The Coles Group Ltd (ASX: COL) shares price fell sharply today before recovering to end down 4.22% to $16.33.

The share price fall was in response to the Coles Investor Strategy Day held this morning.

I take a more positive view of the presentation, with management providing more colour on capital expenditure (capex), dividends and plans for the future.

Following the share price fall, I think Coles shares represent good value.

Considered focus on capex

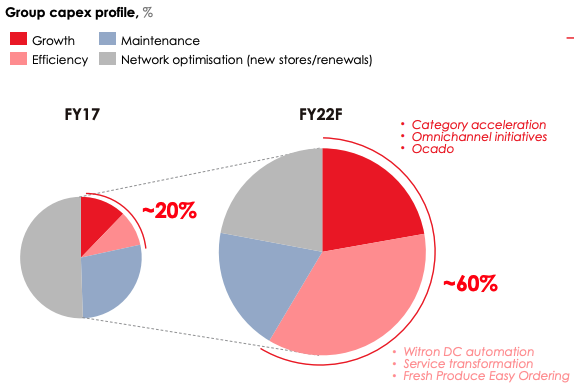

Much of the market commentary (and subsequent share price fall) focused on the 27% increase in capex for FY22 from $1.1 billion to $1.4 billion.

I take a different point of view. Management has identified an opportunity to improve its omnichannel offering by investing additional profits into Growth and Efficiency capex.

The new investments in automated distribution centres and an improved online offering will reduce costs and accelerate sales growth over the medium term.

For context, shoppers who purchase online and in-store spend 2.3x more than just in-store customers.

Companies shouldn’t be penalised for reinvesting profits to build shareholder wealth. Given the 15.3% return on capital Coles achieved in FY20, I’m backing management to make the most of the increase in capex.

Defensive and stable dividends

I’ll disclaim upfront I’m not a big fan of dividend companies. I think it foreshadows the business’s best growth is behind it as it reaches the mature stage of its business cycle.

However, if I were to choose a company for dividends, Coles would be at the top of my list.

It’s defensive in nature. Regardless of GDP figures, interest rates or global pandemics – Australians still buy groceries.

While growth is largely limited to single digits, CEO Steven Cain noted the Australian population will increase by 10 million people in the next two decades. Moreover, in a potentially inflationary environment, Coles is able to pass on increased prices to customers. This is in addition to the aforementioned benefits of the revamped capex strategy.

The company has a full franked dividend yield of 3.8% (grossed up to 5.4%). Positively, management expects to maintain its 80-90% payout ratio for the foreseeable future.

It’s difficult to find another company with a dividend as high and dependable as Coles.

Moving with the times

Through its ‘Together to Zero’ campaign, Coles is accelerating efforts to reduce emissions, single-use plastics and food waste.

The company has made a number of commitments including:

- 100% renewable electricity by FY25

- net-zero greenhouse emissions by 2050

- diverting 85% of waste from landfill by FY25

- all Coles Brand packaging to be 100% recyclable, reusable or compostable by 2025

Arguably the greatest commitment is to stop selling single-use plastic tableware products from 1 July 2021 (that’s in 13 days).

The focus on environmental, social and governance (ESG) permeates throughout the strategy presentation. However, as shareholders why should we care? None of this is adding to the bottom line.

The answer is whether we like it or not, ESG is becoming front of mind for an increasing number of large investors and companies.

Woolworths Group Ltd (ASX: WOW) is in the process of demerging its liquor and gambling operations Endeavour Group due to ESG pressures. Current shareholders don’t want to own pokies, and pension and industry funds won’t invest if the company is considered unethical.

Public companies with activities considered to be ESG non-compliant trade on lower multiples. Conversely, climate leaders are becoming increasingly sought after.

By making a considered effort to increase its ESG efforts, Coles is signalling to the market to rerate its multiple upwards.