Yesterday, Endeavour Group Ltd (ASX: EDV) completed its first day trading on the Australian Stock Exchange (ASX) as a public company. The share price closed at $6.02.

Endeavour encompasses the liquor stores, hotels, hospitality venues and gaming assets formerly under the control of Woolworths Group Ltd (ASX: WOW).

Notable Endeavour operating businesses include Dan Murphy’s, BWS, ALH Hotels, Pinnacle Drinks, EndeavourX, Jimmy Brings, Shorty’s liquor and Cellardoors.

Here I present the bull and bear case for the Endeavour Group demerger.

Bull Case

History of success

Before even delving into Endeavour Group, demergers more broadly have a history of outperforming in Australia.

A Morgan Stanley study of 20 demergers found the combined entities outperform the benchmark S&P/ASX 200 by 6% in the first year. More impressively, the outperformance increased to an average of 17% over two years.

The basic idea is that 1 + 1 = more than 2.

By spinning off Endeavour, both it and Woolworths will be subject to an equal amount of market scrutiny. Within a conglomerate, it’s easy to hide underperforming divisions. As an independent listed company, it’s much harder.

Coles Group Ltd (ASX: COL) from Wesfarmers Ltd (ASX: WES) is a recent successful supermarket spinoff. Both have outperformed the market benchmark since Coles listed in 2018.

Simplified and independent strategies

As a separately listed company, Endeavour will be able to pursue its own strategy and growth agenda. These two points are important.

While Endeavour has previously had its own internal management, the overall strategy has had to align with the broader Woolworths group. Now with an independent management team and board, Endeavour is able to leverage its own strengths to achieve its independent vision of “creating a more sociable future together”.

Moreover, Endeavour will have its own growth agenda and capital expenditure (capex) budget. In previous years, capex has been allocated to where returns could be achieved – mainly in supermarkets. As a result, Endeavour has foregone refurbishments and acquisitions.

Management is now empowered to improve and expand the 1,630 large store network, 332 hotels, 1,775 liquor licenses venues, 12,364 pokie machines and 290 TABs and KENO outlets.

Two companies, one partnership

Despite spinning off Endeavour from the broader Woolworths Group, the company will remain a committed partner.

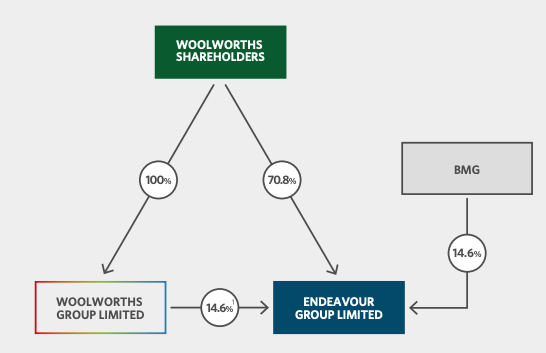

Woolworths will retain a 14.6% ownership stake (down from 85.6%), incentivising Woolies management to take an active role in the success of Endeavour. Moreover, the two companies have signed strategic partnerships covering five key areas:

- Supply Chain & Stores

- Loyalty & Fintech

- Digital & Media

- Business Support

- International

Endeavour will pay a tidy sum of $564 million each year for the partnership. However, it will enable Endeavour to share in Woolworths wide distribution network, digital media arms and technology enhancements.

Bear Case

Added financial costs

The demerger from Woolworths will cost shareholders approximately $50 million. Additionally, Endeavour will incur $47 million extra corporate and operating costs per annum as a result of becoming a separate company. Effectively, the benefits and synergies of being a conglomerate are being unwound, eating into profits.

This is in addition to the $564 million paid to Woolworths each year for services such as logistics and inventory.

While it’s presently a rosy marriage, expect the strategic partnership to come under review over the years as one side believes it’s holding the short straw.

Cultural shift

This is a difficult challenge for the demerger to quantify. As a past employee, I shared a tea room, pallet jacks and roster breaks with employees of Woolworths while I worked at BWS. Despite being two separate business units and wearing different coloured polos, there was a sense of comradery.

Similar to the strategic partnership, it all seems amicable today. However staff turnover and diverging strategic interests will create a gap between the two, now separate companies.

Do Endeavour and Woolworths remain in a symbiotic relationship? How do staff interact? What happens when strategies conflict?

ESG weighs on multiple

Environmental, social and governance (ESG) factors are becoming increasingly important to investors, especially large institutions (pension, industry funds). It was one of the contributing factors for Woolworths spinning Endeavour off:

“Existing and new shareholders will have flexibility to choose their level of investment in Woolworths and Endeavour”.

Market analysts say Endeavour will trade on a lower multiple to Woolworths due to ESG concerns over its gambling and liquor assets.

Whether you decide to invest on ESG merits is up to you, however, it’s likely Endeavour will always trade on a relative basis below Woolworths.

My take

I am biased against conglomerates. Often there is one strong performing division propping up the performance of weaker segments. I prefer each business to have its own strategy, shareholder base and growth runway.

Therefore, I believe Woolworths was prudent to spin off Endeavour. Retaining the 14.6% ownership alleviates concerns that Woolworths was simply trying to move Endeavour on rather than remain invested in its future success.

I am bullish on both businesses. Woolworths will benefit from the market rerating it as ‘ESG compliant’ and subsequently increase its multiple. Endeavour will benefit from a refreshed and independent strategy.

When reflecting back in five years, I believe the demerger will be a net positive for Endeavour and Woolworths shareholders.