ASX: BHP) falling 2.8% and 1.5%, respectively, after the iron ore price dropped 9.5% during the day.

On the positive side, the fall in commodity prices has supported a weaker AUD.

Commonwealth Bank of Australia (ASX: CBA) reached a record high (yes, a record!) adding 0.6%, which is quite an achievement given the country is still not past the pandemic.

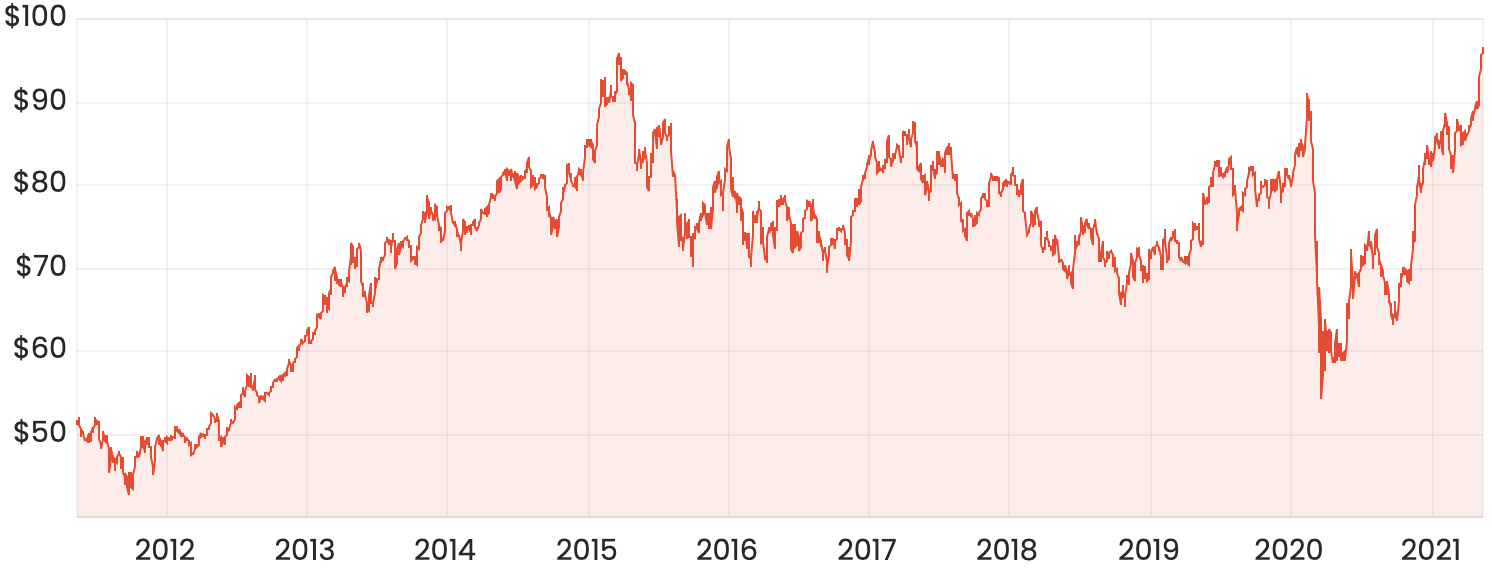

10-year CBA share price chart

Over the week dispersion continued to grow, with more businesses unable to deliver on inflated expectations.

Mining services provider Perenti Global Ltd (ASX: PRN) led the detractors, down 28.6%, with A2 Milk Company Ltd (ASX: A2M) and Xero Limited (ASX: XRO) down 21.2% and 15.9%, respectively.

The sell-off in the tech sector was likely the news of the week, with the ASX IT index down 6.9% and 20.5% over the last month.

Zip Co Ltd (ASX: Z1P) has fallen by half in just three months and Afterpay Ltd (ASX: APT) is down 45% since February.

Corporate activity has remained active, seeing Crown Resorts Ltd (ASX: CWN) receive two bids, up 6.7% for the week, and Woolworths Group Ltd (ASX: WOW) move forward with its demerger.

Consumer staples and healthcare were the only positive ASX sectors over the week as investors sought safety in ‘defensive’ names.

ASX 200 today

The ASX 200 is expected to push higher when the market opens on Monday, following a strong positive lead from US markets on Friday.

The Nasdaq, in particular, turned a corner, jumping 2.3% for the day. For all the latest, check out Rask Media’s US stock market report.