After its ASX initial public offering (IPO) just two weeks ago, the Zoom2u Technologies Ltd (ASX: Z2U) share price has more than doubled.

The business raised $8 million at an issue price of $0.20 to fund its future growth. Since then the Zoom2u share price has rocketed to $0.53.

Let’s dive into the business and see what’s exciting getting investors excited.

The Australian version of Uber?

Founded by CEO Steve Orenstein (who owns 31.75% of the company), Zoom2u is in the business of digital delivery services.

The company has developed and operates two main technology platforms:

- Zoom2u – connects customers with a reliable delivery network. Similar to Uber Technologies Inc (NYSE: UBER), instead for deliveries.

- Locate2u – white label product for businesses to manage their own delivery fleets

The business also operates a paper shredding service named Shred2u and ad-hoc projects under 2uEnterprises.

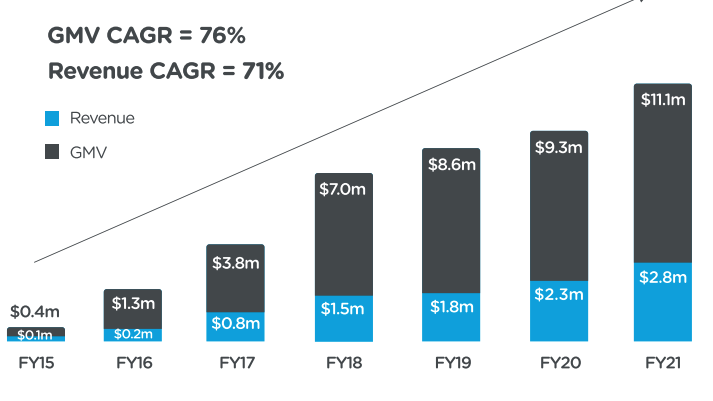

Zoom2u is growing, albeit off a very low base with only $2.8 million revenue in FY21.

Gross Marketplace Value (GMV) represents the price of total deliveries. Revenue is the money left over after Zoom2u pays its drivers.

For example, if delivery costs $10 and it costs $8 to pay the driver, GMV will be $10 and revenue will be $2.

Notably, the company recently announced a deal with Telstra Corporation Ltd (ASX: TLS) to provide two-hour delivery for handset devices. However, no minimum volume or fee commitment has been made.

Things to be mindful of

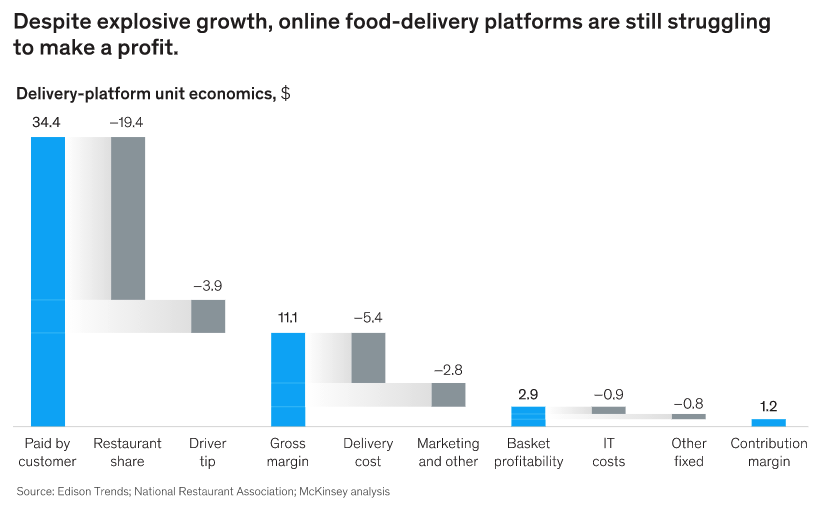

Digital delivery is a tough business. A lot of the costs go towards paying drivers.

When a business has low margins, often its only way to become profitable is by scaling rapidly.

Supermarkets are an example of this. Woolworths Group Ltd (ASX: WOW) has 5% operating margins but is profitable because of its scale. A similar trend happened in e-commerce with the likes of Amazon.com Inc. (NASDAQ: AMZN) and its retail business.

Zoom2u needs to scale rapidly to be able to compete with the big gorillas in this space, notably Uber.

Despite the rapid share price rise, Zoom2u is still a microcap with a $60 million market capitalisation. This introduces a range of unique risks including liquidity, the ability to buy and sell shares, and volume, which is the ability to purchase shares without moving the whole market.

Finally, the business is still unprofitable on a statutory basis and incurring net cash outflows. Investor needs to keep in mind this business is likely a long way from meaningful profits.

My take

Zoom2u looks like an interesting business with a big addressable market.

For the time being, the business is too small for me to invest in. But I’ll be keeping track of it moving forward, particularly growth in GMV and new contracts.

If you’re interested in small ASX shares, check out three I’d buy today.