Australia’s largest olive farmer Cobram Estate Olives Limited (ASX: CBO) is set to debut on the market Wednesday.

Let’s take a look at the business and why it might be an interesting investment.

A household name

Cobram Estate Olives, formerly Boundary Bend Limited, was founded by Paul Riordan and Rob McGavin in 1998. Both remain shareholders today with Riordan holding 4.8% and McGavin 18.6% of the company.

The first olive tree was planted in 1999 at Boundary Bend along the Murray River in North West Victoria.

Since then, Cobram Estate has grown to become a vertically integrated olive oil producer from planting olives to marketing its products in 17 countries.

Today, the company produces 71% of Australia’s total olive oil production.

Notable labels include the number one and two selling olive brands in Australia, Cobram Estate and Red Island.

Cobram Estate has won 458 awards since 2003. Notably, the Californian range was named the world’s healthiest extra virgin olive oil in 2017.

Isn’t all olive oil the same?

Olive oil refers to to the oil extracted from the fruit of an olive tree.

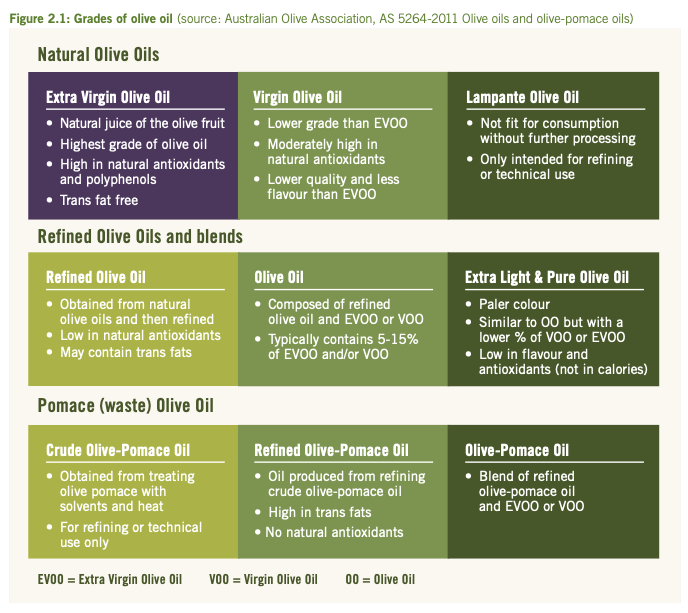

There are various grades, with extra virgin olive oil the highest quality. It is made from minimal processing and preserves the nutritional and flavour benefits.

Lower-grade olive oils include virgin, refined and extra light. These require further processing involving various levels of heat and chemicals. As a result, the oil loses flavour and scent while increasing fatty acid levels.

To be classified as extra virgin, samples must be tested in a laboratory and meet the requirements of Australian Standard (AS 5264-2011).

What makes this an exciting investment?

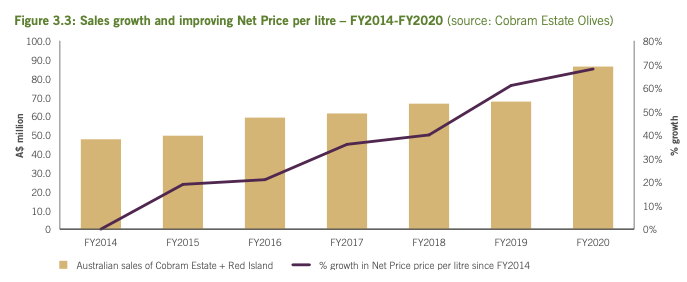

Cobram Estate has managed to differentiate its products over years to gain recognition as a leading Australian olive oil producer.

Cobram Estate (brand) won the gold medal for top tasting oils awarded by Choice, with Red Island coming in second.

The company currently ranks number one for Australian sales with 35% of total olive oil sales and 48% of extra virgin olive oil sales.

Due to its scale and proprietary Oliv.iQ farming system, which differentiates itself from competitors’ traditional farming methods, Cobram is one of the lowest cost producers given its quality of olive.

Spanish groves, which are home to 50% of global production, have an average farm size of 4 hectares. This pales in comparison to Cobram Estate with 6,500 hectares planted.

In an investor presentation, management noted its cost of production is 30% below the industry average. Furthermore, the company cost per litre ranks on par or better than other large scale producers.

It also takes three years for an olive plant to grow and eight years for it to reach sufficient product levels. This creates a barrier to entry for new entrants as there is a long lead time between planting and revenue.

Management’s estimate to replicate Cobram’s current production would “cost $500 million and 10 years”.

The company has a number of growth opportunities, including its United States operations and Wellness division. It has invested significantly since 2014, which dampened near-term profits to capitalise on long-term returns.

Cobram Estate is benefitting from a number of structural drivers. 93% of Australians are more likely to buy ‘made in Australia’, which has increased since the pandemic. Sales for extra virgin olive oil has outpaced low-quality oils over the past three years.

Moreover, as society looks for healthier alternatives, studies have shown material health benefits of olive oil with reductions in cardiovascular diseases and type 2 diabetes.

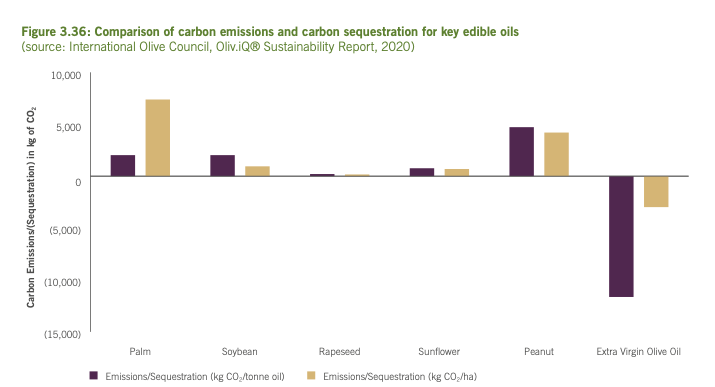

Olive oil plants actually capture CO2 emissions resulting in a net positive benefit on the environment.

From the outside, the company seems to have a strong corporate culture. Employee retention hovers around 90%. Moreover, the business will be gifting 500 shares to each of its employees as part of the IPO.

Things to watch

The company is not raising any capital nor did Cobram provide a reason for listing in its investment overview. This infers the company is going public to provide a liquid market to buy and sell shares. While this on its own isn’t terrible, it’s better to see a business going public to raise capital to fund growth opportunities.

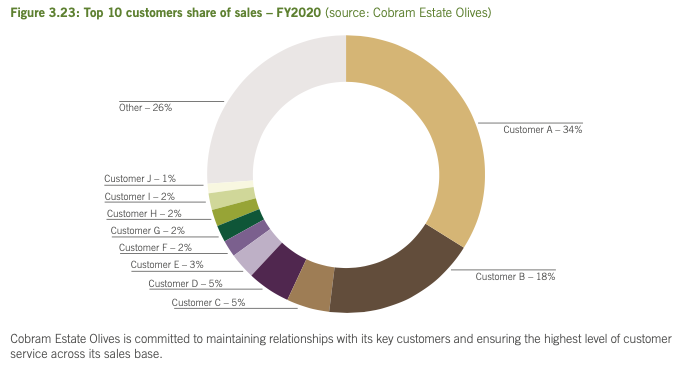

Customer concentration is high at Cobram Estate, with Woolworths Group Ltd (ASX: WOW) and Coles Group Ltd (ASX: COL) accounting for 52% of FY20 sales. The big supermarkets may push for lower prices resulting in margin compression.

The global olive oil market is growing at a negligible growth rate of 1% per annum. Therefore Cobram Estate has to be able to market its product and differentiate itself from competitors to grow sales and market share.

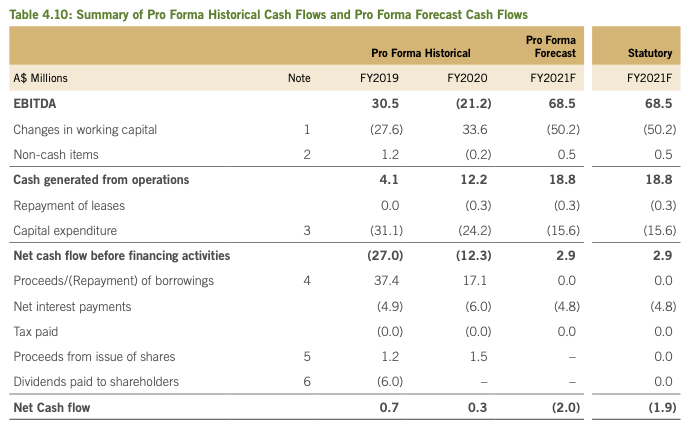

As an investor, trawling through financials is hard on its own. For Cobram Estate, this is made more difficult by the fact the company operates on a 2-year cycle. It will have a high yield and then a low yield year. This means sales and profits fluctuate wildly making it difficult to forecast.

Moreover, the company has to revalue its groves each year, which result in a non-cash gain/loss recognised on the P&L, skewing results.

Notwithstanding its low cost of production, the company recorded an average gross margin of just 22% over the past three years (when removing the effect of revaluing olive trees). This indicates to me that olive oil is largely a commoditised product with minimal differentiation and low pricing power.

Moreover, despite positive EBITDA numbers, the company has failed to generate positive free cash flow over the past three years. Cobram Estate has relied on drawing on debt to support its United States growth ambitions.

Due to its irrigated farming practice, the company consumes over 36 gigalitres of water per year. For context that’s 14,400 Olympic swimming pools.

Recently, water supply has been plentiful however low rainfall or low dam levels can drive up prices, which would impact Cobram Estate’s already low gross margin.

Final thoughts

Low-cost operations with high-quality olives is a recipe for a successful business. However, the financials really throw a spanner in the works. It’s hard for me to value a business that doesn’t have positive free cash flow, by my calculation.

I believe management is high quality and health-conscious consumers will gravitate towards olive oil. It’s a matter of whether the company can expand margins and take market share from incumbents.

The company does not have an IPO price, so it will be interesting to see what the market values Cobram Estates.

It’s a pass for me but I’ll be keeping a keen eye on Cobram Estate’s start to public life.