After previously flagging its plan to demerge in March, AGL Energy Limited (ASX: AGL) has confirmed its intention to split the company into two businesses.

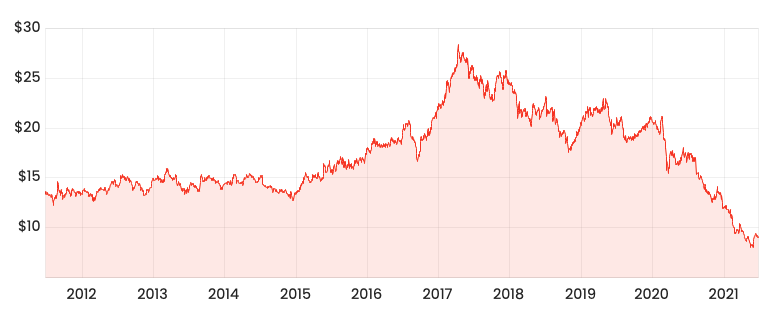

The market has reacted negatively to the news in morning trading, with the AGL share price down 7% to $8.47.

AGL share price

Formal demerger confirmed

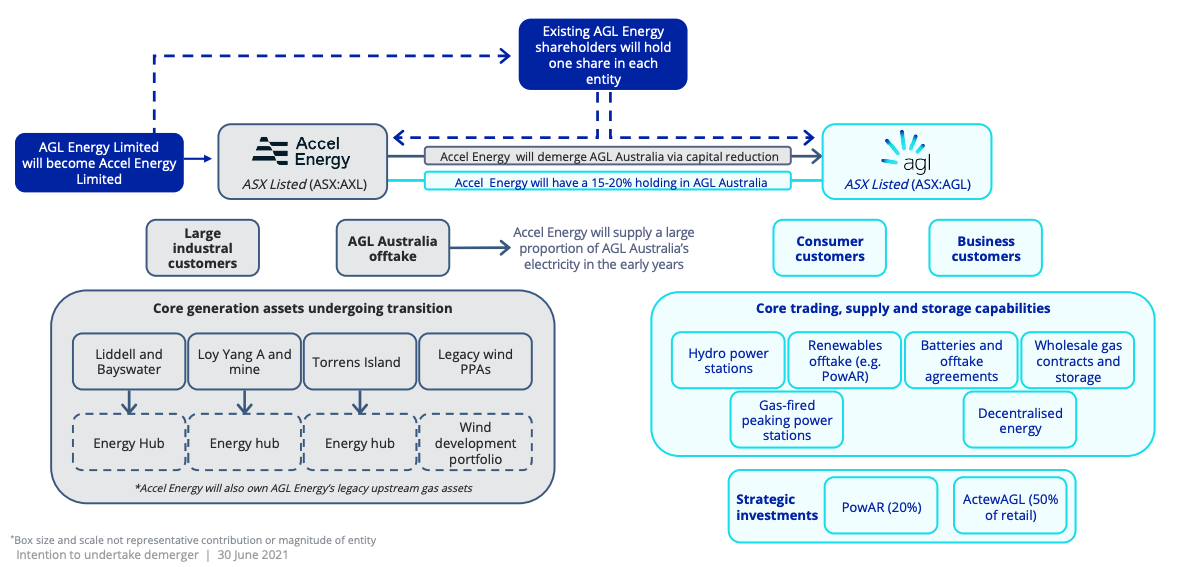

The current AGL Energy business will be renamed Accel Energy Limited, with the energy retail arm to be demerged into a seperate company called AGL Australia Limited. The demerger will create two independent energy companies listed on the Australian Stock Exchange (ASX).

Accel Energy Limited (ASX: AXL)

Accel Energy will be Australia’s largest electricity generator. It will house the group’s coal assets with a focus on the redevelopment of its sites into low-carbon industrial energy hubs. Additionally, Accel Energy will house the wind farm portfolio and some other gas and battery assets.

Current AGL Energy Chairman Peter Botten will Chair Accel Energy. Interim AGL Energy CEO Graeme Hunt will become the permanent Managing Director and CEO.

Accel Energy will maintain an investment-grade credit rating, with an $800 million term loan.

AGL Australia Limited (ASX: AGL)

AGL Australia will be a leading multi-product energy retailer with over 4.5 million customers. The company will be carbon neutral for scope 1 and 2 emissions while continuing its expansion into adjacent services such as broadband and mobile. Additionally, the company will home the hydro-power portfolio, battery assets and solar power stations.

Accel Energy will retain a 15%-20% shareholding in AGL Australia post demerger. AGL Australia and Accel Energy will also implement contracts to manage energy market price and supply risk.

Current Non-Executive Director at AGL Energy Patricia McKenzie will chair AGL Australia. Current Chief Customer Officer at AGL Energy Christine Corbett will become Managing Director and CEO.

The company will establish a $2 billion multi-bank debt facility complemented with a $910 million private note placement. AGL Australia will also retain an investment-grade credit rating.

Shareholders best interests

The AGL board believes the demerger will be in the “best interests of shareholders, protect value and provide greater strategic focus”.

Subject to final board, regulatory and shareholder approval, current AGL Energy shareholders will hold one share in each of Accel Energy and AGL Australia for every share they own in AGL Energy.

Dividend cut

In preparation for the demerger and pursuing growth investments, AGL Energy will terminate its Special Dividend program. The company will also underwrite a dividend reinvestment plan for the final two dividends prior to demerger.

This will enable the company to preserve $400-$500 million in excess cash to support both companies post-split.

Trading update

AGL Energy provided an update on full-year guidance:

- Underlying EBITDA within the lower half of the $1,585 million to $1,845 million range

- Underlying NPAT in the middle of the previous range of $500 million to $580 million

The company expects a material decrease in earnings as a result of lower wholesale energy prices in FY22.

My take

The AGL Energy demerger is remarkably similar to the Woolworths Group Ltd (ASX: WOW) spin-off

of Endeavour Group Ltd (ASX: EDV).

AGL Energy shareholders will receive one share each in AGL Australia and Accel Energy in addition to Accel retaining minority ownership in AGL Australia. Furthermore, AGL seems to have followed Woolworth’s approach to separating the more environmental, social and governance (ESG) compliant business from the less ethical one.

Management will be hoping past demerger success in Australia will halt the 70% AGL Energy share price fall since 2017.

For now, I’ll be watching with interest. AGL looks cheap on traditional metrics however energy retailing is highly commoditised and the legacy coal assets remain a concern.