Following the completion of its strategic review, Tabcorp Holdings Limited (ASX: TAH) has announced its intention to split the business in two.

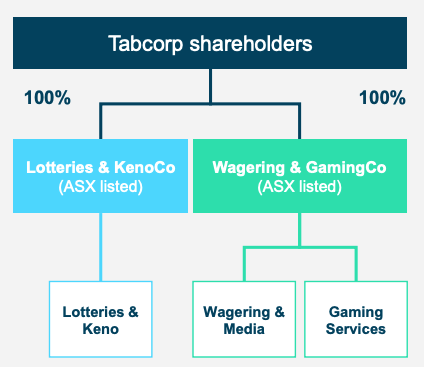

The company will demerge its Lotteries & Keno (L&K) business from the Wagering & Gaming (W&G) segments, creating two standalone companies listed on the Australian Stock Exchange (ASX).

The market has reacted negatively to the announcement, with the share price down 4.23% to $4.98 in early morning trading.

1 + 1 equals greater than 2

Tabcorp will be split in two with each company having distinct growth opportunities, strategies and capital structures.

Lotteries & KenoCo will house Australia’s leading lottery operator, which is licensed to operate in all Australian states and territories except Western Australia. In FY20, L&K achieved $2.9 billion in revenue and $542 million in EBITDA. The outstanding USPP notes will be held within L&K.

Current Tabcorp Chairman Steven Grigg will become Chair while current Managing Director of L&K Sue van der Merwe will become CEO.

Wagering & GamingCo will hold the TAB wagering business, Sky racing media and MAX, Australia’s largest gaming services provider. In FY20, W&G yielded $2.3 billion in revenue and $454 million in EBITDA.

Current Tabcorp Director Bruce Akhurst will become Chair. Meanwhile, Adam Rytenskild, a current member of Tabcorp’s executive team, will become CEO.

Tabcorp Group CEO David Attenborough will leave the company once the demerger is finalised.

The demerger is expected to cost between $225-$275 million in one-off costs and $40-$45 million per annum in ongoing costs. The expected completion date is June 2022.

Thanks, but no thanks

The W&G business has attracted interest from several potential buyers including Entain PLC (LON: ENT), Apollo Asset Management and Betmakers Technology Group Ltd (ASX: BET).

Ultimately, the board believed shareholder value would be better built through retaining W&I. Despite the decision to go separate ways, Tabcorp and BetMakers will continue discussions on future partnerships.

Interestingly, the board noted it would “remain open to future engagement with bidders on revised proposals“.

My take

Who knew demergers would become so trendy?

First, Woolworths Group Ltd (ASX: WOW) spun off Endeavour Group Ltd (ASX: EDV). Then last week AGL Energy Limited (ASX: AGL) announced it was splitting its retail and generation businesses. Now Tabcorp is breaking up, only four years after its merger with TattsGroup.

The wagering business has been underperforming for some time, so it made sense to spin it off to another buyer. Strangely the board has opted to keep it.

Effectively nothing has changed at Tabcorp other than that it will now operate as two companies rather than one conglomerate. Management will remain largely the same, and the Chairman is one of the directors who has presided over its past underperformance.

Moreover, $225 million is no small cost for the demerger, which is directly from shareholder profits. And that’s at the lower end of guidance.

I believe the Tabcorp board is hoping for a higher bid from either Entain or Apollo. However, I’m unsure if the odds are in Tabcorp’s favour this time.