The AGL Energy Limited (ASX: AGL) share price lost power today, finishing 5.5% lower as investors digested the company’s FY21 results.

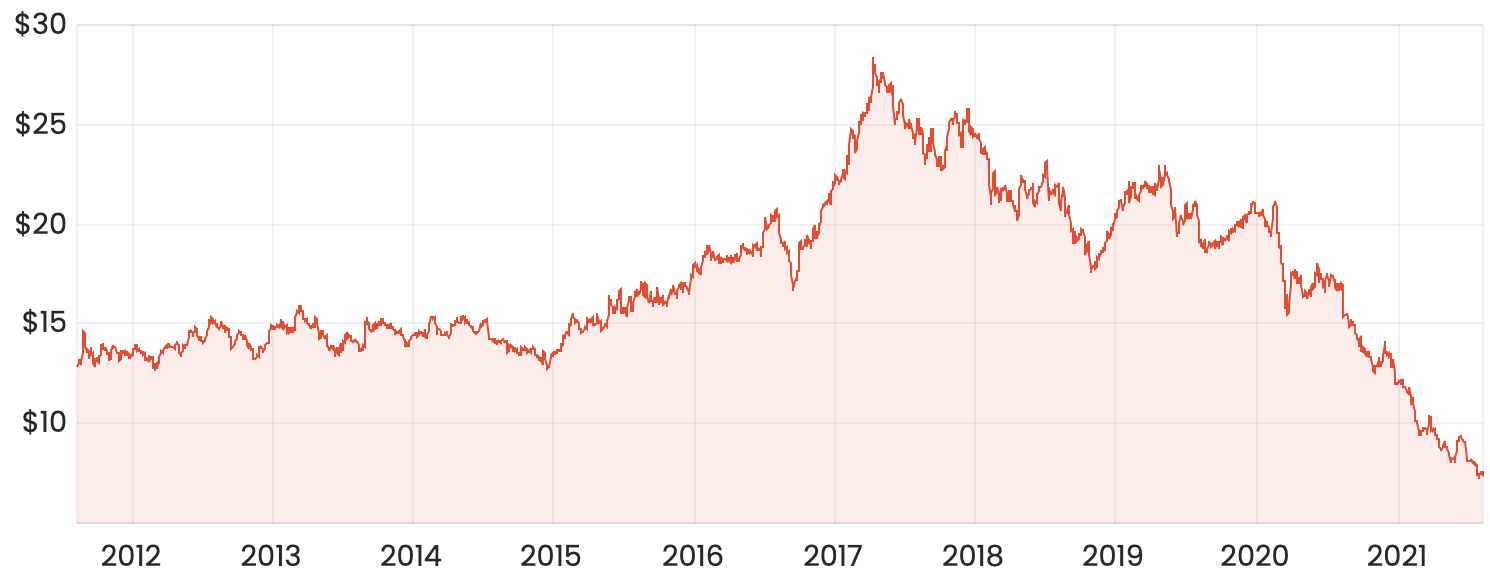

It’s been a tough year for AGL shareholders, with shares tumbling nearly 60% over the last 12 months. The 10-year AGL share price chart, below, paints a bleak picture. Let’s dig into the results.

AGL share price chart

Unpacking AGL’s FY21 report

Here are some of the headline numbers from AGL’s result:

- Revenue fell 10% to $10.9 billion

- Total generation volumes came in at 41,137 GWh, down 6%, reflecting the impact of planned and unplanned outages and reduced grid demand

- The company ended the period with 4.5 million services customers, up 254,000 services through both organic growth and the Click acquisition

- Underlying EBITDA dropped 18% to $1.7 billion as wholesale electricity prices and margin pressures in gas impacted earnings

- Statutory loss after tax of $2.1 billion, compared to a profit of $1 billion in FY20

Commenting on the results, AGL’s interim CEO Graeme Hunt said that FY21 was one of the toughest energy markets he’s seen. Wholesale electricity prices were at levels not seen since 2012, while demand was impacted by lockdowns, mild weather and increasing penetration from rooftop solar.

The company’s gas segment also took a hit as legacy gas supply contracts rolled off, which has squeezed margins.

On the bottom line, AGL’s big $2.1 billion loss was impacted by impairment losses, onerous contracts and costs associated with acquisitions, restructuring and cessation of the Crib Point project.

What’s more, COVID-19 has continued to have an impact, both indirectly through suppressed industrial demand, and directly through costs associated with ensuring that the virus is appropriately managed on-site.

AGL’s dividend

It wasn’t all bad news for income investors. Despite the company’s significant statutory loss, AGL declared a final dividend of 34 cents (unfranked).

This takes the company’s full-year ordinary dividends to 65 cents, putting shares on a dividend yield of 9.0%. This is a big yield at first glance, but there are question marks over how sustainable AGL’s dividends will be.

It’s also worth keeping in mind the two inputs that go into calculating a company’s dividend yield: dividends and share price. All else being equal, as a company’s share price heads lower, its dividend yield moves higher. AGL’s big 9% yield is a case in point.

FY22 guidance

Looking ahead, AGL is guiding for FY22 underlying EBITDA of between $1.2 billion and $1.4 billion, and underlying NPAT of between $220 million and $340 million. This is down from FY21’s underlying results of $1.7 billion EBITDA and $537 million NPAT.

The company noted this guidance reflects a further material step down in wholesale electricity earnings as hedging positions, established when wholesale prices were materially higher, progressively roll off and the non-recurrence of Loy Yang insurance proceeds.

In terms of costs, AGL says it’s on track to deliver at least $150 million in operating cost reductions for FY22 and a $100 million reduction in sustaining capital expenditure by FY23.

Demerger progresses

In June, AGL formally announced plans to split its business in two. The current AGL Energy business will be renamed Accel Energy, with the energy retail arm to be demerged into a separate company called AGL Australia. The demerger will create two independent energy companies listed on the ASX.

Interim CEO Graeme Hunt says it has made “good progress” on the transaction and subject to shareholder and relevant approvals, it’s on track for implementation in the fourth quarter of FY22.

The company has also made some personnel decisions, with current Chief Operating Officer Markus Brokhof to step into the same role at Accel Energy, and current Chief Financial Officer Damien Nicks to continue on at AGL Australia.

Summary

AGL is feeling the heat as the industry embraces the shift to new wind and solar power. AGL ranks as Australia’s heaviest greenhouse gas emitter, and today’s result is evidence that the company has been too slow to transition to cleaner forms of energy. The demerger will certainly be one to watch, following in the footsteps of Woolworths Group Ltd (ASX: WOW) which spun off its drinks, hotels and pokies business in June.

In the meantime, to stay up to date with ASX reporting season this August, make sure to bookmark Rask Media’s ASX reporting season calendar.