After first being announced in 2019, the demerger of Endeavour Group Ltd (ASX: EDV) from Woolworths Group Ltd (ASX: WOW) will be completed today.

Endeavour will begin trading on the Australian Stock Exchange (ASX) at its own company with a market capitalisation of around $12 billion.

WOW share price

Who is Endeavour Group?

Endeavour Group includes the liquor, hotels, hospitality venues and gaming assets under the Woolworths umbrella.

Operating businesses include Dan Murphy’s

, BWS, ALH Hotels, Pinnacle Drinks, EndeavourX and Cellardoors. Endeavour Group will house a store network of 1,630, in addition to 332 hotels, 1,775 liquor licenses venues with 12,364 pokie machines and 290 TABs and KENO outlets.

It will also acquire the My Dan’s loyalty program, which has 5.1 million members.

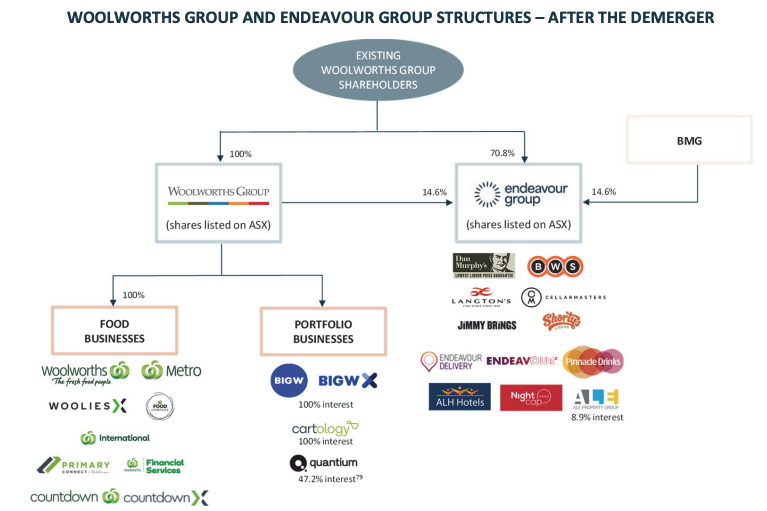

Prior to the listing, Woolworths held an 85.4% stake in Endeavour Group. As of today, Woolworths will only have a 14.6% shareholding.

Why is Woolworth’s demerging Endeavour?

The primary reason for demerging Endeavour Group from the broader Woolworths portfolio is to maximise shareholder value.

Both Woolworths and Endeavour will have separate management teams and boards to pursue distinct strategies. Separated, the two businesses will be more agile and better positioned to respond to changes in consumer preferences.

Spinning off Endeavour enables Woolworths to reduce environmental, social and governance (ESG) concerns about its business. Institutional investors such as superannuation and pension funds have been reluctant to invest in Woolworths Group due to the group’s exposure to alcohol and gambling.

Additionally, each company will be able to adopt independent capital allocations plans. Previously, investment has focused on where the best returns could be achieved – mainly growing supermarket network. As a result, underinvestment occurred within the Endeavour Group portfolio.

With Woolworths retaining a minority stake in Endeavour, both companies will remain aligned through a strategic partnership. The agreement covers five key business areas; Supply Chain & Stores, Loyalty & Fintech, Digital & Media, Business Support and International.

What does this mean for shareholders?

If you are a current Woolworths shareholder, as of today you will have another company in your portfolio.

For every one share in Woolworths you own, you will receive one share in Endeavour Group. These new shares can be freely bought and sold on the ASX.

Endeavour Group will likely trade on a lower multiple to Woolworths due to ESG mandates. However, demergers have a history of success in Australia, especially in supermarkets.

Both Wesfarmers Ltd (ASX: WES) and Coles Group Ltd (ASX: COL) have outperformed S&P/ASX 200 benchmark since its demerger.

Worried about Woolies? Want a better company to invest in right now? We’ve set up a free analyst report — featuring our top medical technology company on the ASX. Click here now to get the report on this #1 stock.

If you are interested in more new listings on the ASX, check out my latest write up on PEXA Group Limited

(ASX: PXA).