The Marley Spoon AG (ASX: MMM) share price continues to sink after strategic partner and substantial shareholder Woolworths Group Ltd (ASX: WOW) sold its 9.87% shareholding.

Shares in Marley Spoon have fallen a further 4% in morning trade following yesterday’s 10% drop.

MMM share price

What’s causing the Marley Spoon share price slide?

Woolworths has sold all of its shares in Marley Spoon, however, it remains committed to the five-year strategic partnership announced in June 2019.

This netted Woolworths approximately $54 million after the shares were sold for $1.91 each in a block trade on Monday.

Woolworth’s investment arm W23 originally secured a $23 million convertible note and $7 million shares in Marley Spoon shares back in 2019.

For context, a convertible note is a debt instrument that can be later turned into shares in the company.

Recently, Woolworths exercised the final batch of its convertible notes into shares. As a result, the company has decided to sell all of its 9.87% holding, equal to 28,026,000 shares.

Why would Woolworth’s sell its shares?

It’s difficult to know for sure, however, a Woolworths spokesman said:

“Marley Spoon experienced strong growth over the term of W23’s investment and has matured into an established listed company, and no longer fits squarely within the investment criteria of W23.”

Essentially, W23 believes Marley Spoon’s best growth is behind it and is looking elsewhere for investments.

My take

The fact Woolworths says it remains a committed partner is at odds with its decision to sell out of Marley Spoon.

If you look at it from Woolies’ perspective, providing supply chain access and shelf space for Marley Spoon has little merit if Woolworths won’t benefit from the business’s potential success.

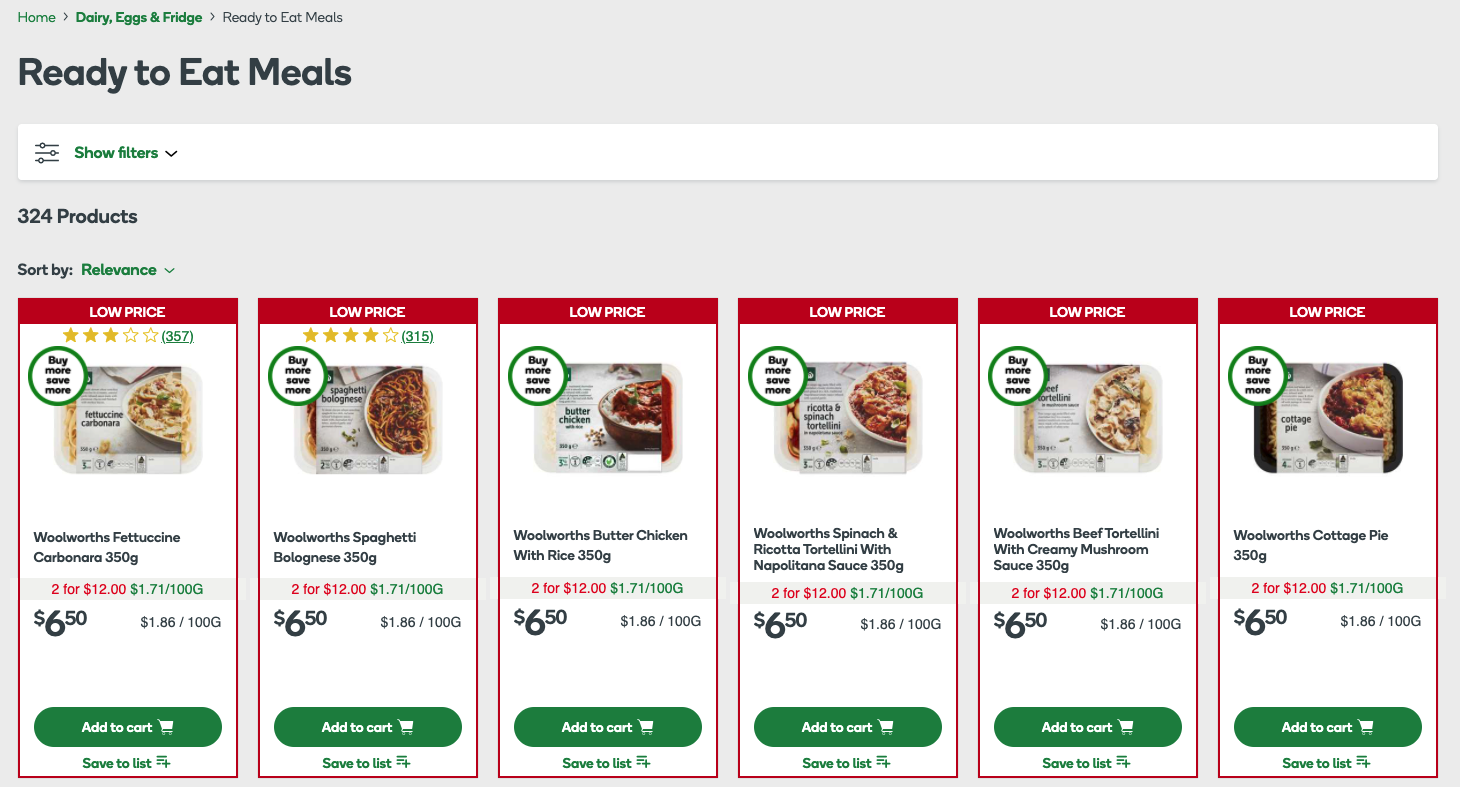

Possibly, Woolworths has been observing Marley Spoon from a distance and is now choosing to focus on its own ready-to-eat meal range.

Another potential reason is that Woolworths believes Marley Spoon will be at a disadvantage in a post-pandemic world as more customers dine out. Subsequently, W23 is looking to crystalise its investment now for an 80% gain in just over two years.

I don’t have a view either way on Marley Spoon since I haven’t completed a valuation of the business.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.