Recent spinoff Endeavour Group Ltd (ASX: EDV) has announced its first set of financial results this morning.

Endeavour contains the alcohol, hotels and gambling operations from former owner Woolworths Group Ltd (ASX: WOW).

Notable brands include Dan Murphy’s, BWS, ALH hotels and Cellardoors.

Endeavour records maiden result

Endeavour Group has delivered a solid set of results for FY21. The main highlights include:

- Revenue up 9.3% to $11.6 billion

- Online sales jumped 34.7% to $859 million and now account for 7.4% of revenue

- Earnings before interest and tax (EBIT) up 22.1% to $899 million

- Net profit after tax of $445 million

- Fully franked dividend of 7 cents per share

The business’s two divisions – retail and hotels, both performed strongly.

Retail sales increased 9.6% on the back consumers switching to at-home consumption due to pandemic restrictions at on-premise venues.

With the on-off lockdowns, Australians needed something a little stronger to drink. As a result, spirit consumption grew by 20%. Meanwhile, all major categories experienced growth.

Premium products, craft beers champagne, and non-alcohol alternatives will provide strong growth opportunities in future years.

Despite all hotels being open for only 195 days due to on-premise restrictions, sales increased 7.3%.

This is largely a result of the FY20 fourth quarter where from March, most hotels were closed.

When restrictions were eased, customers returned quickly to the local pub.

With most hotels shut at some point throughout the year, management took the opportunity to undertake 26 refurbishments and upgrade an ageing gaming machine fleet.

Outlook for FY22

Management has not provided guidance for the year noting continued trading uncertainty.

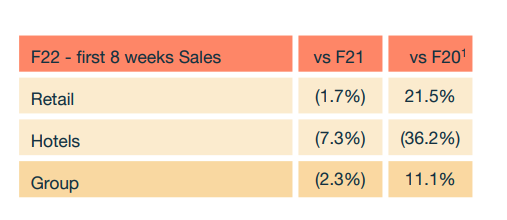

However, they did provide an update on the first eight weeks of FY22. It should be noted FY20 numbers are before the pandemic hit.

My take

A sound first result for Endeavour.

The only negative I’d have would be on guidance. Given further details have been released on the vaccine rollout, I would have expected some sort of forecast.

Similar to Bunnings and Wesfarmers Ltd (ASX: WES), Endeavour’s jewel in the crown is Dan Murphy’s.

The business grew members by 20% over the year and the combined net promoted score across retail of +75 indicates strong satisfaction amongst customers.

It’ll always trade on a lower multiple due to environmental, social and governance (ESG) concerns.

However, I think the business will grow at high single digits over the medium-term making it relatively easy to forecast.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.